AI Video for Stock Market Content India 2026: SEBI-Compliant Automation for Finfluencers, RIAs, and Finance YouTubers

Key Takeaways

- Compliance is a competitive moat in 2026; AI embeds SEBI/ASCI guardrails into every workflow.

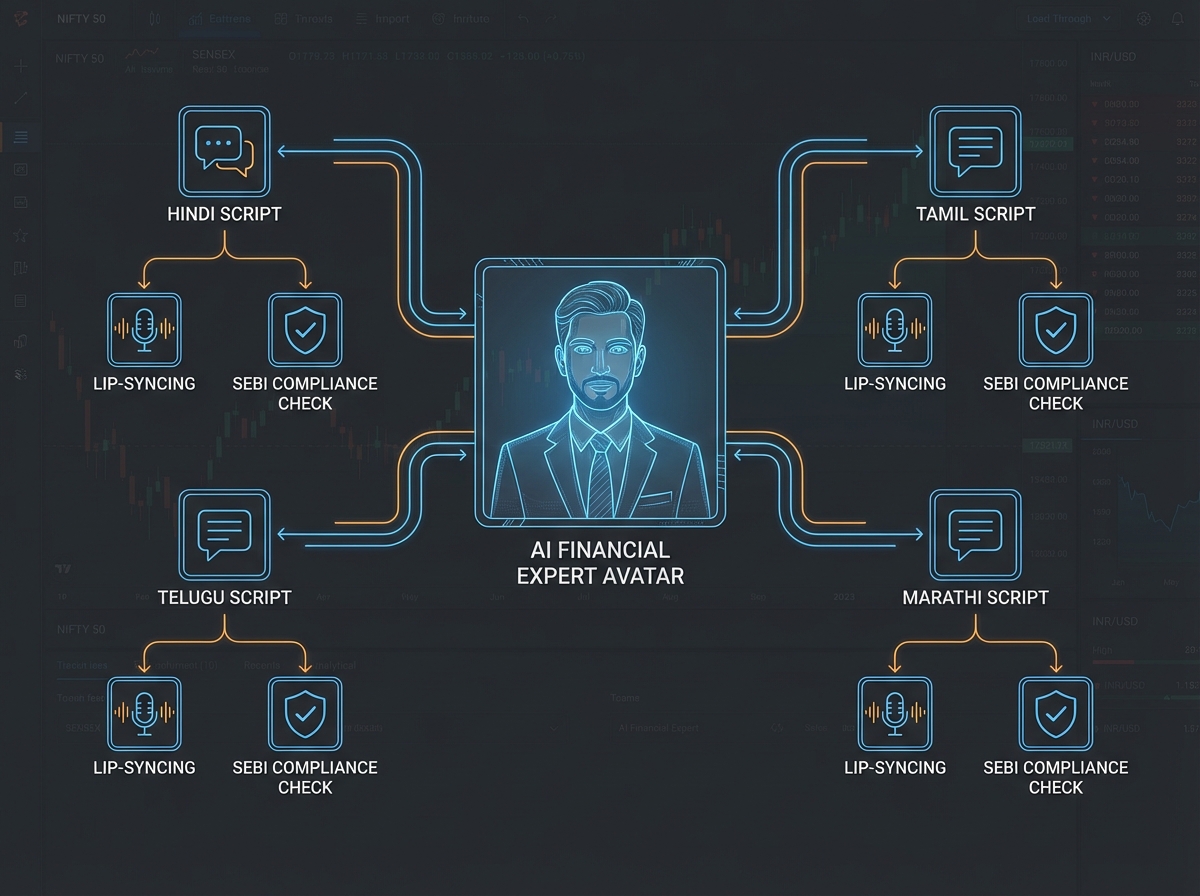

- Scale with vernacular, high-volume production using avatars and multilingual pipelines.

- Adopt end-to-end workflows for stock analysis, mutual fund explainers, trading methods, and daily market recaps.

- Win on YouTube with clear disclosures, accurate metadata, and synthetic content labeling.

- Enterprise governance with Studio by TrueFan AI ensures security, automation, and zero compliance incidents.

In the rapidly evolving digital landscape of 2026, AI video for stock market content India 2026 has emerged as the definitive solution for Indian finfluencers and RIAs looking to scale compliant education at speed. As regulatory scrutiny reaches an all-time high, the ability to produce high-quality, legally sound financial content is no longer just an advantage—it is a necessity for survival in the creator economy.

The Indian financial content ecosystem is undergoing a seismic shift. With the Securities and Exchange Board of India (SEBI) intensifying its crackdown on unregistered “finfluencers” and the Advertising Standards Council of India (ASCI) tightening disclosure norms, the “wild west” era of stock tips is over. Today, success belongs to those who leverage finance YouTube automation India to deliver data-driven, localized, and fully compliant market insights.

1. The 2026 Landscape: Why Compliance is the New Competitive Moat

The year 2026 marks a turning point for financial creators in India. Following the landmark SEBI orders of late 2025, including the high-profile action against unregistered entities for misleading claims, the industry has seen a massive consolidation. According to recent market data, non-compliant finfluencers faced a staggering 40–60% decline in brand deals by early 2026 as corporations shifted budgets toward registered professionals and compliant platforms.

The Shift to Vernacular and Volume

While compliance is the floor, volume and localization are the ceiling. India’s retail investor base has expanded deep into Tier 2 and Tier 3 cities. Research indicates a 300% increase in demand for vernacular finance content in languages like Hindi, Tamil, Telugu, and Marathi. For a single creator or a small advisory firm, keeping up with daily market moves in multiple languages is physically impossible without automation.

Key 2026 Statistics and Trends:

- Brand Deal Contraction: Compliant creators now command 75% of the total financial ad spend in India, leaving unregistered influencers with dwindling options (Source: Equentis, 2025).

- Video Preference: 72% of Indian retail investors report a preference for video-based market analysis over text-based reports (Projected 2026 Data).

- Production Efficiency: AI-driven workflows have reduced the average cost of producing a professional financial video by 85%, allowing firms to pivot from weekly to daily uploads.

- Regulatory Speed: SEBI’s new “Performance Validation Agency” (PVA) now utilizes AI to audit content, making manual compliance checks a bottleneck of the past.

Platforms like Studio by TrueFan AI enable creators to navigate this complex environment by providing the tools necessary to automate production while embedding compliance guardrails directly into the workflow.

2. The Compliance-First Blueprint: Navigating SEBI and ASCI in 2026

To succeed in 2026, your stock market YouTube videos AI strategy must be built on a foundation of legal adherence. The regulatory framework in India is multi-layered, involving SEBI for investment advice and ASCI for advertising standards.

SEBI IA/RA Advertisement Code Essentials

If you are a Registered Investment Adviser (RIA) or Research Analyst (RA), every video you post is considered an “advertisement” under the April 2023 code.

- Prohibitions: You cannot promise “assured returns,” use “SEBI approved” logos as an endorsement, or showcase misleading past performance.

- Mandatory Disclosures: Your name, SEBI registration number, and registered office address must be prominent.

- Record Keeping: You must maintain a record of every video, script, and approval for at least five years.

ASCI Influencer Guidelines (2025-2026 Updates)

The ASCI update of April 2025 introduced stricter “Material Connection” disclosures.

- Disclosure Placement: The #ad or #collab tag must be superimposed on the video, not just hidden in the description.

- Financial Qualification: Influencers offering financial advice must possess relevant qualifications (e.g., CA, CFA, or SEBI registration) and display them clearly.

- Crypto/VDA Disclaimers: For any content involving Virtual Digital Assets, the mandatory disclaimer must be spoken and shown: “Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.”

“Education vs. Advice”: The Great Divide

The most critical distinction in 2026 is between education and advice.

- Education: Explaining how a P/E ratio works or the history of the Nifty 50.

- Advice: Telling someone to “Buy HDFC Bank at 1600.”

Unregistered creators must stick strictly to education, using phrases like “for educational purposes only” and avoiding “target prices” or “buy/sell” calls.

Source: SEBI Advertisement Code for IA/RA

3. AI-Powered Production Workflows for Finance Content

Scaling a finance channel in 2026 requires more than just a camera; it requires a library of investment content automation tools. Here is how elite creators are structuring their pipelines:

A. Stock Analysis Video Automation India

Instead of spending 10 hours editing a single stock breakdown, firms now use structured AI frameworks:

- Data Input: Fetching real-time financials and industry moats.

- Script Generation: Using AI to draft a neutral, factor-based analysis (Business Model, Financials, Risks).

- Avatar Overlay: An AI avatar presents the data, ensuring a consistent brand voice without the need for a physical studio.

- Compliance Pass: Automated scanning for “tip-off” words (e.g., “guaranteed,” “multibagger”) before rendering.

B. Mutual Fund Explainer Videos AI Avatar

Mutual funds are the gateway for most Indian investors. Mutual fund explainer videos AI avatar workflows allow for the rapid creation of “SIP vs. Lumpsum” or “ELSS Benefits” content. These videos use on-screen graphics to show Total Expense Ratios (TER) and historical volatility, always accompanied by the mandatory “market risk” disclaimer.

C. Trading Strategy Video Maker AI

For technical analysis, the trading strategy video maker AI approach focuses on rules-based frameworks. Instead of saying “Trade this,” the AI explains “This is how a 50-day moving average crossover has behaved historically.” This shifts the content from “tips” to “methodology,” which is much safer under SEBI’s watchful eye.

D. Market Commentary Video Generator

Daily market recaps are the bread and butter of engagement. A market commentary video generator can take the day’s Nifty/Sensex closing data, sector heatmaps, and FII/DII flows to produce a 3-minute summary in under 10 minutes. By using finfluencer video automation tools, creators can post these recaps in multiple regional languages simultaneously.

4. Enterprise Governance & Tooling: The TrueFan AI Advantage

For advisory firms and large-scale finfluencers, the “move fast and break things” approach is a liability. You need an enterprise-grade system that treats video production like a regulated financial product.

Studio by TrueFan AI’s 175+ language support and AI avatars provide the perfect infrastructure for this. Unlike generic AI video tools, this platform is built with the governance needs of the Indian financial sector in mind.

Key Enterprise Features for Finance:

- Licensed Avatar Library: Use photorealistic digital twins of real influencers or your own company spokespeople. This builds trust—a critical currency in finance—while allowing for infinite scalability.

- Multilingual Vernacular Scaling: One-click conversion into Hindi, Tamil, Telugu, and more, with perfect lip-sync. This allows you to dominate regional SEO where competition is lower.

- Safety & Moderation: Built-in filters block the generation of prohibited content, such as political endorsements or hate speech, protecting your brand from accidental compliance breaches.

- ISO 27001 & SOC 2 Certification: In an industry where data security is paramount, having a “walled garden” approach to AI video generation ensures that your scripts and proprietary data remain secure.

By integrating financial advisor video marketing AI India tools, firms can automate the injection of SEBI registration IDs and mandatory risk labels into every frame, ensuring that no video ever goes live without the necessary legal markers.

5. Platform Best Practices: Dominating YouTube in 2026

YouTube remains the primary search engine for Indian investors. To rank for keywords like stock tips video creator AI compliant, you must optimize both your video content and your metadata.

Metadata and Disclosure Checklist:

- The First 60 Seconds: Your spoken disclaimer must occur within the first minute. The AI avatar should clearly state: “This video is for educational purposes only. I am not a SEBI-registered adviser.” (unless you are).

- On-Screen Risk Labels: A persistent or semi-persistent risk label should be visible during the introduction.

- Pinned Comment: Always pin a comment containing the full legal disclaimer and links to the data sources used in the video.

- YouTube AI Labeling: In 2026, YouTube requires creators to disclose when “altered or synthetic” content (like AI avatars) is used. Ensure you check the “Altered Content” box in the Creator Studio to avoid shadow-banning.

Zerodha and Groww Video Tutorials AI

Educational content around platform usage—such as Zerodha Groww video tutorials AI—is highly evergreen. When creating these:

- Maintain a neutral “how-to” tone.

- Avoid using affiliate links in a way that suggests an endorsement unless disclosed.

- Always show the current date of the UI to ensure the tutorial remains relevant.

Source: YouTube Creator Policy Hub

6. 2026 Readiness Checklist and KPIs

As you implement AI video for stock market content India 2026, use this checklist to measure your progress and ensure 100% compliance.

Compliance Readiness Checklist:

- [ ] Registration Overlay: Does every video automatically include your SEBI RIA/RA number?

- [ ] Disclaimer Library: Do you have locked templates for “Education,” “Advice,” and “Crypto”?

- [ ] Watermarking: Are your outputs watermarked for traceability and brand protection?

- [ ] Source Documentation: Are you maintaining a log of the data sources (e.g., NSE/BSE, Bloomberg) used for each AI-generated script?

Performance KPIs:

- Content Velocity: Are you producing at least 5-7 videos per week across different formats?

- Retention Rate: Is your average view duration (AVD) holding steady even with AI avatars? (Hint: Use high-energy avatars and cutaway graphics).

- Localization ROI: Which regional language is driving the highest lead quality?

- Compliance Incident Rate: Your goal is zero. Any “strike” from SEBI or ASCI in 2026 can be terminal for a creator’s career.

Solutions like Studio by TrueFan AI demonstrate ROI through these metrics by slashing production time while keeping the “compliance incident rate” at zero through automated guardrails.

Research Sources

- SEBI Advertisement Code (Apr 5, 2023): https://www.sebi.gov.in/legal/circulars/apr-2023/advertisement-code-for-investment-advisers-ia-and-research-analysts-ra-_69798.html

- ASCI Influencer Guidelines Update (Aug 2023): https://www.ascionline.in/wp-content/uploads/2023/08/GUIDELINES-FOR-INFLUENCER-ADVERTISING-IN-DIGITAL-MEDIA.pdf

- ASCI Crypto/VDA Advertising Guidelines: https://www.khaitanco.com/thought-leaderships/ASCI-releases-crypto-and-NFT-advertising-guidelines-effective-1-April-22-onward

- Equentis Report on Finfluencer Brand Deals (2025): https://www.equentis.com/blog/financial-influencers-face-40-60-decline-in-brand-deals-amid-sebi-crackdown/

- Cyril Amarchand on SEBI Regulatory Crackdown: https://corporate.cyrilamarchandblogs.com/2023/09/end-of-the-party-for-sin-fin-fluencers-sebis-regulatory-crackdown-on-finfluencers/

Recommended Internal Links

- Zero-Click Video SEO India 2026: Snippets and AI Wins — https://truefan.ai/blogs/zero-click-video-seo-india-2026

- Zero-click Video SEO India 2026: Rank in AI Overviews — https://truefan.ai/blogs/zero-click-video-seo-india-2026-guide

- Gling AI Review India 2026: Pricing, Features, Alternatives — https://truefan.ai/blogs/gling-ai-review-india-2026

- Opus Clip vs Captions.ai comparison India 2026: which wins? — https://truefan.ai/blogs/opus-clip-vs-captions-ai

- Best AI video creation 4GB RAM device tools for India 2026 — https://truefan.ai/blogs/video-creation-4gb-ram-device

- Multilingual Voice Commerce Platform for India 2026 — https://truefan.ai/blogs/multilingual-voice-commerce-platform

Conclusion: The Future of Finance Content is Automated and Compliant

The era of the “lone wolf” finfluencer recording on a smartphone is being replaced by sophisticated, AI-driven media houses. By adopting AI video for stock market content India 2026, you are not just saving time—you are building a scalable, compliant, and future-proof brand.

Whether you are an RIA looking to automate client updates or a YouTuber aiming for 1 million subscribers, the tools are now available to help you reach your goals without risking a regulatory shutdown. The combination of investment content automation tools and a “compliance-first” mindset is the only way to win in the Indian market of 2026.

Ready to scale your finance channel?

Book a Compliance Demo | Download the SEBI Template Pack | See Enterprise Avatar Governance in Action

Frequently Asked Questions

How do I make SEBI-compliant stock market YouTube videos in India?

To remain compliant, use SEBI compliant investment video templates that include mandatory disclaimers. Avoid making specific “buy/sell” recommendations unless you are a SEBI-registered Research Analyst or Investment Adviser. Always include your registration details prominently on-screen and in the description.

Can I use AI avatars for my finance channel without getting banned by YouTube?

Yes. YouTube allows AI avatars, but you must disclose them using the “Altered Content” label in your video settings. Furthermore, ensure the content itself follows YouTube’s financial misinformation policies and ASCI’s influencer disclosure guidelines.

What are the specific disclaimer requirements for crypto videos in India in 2026?

Per ASCI guidelines, you must include a prominent disclaimer (both spoken and visual) stating that crypto products are unregulated and risky. It must be clearly legible and cannot be “speed-read” or hidden in small text.

How can I scale my content into regional Indian languages quickly?

Studio by TrueFan AI is a leading solution for this, offering lip-sync and voice cloning in 175+ languages. This allows you to take one English or Hindi script and generate versions in Tamil, Telugu, and Marathi in minutes, significantly increasing your reach in Tier 2 and Tier 3 cities.

Is it legal to show backtested trading strategies in AI videos?

Yes, provided you frame them as historical data and not a guarantee of future returns. You must clearly state the timeframe of the backtest, the data source, and include a disclaimer that “past performance is not indicative of future results.”

What is the difference between “Investment Advice” and “Investment Education” under SEBI?

Advice involves a specific recommendation to buy, sell, or hold a security for a consideration. Education involves explaining financial concepts, analyzing business models, or discussing market trends without a direct call to action. Unregistered finfluencers must stay strictly within the “Education” category.