Predictive Churn Prevention Q1 2026: AI Playbooks for SaaS Renewal Season

Estimated reading time: 12 minutes

Key Takeaways

- Q1 decisions are often pre-decided; shift to early, predictive detection of churn intent

- Build supervised churn models and automate customer health scores for daily risk signals

- Use usage-based triggers mapped to channels and SLAs to drive timely interventions

- Deploy personalized AI videos to recap ROI and influence renewal negotiations

- Address involuntary churn in India with compliant payments ops and an 8-week sprint to impact

The landscape of software-as-a-service (SaaS) is entering a period of unprecedented volatility as we approach the first quarter of 2026. For growth-stage and enterprise SaaS companies, predictive churn prevention Q1 2026 is no longer a luxury—it is the primary determinant of Net Revenue Retention (NRR) and long-term valuation.

Q1 has traditionally been the "Great Audit" season, where CFOs and RevOps leaders scrutinize seat utilization and shelfware. However, 2026 brings new complexities: budget re-allocations are happening faster, and the "AI-efficiency" mandate is forcing teams to justify every dollar spent on the tech stack.

To survive this renewal season, leaders must shift from reactive risk monitoring to proactive outcome prediction. This guide provides a comprehensive blueprint for deploying predictive analytics customer retention strategies that combine technical modeling with hyper-personalized intervention.

1. Why Q1 2026 Requires a Radical Renewal Playbook

The traditional SaaS renewal playbook is broken. Relying on a CSM to reach out 90 days before a contract ends is a strategy rooted in 2022. By the time that 90-day window opens in Q1 2026, the decision to churn or downgrade has likely already been made in the preceding quarter’s budget meetings.

SaaS renewal season strategies must now account for the "Silent Churn"—accounts that remain active but have mentally checked out. In 2026, industry data suggests that nearly 35% of Q1 churn is "pre-decided" by mid-December of the previous year. This necessitates a shift toward predictive churn prevention Q1 2026 models that identify intent signals months in advance.

Furthermore, the role of Customer Success (CS) is evolving from risk mitigation to revenue generation. According to recent 2026 industry forecasts, leading CS organizations are now measured on their ability to predict outcomes rather than just tracking health scores. This shift is driven by the need to combat downgrades prevention campaigns that often fail because they lack the data-driven precision required to change a CFO's mind.

Source: ChurnZero 2026 CS Trends: Experts Predict the Shift to Outcome Prediction

2. The Technical Engine: Churn Prediction Modeling and Health Score Automation

At the heart of any successful retention strategy lies churn prediction modeling. This involves using supervised learning models—such as gradient boosting or logistic regression—to calculate the probability of an account churning, downgrading, or renewing. These models ingest product telemetry, engagement signals, and commercial data to provide a forward-looking view of revenue risk.

The Input Feature Schema for 2026

To build a robust model, your data warehouse must aggregate four critical categories of signals:

- Product Telemetry: Beyond simple DAU/WAU, look at feature depth (are they using the "sticky" premium features?) and seat utilization percentages. A sudden drop in API calls or query volume is often a 60-day leading indicator of churn.

- Engagement Signals: Track the activity of the "Executive Sponsor." If the person who signed the check hasn't logged in or attended a QBR in six months, the account is at high risk, regardless of how much the end-users love the tool.

- Commercial Health: Monitor billing incidents and payment failure history. In markets like India, where RBI e-mandates and UPI AutoPay are standard, a single failed transaction can trigger involuntary churn if not handled via customer success automation.

- External Macro Signals: Integrate industry-specific seasonality. If your client is in a sector facing a 2026 budget freeze, your model must weight their risk higher.

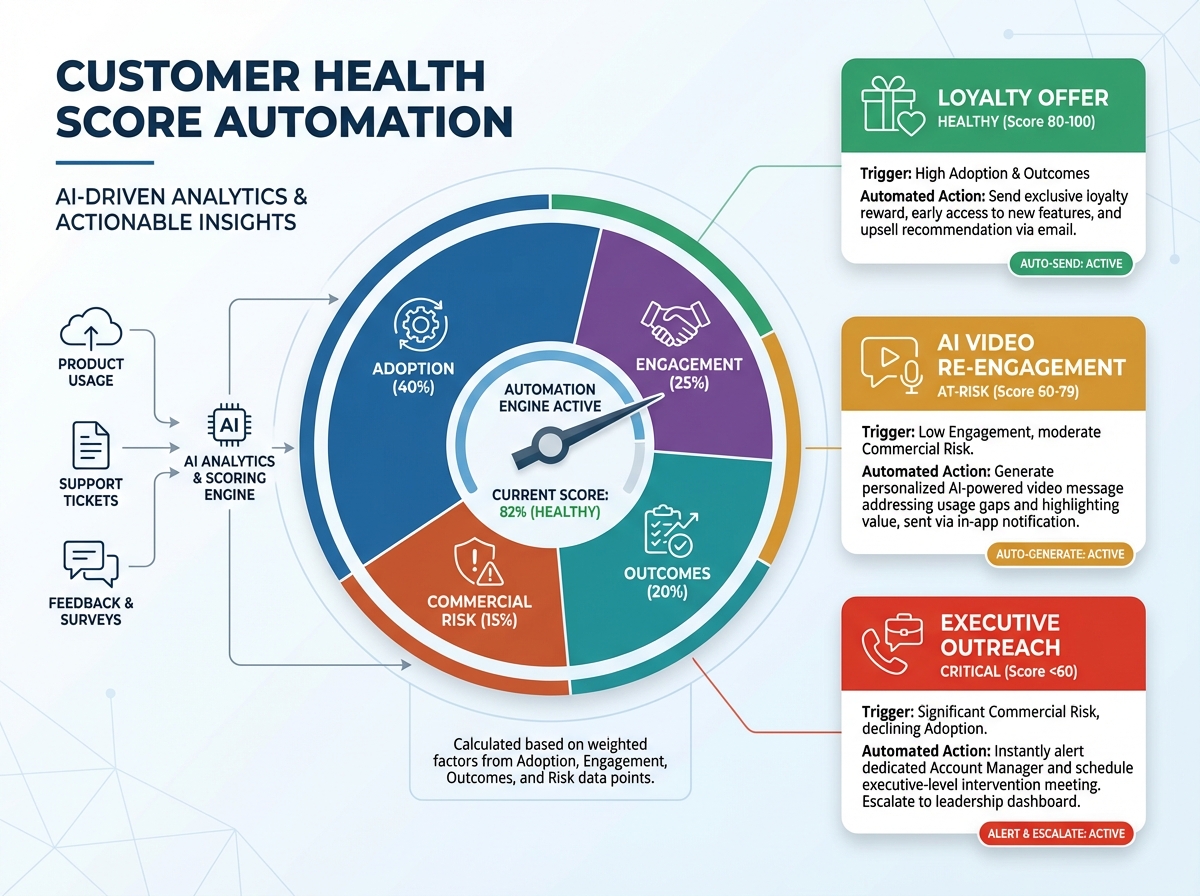

Implementing Customer Health Score Automation

Once the model is trained, you must operationalize it through customer health score automation. This is a composite scoring system that refreshes daily, classifying accounts into Red, Amber, or Green (R/A/G) buckets.

In 2026, a high-performing health score might be weighted as follows:

- Adoption (40%): Feature depth, seat utilization, and login frequency.

- Engagement (25%): Executive sponsor activity and support sentiment.

- Outcomes (20%): ROI milestone attainment and goal tracking.

- Commercial Risk (15%): Payment failure history and contract length.

These scores should automatically trigger specific workflows. For instance, a "Red" score for an enterprise account should immediately trigger a high-touch executive outreach, while an "Amber" score might trigger a subscription retention AI video to re-engage the admin.

Source: Vitally: How to Create a Customer Health Score with Four Metrics

3. Operationalizing Action: Usage-Based Retention Triggers

Prediction without action is just overhead. The most effective predictive churn prevention Q1 2026 strategies rely on usage-based retention triggers. These are automated rules that fire the moment a leading indicator of risk or opportunity changes.

Common Triggers for Q1 2026

- The 14-Day Decay: A 30% drop in login frequency over a two-week period for power users.

- Feature Abandonment: A user stops using a core workflow (e.g., an integration or reporting module) that was previously a daily habit.

- Credit Depletion: In usage-based pricing models, an account nearing its API or query cap without a scheduled top-up is a prime candidate for an expansion conversation—or a churn risk if they feel "capped."

- Support Backlog Threshold: An account with more than three "High Priority" tickets open for over 48 hours.

Mapping Triggers to Channels

Each trigger must be mapped to a specific channel and Service Level Agreement (SLA). For example, a "Credit Depletion" trigger should fire an automated in-app notification and a WhatsApp message within 2 hours, offering a seamless upgrade path.

As SaaS companies increasingly move toward consumption-based models in 2026, managing these triggers becomes the "new" renewal management. Transitioning to these models requires a sophisticated understanding of how usage correlates with value.

Source: Chargebee Pricing Labs: Transitioning to Usage-Based Pricing

4. The Personalization Frontier: Subscription Retention AI Videos

In a crowded Q1 inbox, a standard "Checking in on your renewal" email will be ignored. To cut through the noise, enterprise teams are turning to subscription retention AI videos. These are dynamically generated, hyper-personalized videos that address the specific usage and goals of an account.

Platforms like TrueFan AI enable SaaS companies to generate thousands of these videos at scale, featuring a spokesperson or celebrity who speaks directly to the customer’s achievements. Imagine a CFO receiving a video that says, "Hi Sarah, your team at Acme Corp saved 400 hours this quarter using our automation suite. Here is how that translates to your Q1 ROI goals."

Campaign Types for AI Video

- The Executive Recap: A "QBR-in-a-video" sent to the buying committee, summarizing business outcomes and benchmarks against industry peers. This is a core component of subscription value reinforcement videos.

- The Admin Re-Activation: A video sent to dormant admins highlighting a new feature that solves a specific pain point identified in their previous support tickets.

- The Renewal Negotiation: A personalized offer video that presents three renewal options (e.g., a loyalty discount, a seat expansion bonus, or a multi-year price lock).

By using customer success automation to trigger these videos based on health scores, companies can deliver a high-touch experience at a low-touch cost. This level of renewal negotiation personalization is what separates market leaders from those struggling with high churn rates in 2026.

5. Solving "Invisible" Churn: India Payments and Lifecycle Optimization

A significant and often overlooked portion of churn is "involuntary." This occurs when a customer wants to stay, but their payment fails due to technical or regulatory friction. In the Indian market, involuntary churn reduction is a critical pillar of predictive churn prevention Q1 2026.

Navigating India’s Payment Realities

With the RBI’s strict e-mandate and UPI AutoPay regulations, SaaS companies must be proactive. In 2026, it is estimated that up to 45% of SaaS churn in India is involuntary, caused by expired cards or failed mandate migrations.

To combat this, your SaaS renewal season strategies must include:

- Smart Dunning: Escalating retry schedules based on specific failure codes (e.g., retrying "insufficient funds" at the start of the month).

- Pre-debit Notifications: Automated WhatsApp and email reminders 48 hours before a mandate is charged, as required by RBI.

- Mandate Refresh Flows: Using subscription retention AI videos to guide customers through the process of updating their UPI AutoPay or e-mandate before it expires.

TrueFan AI's 175+ language support and Personalised Celebrity Videos can be particularly effective here, explaining complex regulatory requirements to customers in their native language, thereby reducing friction and increasing compliance.

Source: Razorpay: Understanding Recurring Transactions and UPI AutoPay

Source: Juspay: Recurring Payments 101 for Merchants

6. Measurement and Implementation: The 8-Week Sprint to Q1 Impact

To see results by the peak of the Q1 2026 renewal season, companies must follow a disciplined implementation blueprint. Proving the impact of predictive analytics customer retention requires clear KPIs and a structured rollout.

The 8-Week Implementation Blueprint

- Weeks 1-2: Data Foundations. Connect your CDP to your warehouse. Establish your feature set for churn prediction modeling and validate your health score weights against 2025 data.

- Weeks 3-4: Creative Orchestration. Build your templates for subscription value reinforcement videos. Map your usage-based retention triggers to specific campaign workflows in your CS platform.

- Weeks 5-6: Pilot and Compliance. Launch your predictive intervention campaigns to a "Red" cohort. Ensure all payment flows in India are RBI-compliant and that your dunning logic is optimized.

- Weeks 7-8: Scale and Optimize. Roll out loyalty reward renewal offers to your "Green" cohort. Use A/B testing to compare the effectiveness of AI video vs. standard email.

Solutions like TrueFan AI demonstrate ROI through increased watch-through rates and higher CTA clicks compared to static content, directly contributing to a lift in NRR. By the end of this sprint, your team should have a dashboard tracking "Recovered Revenue" and "Downgrade Avoidance" in real-time.

Source: TrueFan AI: Video Personalization ROI Metrics

Conclusion

The Q1 2026 renewal season will be a defining moment for SaaS resilience. Success requires more than just a good product; it requires a sophisticated orchestration of data, automation, and personalized communication. By moving toward predictive analytics customer retention and leveraging the power of subscription retention AI videos, companies can transform the renewal process from a point of friction into a driver of long-term loyalty.

Book a TrueFan Enterprise demo to deploy predictive intervention campaigns, subscription retention AI videos, and renewal negotiation personalization at scale. Visit https://www.truefan.ai/ to learn more.

Frequently Asked Questions

What is customer health score automation?

It is an automated system that aggregates product usage, customer engagement, and commercial data to assign a real-time "health" value to an account. This score triggers specific retention or expansion workflows without manual intervention.

How do usage-based retention triggers work in SaaS?

These are automated alerts that fire when a customer's product behavior changes—such as a drop in login frequency or the abandonment of a key feature. These triggers allow CS teams to intervene before the customer decides to churn.

What is involuntary churn reduction in the context of Indian payments?

It refers to the process of preventing subscription cancellations caused by payment failures. This is achieved through smart dunning, RBI-compliant mandate management, and using tools like TrueFan AI to guide users through payment updates.

How do subscription retention AI videos improve renewal rates?

By delivering hyper-personalized, high-production-value content that recaps a customer's specific ROI and achievements, these videos drive higher engagement and executive alignment than standard text-based emails.

What are the best SaaS renewal season strategies for Q1 2026?

The most effective strategies combine predictive churn prevention Q1 2026 modeling with automated, personalized interventions, a focus on involuntary churn reduction, and clear value reinforcement for the buying committee.