ESG score marketing automation 2026: A Playbook for Personalized Sustainability Investor Relations Videos in India

Estimated reading time: ~10 minutes

Key Takeaways

- SEBI’s BRSR Core anchors investor communications to assured data, reducing greenwashing and aligning with Core ESG ratings.

- Video-first IR outperforms static PDFs, enabling credible, audit-trailed storytelling synced with exchange disclosures.

- Personalization architecture tailors narratives by stakeholder type using Scope 1–3, RE mix, DEI, and governance KPIs.

- Green bond campaigns must follow SEBI’s anti-greenwashing guardrails with rigorous pre- and post-issuance reporting.

- Enterprise workflows using TrueFan AI scale compliant, multilingual, hyper-personalized investor videos with rapid updates.

The institutional investment landscape in India has undergone a seismic shift as we enter 2026. The convergence of SEBI’s BRSR Core mandates and the maturation of ESG score marketing automation 2026 has redefined how listed enterprises communicate their sustainability performance. Corporate sustainability storytelling is no longer a peripheral marketing exercise; it is now a core fiduciary requirement.

By leveraging high-fidelity, third-party assured data, enterprises can now architect dynamic narrative assets that resonate with global institutional stakeholders. This playbook explores how to operationalize these technologies to drive responsible investment attraction and secure long-term capital. We will examine the transition from static PDF disclosures to personalized, video-first investor communications that bridge the gap between raw metrics and investor trust.

1. India 2026 ESG and Ratings Landscape: Navigating the New Regulatory Paradigm

The regulatory environment for Indian listed entities in 2026 is characterized by the ubiquity of the BRSR Core framework. This subset of the Business Responsibility and Sustainability Report (BRSR) requires reasonable or limited assurance for key performance indicators (KPIs). For the top 1,000 listed entities, this transition has necessitated a rigorous data lineage that extends deep into the value chain.

SEBI’s direction on Core ESG Ratings has further intensified the need for precision in governance transparency marketing. ESG Rating Providers (ERPs) are now mandated to base their “Core” ratings exclusively on third-party assured data, significantly reducing the efficacy of voluntary, unverified disclosures. Furthermore, the green debt market in India is projected to surpass $50 billion by the end of 2026, driven by tightened greenwashing guardrails.

For investor relations (IR) leaders, the implication is clear: communications must pair narrative with assured datapoints. Automation systems must pull only controlled, approved fields to avoid inconsistencies across decks, exchange filings, and video assets. This ensures that every claim is backed by a verifiable audit trail, which is essential for ESG rating improvement communication.

Sources:

- SEBI: BRSR Core Framework for Assurance and ESG Disclosures

- SEBI: FAQs for ESG Rating Providers (ERPs)

- SEBI: Greenwashing Guardrails for Green Debt Securities

- SEBI: 2025 Ease of Doing Business Update on ESG Assurance

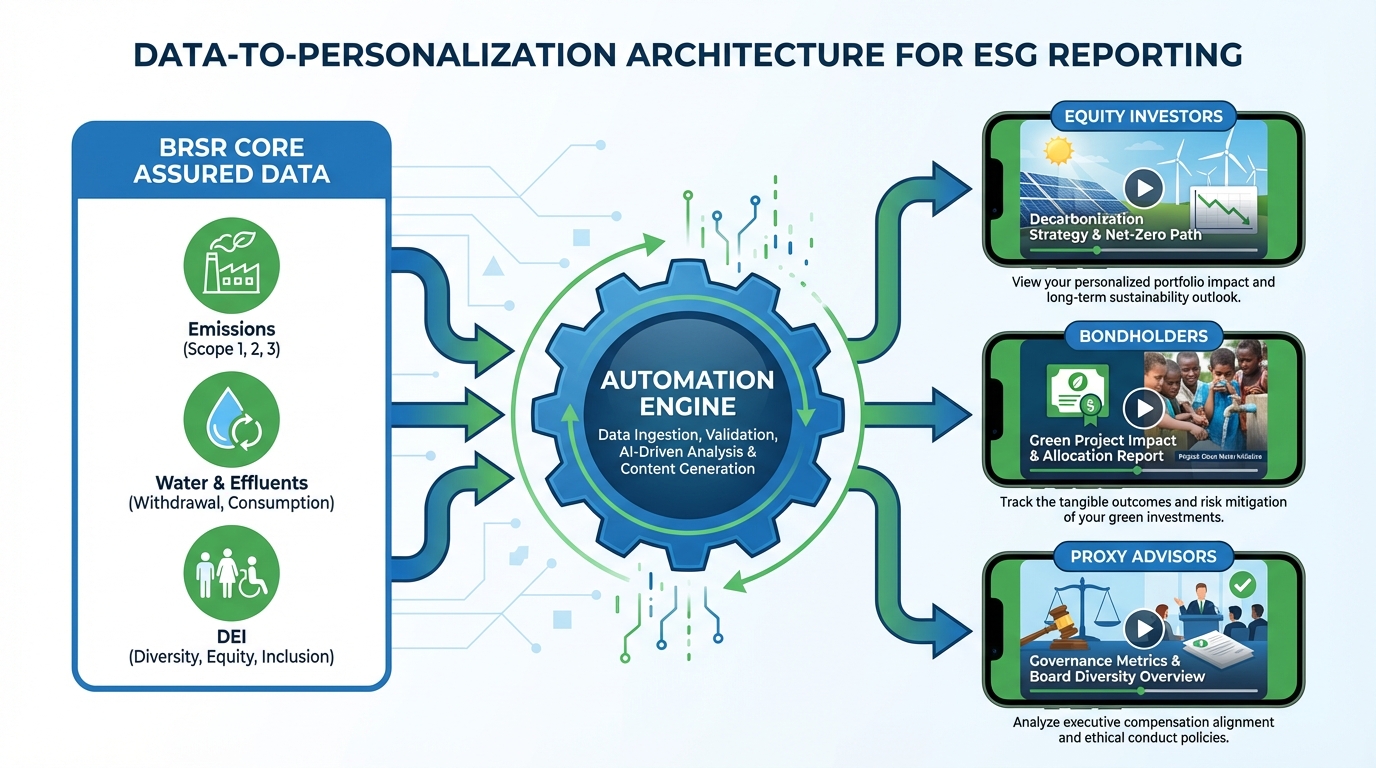

2. Data-to-Personalization Architecture: Implementing Environmental Impact Personalization

Environmental impact personalization is the dynamic tailoring of investor communications based on entity-level ESG metrics and milestones. In 2026, this architecture relies on a “single source of truth” that integrates BRSR Core data with personalization logic. By 2026, 85% of institutional investors in India will prioritize BRSR Core assured data over voluntary disclosures.

The data fields required for this level of granularity include Scope 1–3 emissions, renewable energy share, and water withdrawal intensity. Personalization logic allows an enterprise to emphasize decarbonization trajectories for institutional equity investors while highlighting use-of-proceeds for green bondholders. This ensures that stakeholder sustainability engagement is both relevant and impactful.

To mitigate greenwashing risks, automation platforms must map each data field to a specific disclosure note and a last-updated timestamp. This level of transparency is critical for maintaining credibility in a market where 92% of ERPs now use AI-driven sentiment analysis on video disclosures. By automating the delivery of these insights, enterprises can achieve a 60% reduction in investor inquiry response times.

Key Data Fields for 2026 Personalization:

- Emissions Intensity: tCO2e per INR crore revenue (FY24–FY26 trajectory).

- Renewable Energy Mix: Percentage of total energy consumption from renewable sources.

- DEI Metrics: Gender diversity in leadership and pay equity bands across the value chain.

- Governance KPIs: Board independence percentages and whistleblower resolution SLAs.

3. The Video-First Investor Communications Library: Scaling Credible Narratives

The shift toward video-first communications is driven by the fact that video-based IR content sees a 4.5x higher engagement rate than PDF reports in 2026. Platforms like TrueFan AI enable enterprises to generate a comprehensive library of sustainability investor relations videos at scale. These assets are synchronized with financial results and linked directly to exchange-filed disclosures.

A robust video library should include climate action investor updates that explain milestones like SBTi validation or fleet electrification. Carbon neutrality achievement videos must clearly define boundaries, offset quality, and verification status. These formats ensure that the sustainable business model videos are not just aspirational but are grounded in material reality.

Social impact measurement videos have also gained prominence, quantifying outcomes such as beneficiaries of skilling programs or retention rates in local communities. Finally, ESG compliance reporting videos demystify the assurance scope for investors, providing a “What’s Assured” checklist. This comprehensive approach ensures that all facets of the ESG story are communicated with clarity and authority.

Video Format Checklist:

- Quarterly ESG Highlights: 60–120s; Material topics and YoY KPI trends.

- Climate Milestone Explainers: 45–90s; Location-specific visuals and risk mitigation.

- Green Bond Impact Tiles: 60–90s; Allocation vs. impact KPIs with verifier callouts.

- Governance Skills Matrix: 45–60s; Board composition and risk oversight performance.

4. DEI and Governance as Credibility Pillars: Communicating the S and G

While environmental metrics often dominate the conversation, diversity inclusion investor campaigns and governance transparency marketing are the true pillars of credibility. In 2026, investors demand a granular view of workforce representation and leadership pipelines. This includes equitable pay bands and the efficacy of grievance redressal mechanisms.

Governance transparency marketing must move beyond static board lists to show a dynamic skills matrix and risk oversight performance. This includes board independence percentages and director attendance at committee meetings. These disclosures are vital for ESG rating improvement communication, as ERPs increasingly weigh governance strength in their Core ESG ratings.

To ensure storytelling safeguards, enterprises must standardize definitions—such as defining “women in leadership” by specific grade levels. Including methodology footnotes and timestamps within the video overlays further enhances trust. By demonstrating a commitment to these pillars, enterprises can significantly improve their standing with proxy advisors and DEI-focused institutional funds.

Governance Content Blocks:

- Board Composition: Independence % and diversity of expertise.

- Risk Oversight: Performance on climate-related risk assessments.

- Executive Compensation: Rationale for ESG-linked KPIs and performance outcomes.

- Whistleblower Performance: Resolution rates within defined SLAs.

5. Green Bond Marketing Campaigns: Aligning with SEBI’s 2026 Standards

Green bond marketing campaigns in 2026 require a sophisticated blend of technical disclosure and narrative engagement. Investors now expect a clear pre-issuance framework and a rigorous post-issuance reporting cadence. This includes annual project-level summaries of allocation and impact metrics, such as MWh of renewable energy capacity added or tCO2e avoided.

SEBI’s revised disclosure requirements for green debt securities have established a high bar for anti-greenwashing discipline. Issuers must avoid over-claiming and use conservative baselines for all impact projections. A coordinated set of assets, including roadshow teaser videos and FAQ clips on methodology, can help translate complex frameworks into accessible investor insights.

By 2026, the use of automated video for green bond reporting has become a best practice for responsible investment attraction. These assets provide a “live” view of project progress, which is highly valued by fixed-income investors. Ensuring that these videos are consistent with exchange releases is paramount for maintaining regulatory compliance.

Sources:

- SEBI: Revised Disclosure Requirements for Green Debt Securities

- SEBI: Green Bond Statistics

- SEBI: Framework for ESG Debt Securities (Non-Green)

6. Scaling with ESG score marketing automation 2026: The TrueFan Enterprise Workflow

The operationalization of ESG score marketing automation 2026 requires an enterprise-grade workflow that ensures brand safety and regulatory compliance. TrueFan AI's 175+ language support and Personalised Celebrity Videos technology can be adapted to feature CEOs or brand ambassadors in a highly controlled environment. Learn how this scales personalization. This allows for hyper-personalization at scale, where each investor receives a video tailored to their specific interests.

The workflow begins with the ingestion of approved ESG data fields via secure APIs, ensuring that only assured data is used. Virtual reshoots and AI editing allow for rapid updates to data points without the need for costly production cycles. Solutions like TrueFan AI demonstrate ROI through increased investor watch time and a significant reduction in the time-to-publish for critical sustainability updates.

Finally, the distribution of these assets across multi-channel platforms—including investor microsites, LinkedIn, and WhatsApp Business API—ensures maximum reach. Analytics dashboards provide real-time insights into engagement levels, allowing IR teams to refine their content strategy. This closed-loop system is the future of corporate sustainability storytelling in a data-driven market.

TrueFan Enterprise Capabilities:

- Hyper-Personalization: Dynamic overlays for name, firm, and region-specific KPIs.

- Multilingual Localization: Lip-sync and voice retention across 175+ languages.

- Compliance & Security: ISO 27001 and SOC 2 certified workflows with built-in moderation.

- Real-time Rendering: Sub-30s render targets for time-sensitive exchange announcements.

Frequently Asked Questions

How does ESG score marketing automation 2026 help in reducing greenwashing risks?

Automation restricts content to third-party assured BRSR Core data, mapping every claim to a disclosure note and timestamp. This creates a transparent audit trail, enforces consistency across filings, decks, and videos, and deters over-claiming.

What is the impact of video-first IR on ESG ratings in India?

Video clarifies complex topics and improves analyst understanding. In 2026, most ERPs use AI to analyze video disclosures, so concise, data-backed videos improve sentiment analysis fidelity and can positively influence rating perceptions.

Can small-cap listed entities benefit from these automation tools?

Yes. Automated production, virtual reshoots, and templated disclosures lower costs and time-to-publish. This enables small caps to deliver professional, compliant investor videos and attract institutional attention.

What data is needed to personalize investor communications?

Core inputs include Scope 1–3 emissions, renewable energy mix, water intensity, DEI metrics (leadership representation, pay equity), and governance KPIs (board independence, whistleblower SLAs). Each field should reference its source and last-updated timestamp.

How should issuers align green bond campaigns with SEBI’s 2026 standards?

Publish clear pre-issuance frameworks and post-issuance reports, use conservative baselines, disclose allocation and impact KPIs annually, and ensure video updates match exchange releases to avoid greenwashing and maintain compliance.