Post-festival debt recovery videos India: Behavioral nudges for BNPL and credit cards in Jan–Feb 2026

Estimated reading time: 10 minutes

Key Takeaways

- Use behavioral nudges in personalized videos to reduce friction and improve repayment intent post-festivals.

- BNPL automation should segment users by DPD and ticket size, enabling proactive reminders and micro-EMI options.

- Credit card recovery benefits from dynamic education on Minimum vs Total Due and one-tap EMI conversions.

- RBI-compliant restructuring videos must transparently disclose terms and offer humane hardship pathways.

- Track collection efficiency via WTR, CTA conversions, and agent-minutes-per-case to prove ROI.

The fiscal landscape of early 2026 in India is defined by a significant “festive hangover,” where the exuberant spending of the preceding Diwali and New Year cycles transitions into a period of acute liquidity constraints. For lenders, this seasonal shift necessitates a sophisticated approach to collections that balances regulatory rigor with empathetic engagement. Post-festival debt recovery videos India have emerged as the primary vehicle for this transition, offering a high-comprehension, low-friction medium to navigate the Jan–Feb repayment spike.

As credit card transactions reached a staggering ₹1.91 lakh crore in late 2025, the subsequent months of 2026 are witnessing a commensurate rise in delinquency risks. Platforms like TrueFan AI enable financial institutions to deploy hyper-personalized video content that addresses these risks through behavioral science rather than traditional, high-friction recovery tactics. By integrating empathetic payment reminder campaigns with real-time payment rails, lenders can proactively mitigate the “roll-forward” risk that typically plagues the first quarter of the fiscal year.

Source: Credit card spending and issuances surge in festival season | Post-festive consumption outlook remains strong into FY2026 | Festivals spark surge in quick credit and BNPL

Behavioral nudge payment automation: The psychology of post-festival recovery

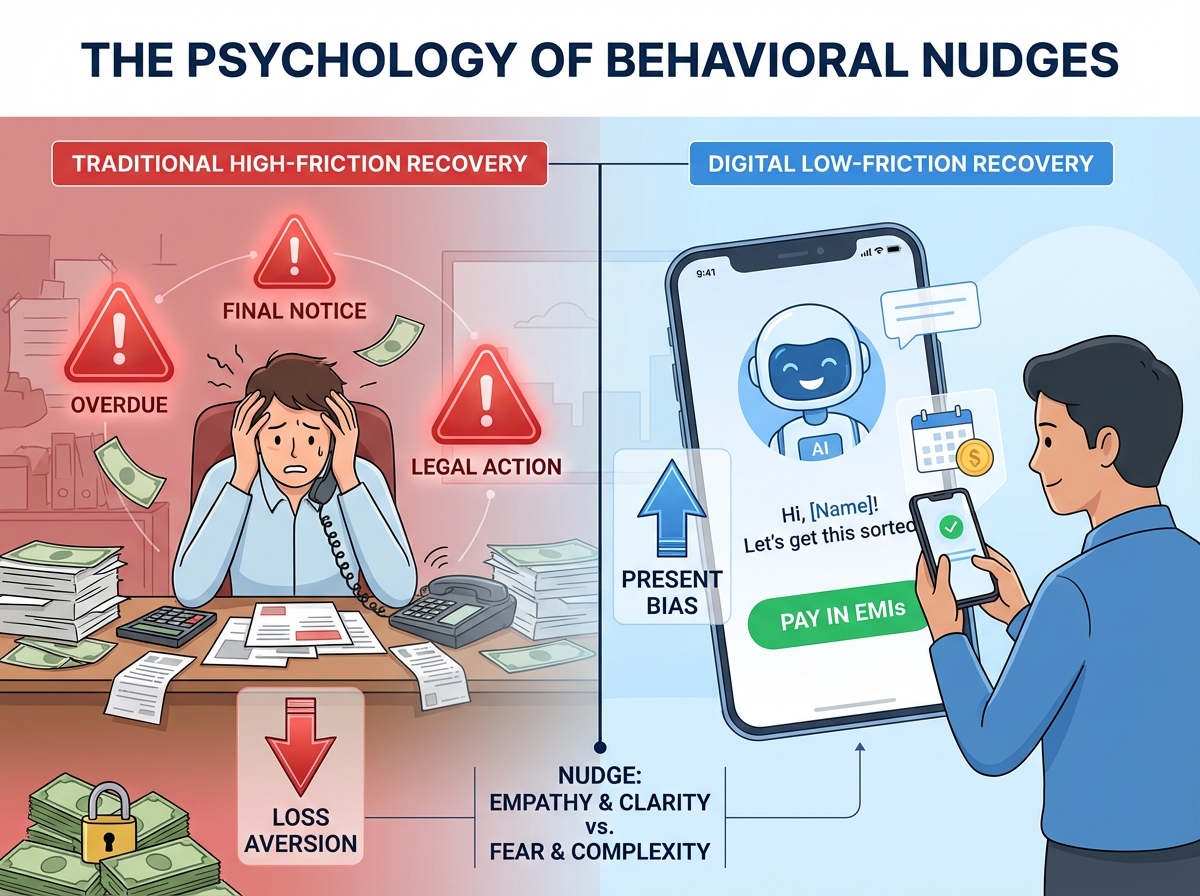

The efficacy of debt recovery in 2026 is no longer predicated on the volume of outreach but on the psychological precision of the nudge. Behavioral nudge payment automation leverages cognitive biases to guide customers toward repayment without triggering the defensive mechanisms associated with aggressive collection calls. In the context of post-festival stress, where cognitive load is high due to multiple financial obligations, video-led nudges simplify the decision-making process.

Loss aversion is a critical component of this framework; by gently illustrating the long-term consequences of rolling DPD (Days Past Due)—such as interest accrual and credit score erosion—videos create a sense of urgency. Conversely, addressing “present bias” involves offering immediate, low-friction solutions like one-tap “Pay Now” buttons or micro-EMI options that make the debt feel manageable in the current moment. This dual approach ensures that the customer feels supported rather than pressured, fostering a sense of financial wellness support videos.

Furthermore, implementation intentions are solidified through clear, actionable next steps embedded directly within the video interface. Whether it is setting up a UPI Autopay mandate or scheduling a callback with a hardship advisor, the goal is to reduce the gap between the intention to pay and the act of payment. By 2026, these “invisible payment” flows have become mainstream, allowing customers to resolve dues within the same digital journey where they received the reminder.

Source: Redefining debt collection for a smarter digital future | Fintech trends 2026: Embedded payments and compliance

BNPL payment collection automation: Managing high-velocity delinquency

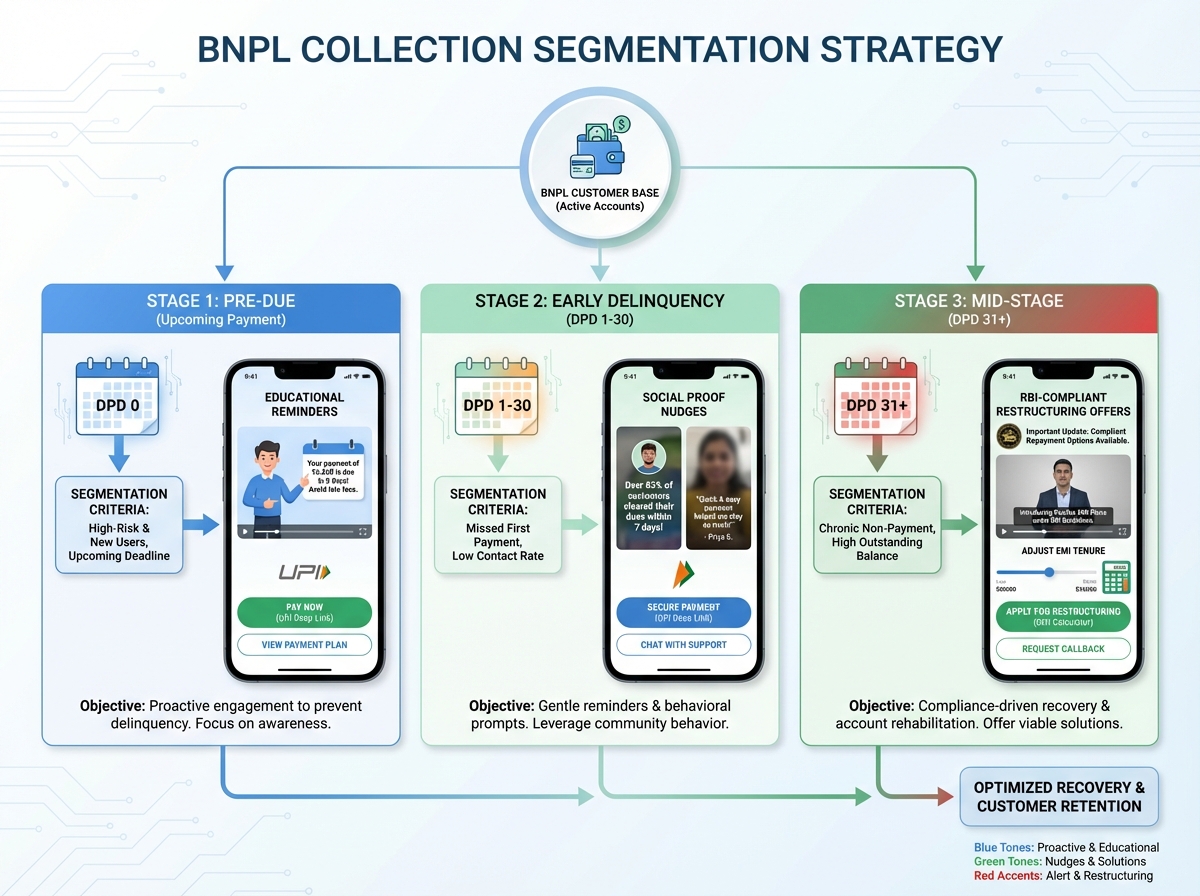

The Buy Now, Pay Later (BNPL) sector in India has seen a 50% surge in quick credit utilization during the 2025 festival season, leading to a complex web of short-tenor exposures in early 2026. BNPL payment collection automation is essential for managing this high-velocity environment, where ticket sizes are smaller but the volume of transactions is immense. Automated segmentation allows lenders to tailor video content based on risk scores, ticket size, and specific DPD buckets.

For the “Pre-due” segment (T-5 to T-1), the focus is on education and flexibility. Videos in this stage serve as customer financial health videos, reminding users of upcoming dates while offering the option to convert the total due into smaller installments before any late fees are applied. This proactive approach not only improves collection efficiency optimization but also enhances the overall customer experience by providing a safety net during a tight liquidity month.

In the early delinquency phase (DPD 1–30), the automation engine triggers videos that utilize social proof and commitment devices. For instance, a video might state, “Most customers in your region choose the 3-month EMI plan to stay on track.” This normalizes the act of restructuring and encourages the user to make a “promise-to-pay” (PTP). The integration of UPI deep links within these videos ensures that once the decision is made, the transaction can be completed in seconds, significantly reducing the “cost to collect” for the lender.

Source: Trends debt collection agencies should look out for in 2026 | Festivals spark surge in quick credit

Credit card recovery personalization: Tailoring the message to the spender

Credit card recovery personalization in 2026 requires a deep understanding of the individual's spending patterns and billing cycles. Unlike BNPL, credit card debt often involves larger balances and more complex interest structures. Personalized videos can dynamically pull data points such as the specific spend categories that led to the high balance—be it electronics, travel, or festive apparel—and offer tailored repayment solutions.

TrueFan AI's 175+ language support and Personalised Celebrity Videos provide a unique opportunity to deliver these messages with a level of authority and empathy that generic SMS or automated IVR calls lack. A video might explain the difference between paying the “Minimum Due” versus the “Total Due,” using visual aids to show how interest accumulates over time. This educational layer is crucial for credit card recovery personalization, as it empowers the customer to make an informed choice rather than a reactive one.

One-tap actions such as EMI modification video offers are particularly effective for credit card holders. By allowing a user to convert a large statement balance into a 6-month or 12-month EMI directly from the video interface, lenders can secure a commitment that might otherwise have resulted in a default. These payment flexibility campaigns are designed to align with the customer's cash flow, particularly in Jan–Feb when salary cycles are often stretched thin by post-festival expenses.

Source: Credit card spending and issuances surge in festival season | TrueFan Enterprise BFSI Solutions

Payment restructuring offer videos: Navigating hardship with RBI compliance

As delinquency moves into the mid-to-late stages (DPD 31–60+), the focus shifts from simple reminders to formal restructuring. Payment restructuring offer videos are a vital tool for lenders to communicate complex options like tenor extensions, moratoriums, or installment reductions. These videos must be strictly RBI-compliant, ensuring that all terms, conditions, and total costs of credit are transparently disclosed to the borrower.

The 2026 regulatory environment in India, guided by the RBI Digital Lending Framework and FACE (Fintech Association for Consumer Empowerment) guidelines, mandates a humane and non-harassing approach to debt recovery. Restructuring videos serve this mandate by providing a “hardship portal” experience. Customers can interact with the video to input their current monthly income and see a real-time adjustment of their EMI plan. This level of transparency builds trust and ensures that the lender is seen as a partner in the customer's financial recovery.

For cases of extreme financial stress customer support, these videos can facilitate a direct route to a human advisor or a grievance redressal officer. By embedding a “Schedule a Call” feature, lenders can ensure that outreach occurs within the RBI-mandated call-hour windows (typically 8 AM to 7 PM). This not only keeps the lender compliant but also ensures that the conversation happens when the customer is most likely to be receptive and prepared to discuss their financial situation.

Source: RBI FAQs on Digital Lending | FACE Guidelines on Debt Recovery 2025 | RBI Master Circular on Credit Card Operations

Financial wellness support videos: Building long-term loyalty and credit health

Beyond immediate recovery, the Jan–Feb 2026 period is an opportune time for lenders to deploy financial wellness support videos. These educational tracks focus on long-term credit score improvement guides and budgeting strategies. By positioning themselves as educators, lenders can transition from being perceived as “collectors” to “financial partners,” which is a key driver of customer retention in a competitive market.

A typical wellness series might include short, vernacular explainers on how timely EMI payments contribute to a healthy credit score, or how to use UPI Autopay to avoid the “forgetfulness tax” of late fees. These videos often include interactive calculators where users can see the potential impact of their current repayment behavior on their future borrowing capacity. This “gamification” of credit health encourages positive financial habits that extend well beyond the post-festival recovery period.

Loyalty-based payment incentives can also be integrated into these wellness tracks. For example, a lender might offer a small fee waiver or bonus loyalty points for customers who maintain a “perfect repayment streak” through the difficult Jan–Feb months. By highlighting these incentives in a video format, lenders can leverage the “reward” center of the brain to counter the stress of debt, making the act of repayment a positive milestone in the customer's financial journey.

Source: Post-festive demand remains strong in country | Redefining debt collection for a smarter digital future

Collection efficiency optimization: Measuring ROI in the 2026 digital ecosystem

The ultimate goal of any video-led recovery strategy is collection efficiency optimization. In 2026, this is measured through a multi-dimensional KPI framework that goes beyond simple repayment rates. Lenders now track contactability uplift, watch-through rates (WTR), and the conversion rate of specific CTAs (Call to Action) within the video. This data-driven approach allows for rapid A/B testing of scripts, thumbnails, and incentive structures.

Solutions like TrueFan AI demonstrate ROI through significant reductions in the “agent-minutes-per-case” metric.

Frequently Asked Questions

How do personalized recovery videos improve repayment rates versus SMS or IVR?

Personalized videos combine behavioral nudges, clear education, and embedded CTAs (e.g., Pay Now, Set up Autopay) to reduce cognitive load and friction. This increases intent formation and shortens the intention–action gap, typically boosting contactability, WTR, and conversions.

What KPIs should lenders track to measure collection efficiency in 2026?

Track watch-through rate (WTR), CTA conversion rate, promise-to-pay (PTP) creation, payment completion time, agent-minutes-per-case, and DPD roll-forward reduction. Use cohort analysis and continuous A/B testing to attribute ROI.

How can BNPL lenders manage high-volume, low-ticket delinquencies effectively?

Automate segmentation by risk/DPD, deploy pre-due education with micro-EMI offers, and use social proof in early delinquency videos. Integrate UPI deep links to complete payments instantly once a PTP decision is made.

What are RBI-compliant best practices for restructuring via video?

Disclose terms, costs, and borrower obligations transparently; restrict contact hours to RBI windows; provide hardship pathways to human advisors; and log consent for any restructuring or mandate setup.

How should credit card recovery messaging differ from BNPL?

Credit card strategies should emphasize education on interest mechanics (Minimum vs Total Due), provide one-tap EMI conversions for large balances, and tailor content to spend categories, while BNPL focuses on short-tenor micro-EMIs and pre-due nudges.