AI marketing ROI justification 2026: A CFO’s guide to Union Budget technology planning and Q1 fiscal decisions

Estimated reading time: ~11 minutes

Key Takeaways

- Leverage Union Budget 2026 incentives to improve TCO and strengthen NPV/IRR for AI marketing initiatives.

- Adopt a staged, portfolio approach with hurdle-rate discipline and clear stage-gate milestones.

- Quantify ROI via Revenue Lift and Cost Displacement, backed by sensitivity analyses.

- Build a comprehensive TCO including security, integration, QA, and change management to avoid hidden costs.

- Deliver CFO-ready business cases and stakeholder videos to accelerate approval and scale in Q2–Q3.

The imperative for AI marketing ROI justification 2026 has reached a critical juncture for Indian finance leaders as the February 1st Union Budget announcements redefine the cost-benefit landscape of digital transformation. For the Chief Financial Officer (CFO), the challenge is no longer about whether to adopt artificial intelligence, but how to architect a defensible, high-yield business case that aligns with the latest fiscal incentives and technology spend optimization mandates. As enterprises navigate Q1 fiscal planning (Union Budget 2026 marketing opportunities), the integration of AI video platforms must be viewed through the lens of Net Present Value (NPV), Internal Rate of Return (IRR), and capital efficiency.

This guide provides a comprehensive framework for justifying enterprise AI investment strategies, specifically focusing on how Union Budget 2026 marketing strategies for the 2026–27 cycle impacts Total Cost of Ownership (TCO) and ROI. By leveraging new tax holidays and localized data center incentives, finance teams can now secure budget approval for marketing automation by demonstrating clear paths to 400%+ ROI and sub-three-month payback periods.

2026 India Budget Backdrop for Digital Transformation Investment

The Union Budget 2026–27 sector opportunities has introduced pivotal shifts in India’s data infrastructure policy that directly influence Union Budget technology planning for large-scale marketing stacks. Finance ministers have extended tax incentives for AI data centers and cloud services until 2047, a strategic move designed to localize compute and reduce the long-term unit costs of high-intensity AI workloads.

Key Policy Shifts and Fiscal Implications

- AI Data Centre Incentives: The strategic push to localize compute means that enterprises utilizing India-hosted AI rendering services can expect a projected 8–15% reduction in unit costs over the next 18 months. This improves the long-run economics of AI video generation and large-scale personalization.

- Safe Harbour Provisions: A new 15% "on cost" safe harbour provision for Indian data center service providers simplifies compliance and pricing models. For the CFO, this translates to more predictable TCO for AI video rendering and storage, reducing the risk of "bill shock" in high-volume campaigns.

- Cloud Service Tax Holidays: The budget highlights a tax holiday for foreign companies offering cloud services via Indian data centers. This is expected to trigger a surge in competition among infrastructure providers, further driving down the cost of egress and storage for enterprise AI adoption.

CFOs must incorporate these incentive-driven cost curves into their ROI and NPV models. By updating depreciation schedules and tax shields to reflect these 2026 mandates, finance leaders can present a more aggressive and accurate fiscal outlook for martech investments.

Sources:

- PIB Press Release: AI Data Centre Incentives 2026

- Union Budget 2026-27 Speech PDF

- The Hindu: Budget 2026 Cloud & Data Centre Highlights

Enterprise AI Investment Strategies That Pass Finance Scrutiny

In the high-stakes environment of fiscal planning Q1 2026, CFOs are moving away from "experimental" AI budgets toward a disciplined portfolio approach. To pass a budget committee, an AI marketing initiative must demonstrate hurdle-rate discipline and a clear stage-gate sequence.

The Portfolio Approach to AI Marketing

- Stage-Gate Sequencing: Begin with a 4–8 week pilot with a constrained scope to validate causal lift. Only upon reaching pre-defined conversion milestones should the project move to a "Scale" phase (1–2 regional campaigns) before an eventual "Enterprise Rollout."

- Hurdle-Rate Discipline: Use the Weighted Average Cost of Capital (WACC) or a committee-set hurdle rate (typically 12–18% for Indian enterprises). Initiatives that do not forecast an IRR significantly above this hurdle, or a payback period exceeding 12 months, should be deprioritized.

The CFO’s Capital Budgeting Toolkit

To evaluate digital transformation investment, the following metrics are non-negotiable in 2026:

- Net Present Value (NPV): The sum of discounted net cash flows, including tax effects and depreciation shields from eligible AI hardware or software capex.

- Internal Rate of Return (IRR): The discount rate that sets the NPV to zero. CFOs should run sensitivity analyses on conversion uplift deltas (e.g., ±25%) to test the robustness of the IRR.

- Marketing Efficiency Ratio (MER): Total Revenue divided by Total Marketing Spend. Monitoring the delta in MER pre- and post-AI deployment is the most transparent way to track the efficiency of technology spend optimization.

As noted by industry leaders, FP&A in 2026 is becoming increasingly strategic, requiring marketing teams to present data with the same financial rigor as a manufacturing or infrastructure project.

Source:

AI Video Platform ROI Calculation: Formulas and Baselines

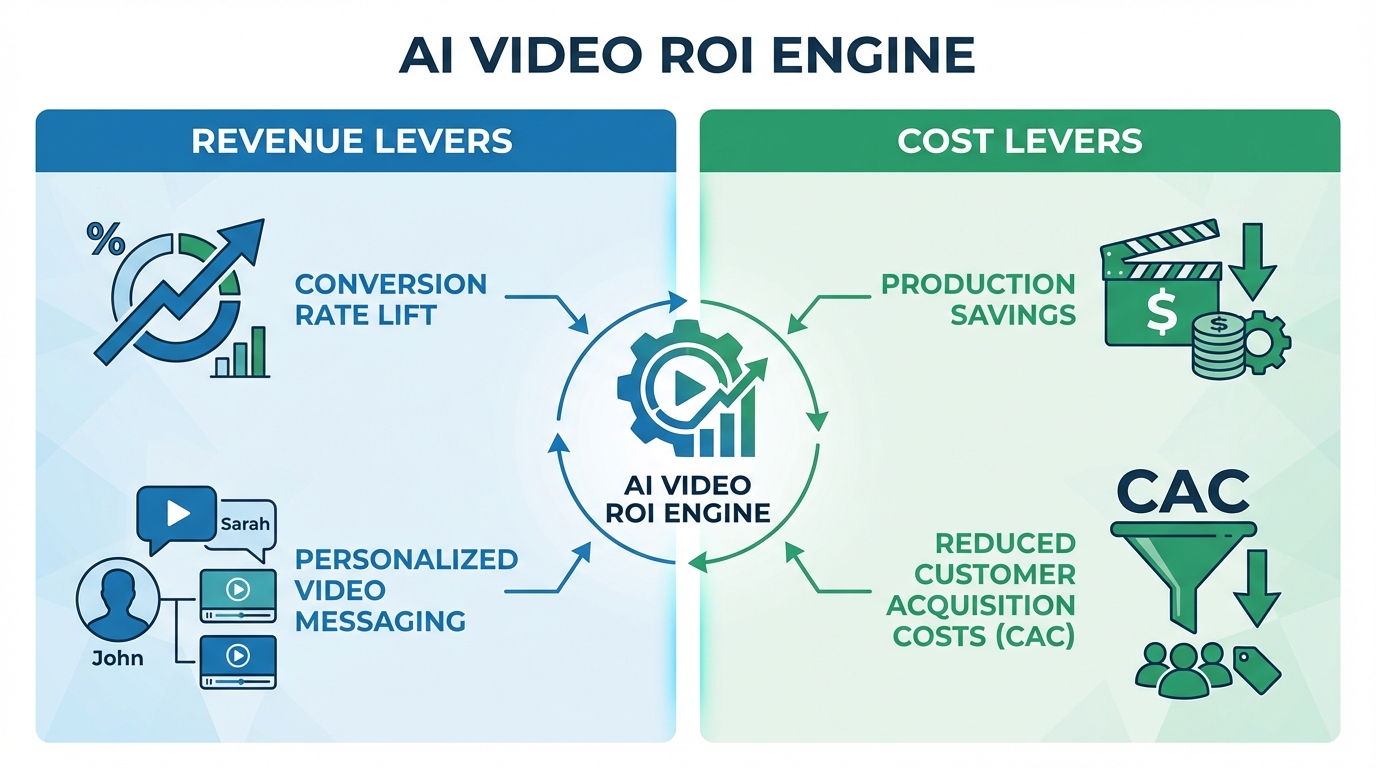

The core of any AI marketing ROI justification 2026 is the ability to quantify the "unquantifiable." For AI video platforms, the ROI is derived from two primary levers: Revenue Lift and Cost Displacement.

1. Revenue Levers: The Conversion Engine

- Conversion Rate (CR) Lift: Personalized video delivered via WhatsApp or SMS significantly outperforms static content.

- Formula: Incremental Revenue = Traffic × Average Order Value (AOV) × (CR_AI – CR_Baseline).

- Pipeline Velocity: In B2B or high-consideration B2C (like automotive or insurance), personalized videos reduce the sales cycle. The value of time is calculated as the working capital relief plus the benefit of earlier revenue recognition.

2. Cost Levers: The Efficiency Engine

- Production Substitution: Traditional video production involves shoots, edits, and manual localization. AI virtual reshoots eliminate these costs.

- Formula: Cost Saved = (Legacy Production Cost per Asset – AI Production Cost) × Total Assets.

- Media Efficiency: Higher Click-Through Rates (CTR) lead to lower Customer Acquisition Costs (CAC).

- Formula: CAC Saved = (CAC_Legacy – CAC_AI) × New Customers Acquired.

The CFO-Ready Formula Pack

| Metric | Formula |

|---|---|

| Net Benefit (Y1) | (Incremental Revenue + Cost Savings) – TCO (Year 1) |

| Payback Period | Initial Investment / Monthly Net Benefit |

| ROI (%) | (Net Benefit / Total Costs) × 100 |

| NPV | Σ[(Net Benefit_t × (1 – Tax)) / (1 + r)^t] – Initial Investment |

Example Scenario: Large-Scale Retail Campaign

Consider an enterprise serving 2 million customers with a baseline CR of 1.2% and an AOV of ₹2,000.

- Incremental Revenue: With AI video increasing CR to 1.6% (a 0.4pp lift), the incremental revenue is ₹1.6 Crore (2,000,000 × 2,000 × 0.004).

- Production Savings: Replacing 3,000 traditional assets (₹35,000 each) with AI variants (₹7,500 each) saves ₹8.25 Crore.

- TCO: Total cost of licenses, compute, and onboarding is ₹2 Crore.

- Result: Net Benefit of ₹7.85 Crore, an ROI of 392%, and a payback period of less than 3 months.

Platforms like TrueFan AI enable enterprises to achieve these metrics by automating the most expensive parts of the creative lifecycle while maintaining high-fidelity output.

Source:

Enterprise AI Adoption Costs and TCO in 2026

A common pitfall in CFO marketing budget approval (financial year-end marketing 2026 guide) is the underestimation of "hidden" adoption costs. A comprehensive TCO model must account for both one-time implementation and ongoing operational expenses.

One-Time Implementation Costs

- Security & Compliance: SSO/SCIM integration, SOC 2/ISO 27001 reviews, and Data Processing Agreement (DPA) legal fees.

- Integration: Connecting the AI video platform to existing CRM (Salesforce/HubSpot), Marketing Automation (WebEngage/CleverTap), and CDP layers.

- Content Governance: Developing the initial "master" templates and establishing Human-in-the-Loop (HITL) approval workflows.

Ongoing Operational Costs

- Compute & Rendering: While the Union Budget 2026 provides incentives, these remain variable costs based on volume.

- Model Drift & QA: Continuous monitoring of AI output to ensure brand safety and linguistic accuracy across India’s diverse markets.

- Change Management: Training the marketing and creative teams to shift from a "production" mindset to an "optimization" mindset.

According to NASSCOM, the "Great AI Investment Surge" of 2026 is characterized by a shift from hype to measurable governance. Enterprises that budget for data readiness and change management are 3x more likely to hit their ROI targets.

Source:

Marketing Technology Budget Allocation: A Three-Tiered Strategy

Effective marketing technology budget allocation requires a phased approach that balances risk with the need for rapid digital transformation.

- Pilot Phase (Q1): 5–10% of Budget

- Objective: Validate causal lift and establish governance.

- Focus: High-impact, low-complexity use cases like cart abandonment or welcome journeys.

- Scale-Up Phase (Q2–Q3): 20–30% of Budget

- Objective: Roll out to top-performing channels (WhatsApp, Email).

- Focus: Integrating AI video into the broader marketing automation budget planning (Union Budget 2026 marketing strategies guide) to drive LTV.

- Enterprise Rollout (Q4+): 40–60% of Budget

- Objective: Full reallocation of traditional video production spend.

- Focus: Virtual reshoots and 175+ language localization as the default standard for all campaigns.

Performance Guardrails

To maintain fiscal discipline, CFOs should enforce minimum performance thresholds:

- LTV/CAC Ratio: Must remain ≥ 3.

- Payback Window: Must be ≤ 9 months during the scale phase.

- Incrementality: 10–15% of spend should be reserved for holdout testing to ensure the AI is driving new value, not just claiming existing conversions.

Approval Toolkit: Budget Approval Stakeholder Videos and Executive Business Case

The final hurdle for CFO marketing budget approval is often the communication gap between marketing’s creative vision and finance’s numerical rigor. In 2026, the most successful teams are using budget approval stakeholder videos—short, 60–90 second AI-generated summaries—to brief committee members before the actual meeting. (Union Budget 2026 marketing opportunities)

The Executive Business Case Structure

A "CFO-ready" deck must include:

- The Baseline: Current funnel metrics, CAC, and production cycle times.

- The Options: A side-by-side comparison of the "Status Quo" vs. "AI Video Platform" (including TCO, NPV, and IRR).

- The Incentive Scenario: How the Union Budget 2026 tax holidays specifically reduce the TCO of the project.

- Risk Mitigation: A clear plan for data protection, consent management, and audit trails.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow marketing teams to create these stakeholder videos in the preferred language of different board members, demonstrating the technology's power while presenting the business case.

Technology Spend Optimization Playbook (Q1 2026)

As enterprises finalize their fiscal planning Q1 2026, the focus shifts to "trimming the fat" from legacy systems to fund AI initiatives. (predictive inventory marketing 2026)

Reallocation Logic

- Identify Low-MER Channels: Audit current spend and shift 10–20% from underperforming static display ads to personalized video variants.

- Localization Efficiency: Replace expensive manual dubbing and regional shoots with AI-driven multilingual generation. This can reduce localization costs by up to 80%.

- Vendor Consolidation: Capitalize on India’s data center incentives by migrating AI rendering workloads to localized providers, reducing egress fees and improving latency.

Executive Dashboarding

A CFO’s dashboard for technology investment metrics should track:

- Financials: Payback progress, NPV realization, and budget utilization.

- Operations: Content throughput (assets per month) and cycle time reduction.

- Quality: QA defect rates and brand safety compliance scores.

Mini Case Walkthrough: The Path to ₹15 Crore Net Benefit

To illustrate the AI video platform ROI calculation, let’s examine a hypothetical walkthrough for a leading Indian financial services firm.

- Baseline: 10 million WhatsApp messages per quarter; 1.0% CR; ₹1,800 AOV. Annual production of 1,200 videos at ₹40,000 per asset.

- The Intervention: Deploying personalized AI video for the top 3 campaigns.

- The Results:

- Incremental Revenue: A lift to 1.35% CR generates ₹6.3 Crore in new revenue.

- Production Savings: Scaling to 4,800 variants (using virtual reshoots) at an average cost of ₹8,000 per asset results in a net production uplift/saving of ₹11.52 Crore.

- TCO: ₹2.8 Crore (inclusive of onboarding and compute).

- Net Benefit: ₹15.02 Crore with an ROI of 436%.

By applying the Union Budget "incentive-on" scenario (assuming a 10% reduction in compute costs due to India-hosting), the NPV of this project improves by an additional ₹18 Lakhs, further de-risking the investment.

Solutions like TrueFan AI demonstrate ROI through these exact levers, providing the scale and speed required to turn these theoretical models into fiscal reality.

Q1 2026 30–60–90 Day Action Plan

Timing is everything in Union Budget technology planning. CFOs should follow this timeline to maximize fiscal year advantages.

Days 1–30: Foundation & Compliance

- Approve pilot scope and select India-hosted rendering partners to leverage 2026 incentives.

- Finalize the GRC (Governance, Risk, and Compliance) checklist.

- Build the baseline dashboard and create the first budget approval stakeholder video.

Days 31–60: Validation & Due Diligence

- Run A/B and geo-holdout tests across two primary channels.

- Validate the conversion lift and refine the ROI model with real-world data.

- Complete procurement due diligence and security audits.

Days 61–90: Scale & Sign-off

- Present the final ROI and payback analysis to the budget committee.

- Secure full CFO sign-off for the Q2–Q3 scale-up.

- Codify governance SLAs and transition to "Business As Usual" (BAU) operations.

Governance, Risk, and Compliance (GRC) Essentials

No enterprise AI adoption costs analysis is complete without a regulatory look at risk. CFOs must ensure the following guardrails are in place:

- Consent-First Architecture: Ensuring all data used for personalization is gathered with explicit user consent, aligning with India’s evolving data protection laws.

- Audit Trails: Every AI-rendered video must be logged and searchable for compliance audits.

- HITL QA Gates: Human-in-the-loop systems must maintain a defect rate of <1% to protect brand equity.

- Moderation Filters: Automated blocklists to prevent the generation of offensive or politically sensitive content.

Conclusion: Securing the Future of Marketing Efficiency

The AI marketing ROI justification 2026 is a rigorous financial exercise that rewards CFOs who align their technology spend with national fiscal policy. By leveraging the Union Budget 2026 incentives, enterprises can transform their marketing from a cost center into a high-yield revenue engine. With payback periods dropping below one quarter and IRRs far exceeding traditional hurdle rates, the case for AI video platforms is no longer just a marketing preference—it is a fiscal necessity.

Ready to build your CFO-grade business case?

Book a TrueFan Enterprise ROI workshop today to receive your INR-based ROI calculator and request stakeholder video templates aligned to your Q1 committee calendar.

Frequently Asked Questions

How do CFOs justify AI marketing ROI in 2026?

CFOs justify ROI by moving beyond "vanity metrics" (like views) to financial metrics (NPV, IRR, and Payback). They incorporate Union Budget incentives, such as tax holidays for India-hosted cloud services, to lower the TCO and improve the net benefit of the investment.

What is the most defensible AI video platform ROI calculation?

The most defensible model is: (Incremental Revenue + Production Cost Savings) – TCO. This must be supported by sensitivity analysis that shows how the project performs if conversion lifts are lower than expected or if compute costs fluctuate.

How does India’s Union Budget 2026 affect AI martech costs?

The budget provides tax incentives for AI data centers until 2047 and a 15% safe harbour on costs for localized providers. This reduces the unit cost of rendering and storage, making high-volume AI video personalization more capital-efficient than ever before.

How does TrueFan AI ensure data security for enterprise clients?

TrueFan AI adheres to ISO 27001 and SOC 2 standards, utilizing India-hosted servers to comply with local data residency requirements while providing full audit trails and HITL QA gates for every asset generated.

What are the primary enterprise AI investment strategies for 2026?

The leading strategy is a "Portfolio Approach"—starting with low-risk, high-reward pilots (Q1), scaling validated use cases (Q2–Q3), and finally reallocating the majority of traditional production budgets to AI-led workflows (Q4).