Union Budget 2026 sector opportunities: Post‑budget marketing strategies India for targeted customer acquisition

Key Takeaways

- Translate policy signals into customer value with budget impact videos and tax reform calculator personalization.

- Adopt a policy-to-pipeline framework powered by real-time signals from official sources for compliant, timely campaigns.

- Orchestrate omnichannel journeys across WhatsApp, email, and in-app with policy-cohort segmentation and pre-approved scripts.

- Deploy sector-specific playbooks for BFSI, MSME, Agritech, EV/Manufacturing, Healthcare, and SaaS/AI to drive acquisition.

- Operationalize with generative AI for rapid personalization, compliance, and multilingual reach at enterprise scale.

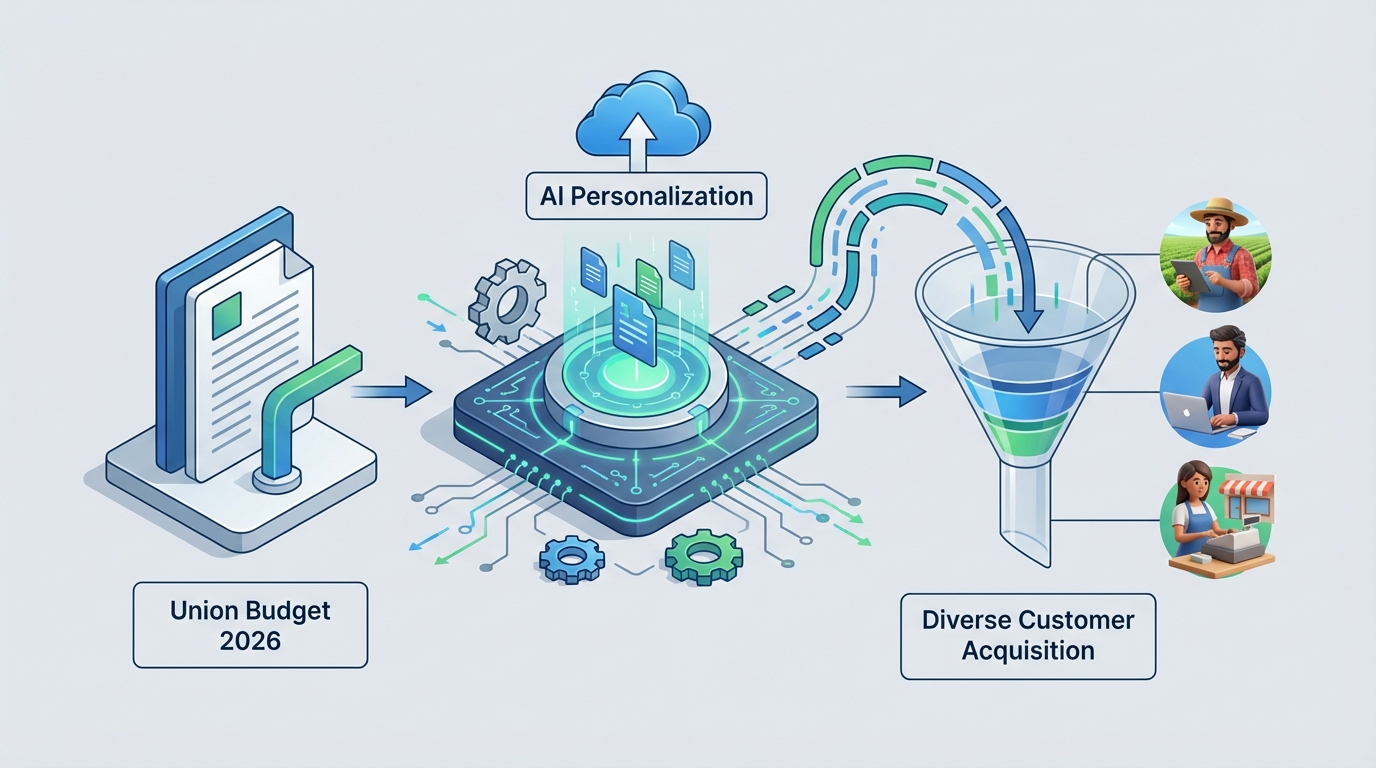

The Union Budget 2026 sector opportunities represent the fastest route for enterprise leaders to turn policy signals into measurable growth. By leveraging budget impact video campaigns and tax reform calculator personalization, brands can now translate complex fiscal shifts into immediate customer trust. This era of economic policy marketing adaptation requires a shift from generic broadcasting to high-precision, budget-driven offer orchestration powered by enterprise-grade personalization.

For CMOs and growth leaders, the 2026 fiscal roadmap is not just a document of allocations; it is a blueprint for policy change customer acquisition. The ability to launch government scheme enrollment marketing within hours of a policy announcement is now the primary differentiator for market leaders. This guide provides a sector-by-sector blueprint for converting the Union Budget 2026 sector opportunities into a robust revenue pipeline.

1. Union Budget 2026 sector opportunities: A Strategic Snapshot

The Union Budget 2026 has introduced pivotal shifts across India’s core economic pillars, creating a fertile ground for sector-specific budget benefits. Digital Public Infrastructure (DPI) continues to be a cornerstone, with projections suggesting DPI-led sectors could contribute up to 10% of India's GDP by 2026. This focus on "AI for All" and cybersecurity strengthening provides a massive tailwind for SaaS and fintech enterprises.

In the agricultural sector, the focus has shifted toward climate-resilient farming and the digitization of agri-value chains. Industry experts anticipate measures that advance access to agri-finance, specifically targeting the credit gap for Farmer Producer Organizations (FPOs). This creates a significant opening for agritech firms to deploy subsidy eligibility automated campaigns that simplify complex incentive structures for rural populations.

2. The Policy-to-Pipeline Strategy: Post-budget marketing strategies India

To capitalize on the Union Budget 2026 sector opportunities, enterprises must adopt a "policy signal-to-value translation" framework. This involves extracting a specific budget allocation or incentive and articulating its tangible value—such as lower TCO or faster approvals—for the end customer. This translation must then be mapped to specific journey stages, from awareness to conversion, using real-time data signals.

A robust strategy relies on a live data signal library that ingests official PDFs, PIB updates, and regulator circulars from the RBI, SEBI, and IRDAI. By monitoring these deltas, marketing teams can ensure their budget opportunity real-time marketing remains accurate and compliant. Segmentation should be based on policy eligibility, such as tax slabs, PLI tranches, or enterprise size, ensuring that every message resonates with the recipient's specific fiscal reality.

Orchestrating these campaigns requires an omnichannel posture, utilizing WhatsApp Business API, email, and in-app notifications. Each channel should deliver policy-cohort specific creatives that address the user's unique pain points and opportunities. Governance is equally critical; pre-approved legal scripts and regulatory compliance video updates must be integrated into the workflow to maintain audit trails and brand safety.

Platforms like TrueFan AI enable enterprises to execute this level of hyper-personalization by rendering millions of one-to-one videos in under 30 seconds. This capability allows brands to use consented avatars—whether celebrities or brand ambassadors—to deliver personalized budget explainers. By automating the creative refresh cadence, companies can maintain relevance throughout the fiscal year as policy nuances evolve.

Source: PwC India Budget 2026

Source: Swastika Investmart Explainer

Source: Official India Budget Documents

3. Campaign Blueprints for Converting Policy into Demand

Budget impact video campaigns

These campaigns involve short, personalized explainer videos that translate specific Budget 2026 changes into persona-based outcomes. For example, a bank could send a video to an FPO in Maharashtra explaining exactly how the new agri-credit window affects their borrowing limits. The hook must appear in the first five seconds, combining the user's name with a relevant policy update to maximize engagement.

Policy change customer acquisition

Always-on acquisition flows can simplify complex rule changes, such as new investment caps or revised eligibility dates, to nudge eligible cohorts toward an application. By using 30-45 second consented-avatar explainers, brands can break down barriers to entry and provide deep links to pre-filled forms. This approach ensures that potential customers understand the immediate benefits of the new fiscal policy.

Government scheme enrollment marketing

This involves multi-step drip journeys that guide users from initial awareness of a scheme—like MSME credit enhancements—to document readiness and final application. QR-linked video walkthroughs and WhatsApp reminders can significantly improve completion rates for complex government programs. Citing sources like the Times of India's report on MSME export credit push adds necessary credibility to these educational efforts. (marketing strategies guide)

Fiscal incentive communication videos

These videos quantify the ROI of specific incentives, such as R&D tax credits or PLI tranche benefits, for mid-cap manufacturers. By pulling data from interactive calculators into a real-time personalized video recap, brands can show a clear path to savings and payback. This level of detail is essential for B2B sectors where financial justification is a prerequisite for any purchase decision.

Tax reform calculator personalization

Brands can embed interactive calculators that reflect the latest tax slab changes and deductions announced in the budget. Upon submission, the system triggers a personalized video explaining the user’s specific tax impact and recommending the next best financial action. This creates a high-value touchpoint that builds trust by providing immediate, tailored utility to the consumer. (personalized videos)

Subsidy eligibility automated campaigns

Automation can react to a user's eligibility status—whether "pre-eligible," "docs pending," or "approved"—with precise next steps in their local language. These triggers, powered by APIs from scheme portals or CRMs, ensure that users are never left wondering about their status. Location-aware guidance further enhances the relevance of these automated nudges.

Budget-driven offer orchestration

This strategy aligns product pricing, credit limits, and rewards with new budget thresholds, such as GST relief or capex incentives. For instance, an automotive brand could tailor EV financing offers the moment new green energy incentives are announced. Synchronizing these offers across all channels ensures a consistent and timely response to market shifts.

Economic policy marketing adaptation

Ongoing creative pivots tied to macro policy shifts allow brands to stay ahead of the curve. By feeding learnings from cohort-level A/B tests back into the scripting process, marketing teams can refine their message for maximum impact. This adaptive approach is vital for sectors like jobs and credit, where sentiment can shift rapidly based on government announcements.

Regulatory compliance video updates

Short, 20-30 second compliance bulletins can inform users of rule updates while maintaining a full audit trail. These updates must be scripted with legal approval and localized to ensure clear communication across diverse regions. Using a consent-first model for these videos mitigates legal risks and ensures that the brand remains a trusted source of information.

Budget allocation industry insights

Executive-level video briefings can synthesize sector allocations into "so what now" moves for C-suite decision-makers. These briefings often embed sector dashboards within the video, providing a high-level overview of commercial opportunities. This approach positions the brand as a thought leader that understands the broader economic landscape.

Budget opportunity real-time marketing

A newsroom-style operation on Budget Day allows for live signal ingestion and instant creative updates. By pre-building modular templates for the top eight sectors, brands can achieve zero-day time-to-first-campaign. This rapid response captures the peak interest period immediately following the Finance Minister's speech.

Source: Times of India MSME Credit Push

Source: People Matters Priorities

Source: Outlook Business Live Updates

4. Sector-Specific Playbooks for 2026

BFSI and Fintech

The 2026 budget’s emphasis on DPI and fintech rails provides a massive opportunity for credit expansion. Marketing should target new-to-credit MSMEs and salaried taxpayers with tax reform calculator personalization tools. By explaining new KYC rules through policy change customer acquisition videos, fintechs can reduce friction in the onboarding process and improve approval rates.

MSMEs, Startups, and Exports

With a projected 12% year-over-year growth in system credit by FY2026, MSMEs are a primary target for government scheme enrollment marketing. Campaigns should focus on export credits and interest subventions, using fiscal incentive communication videos to show how these measures improve global competitiveness. Success in this sector is measured by application starts and the time-to-cash for disbursements.

Agritech and Agri-Finance

Measures for climate resilience and agri-finance access require vernacular guides with geo-specific examples. Budget impact video campaigns can explain state-specific benefits of schemes like PM-Kisan top-ups to FPOs and input dealers. TrueFan AI's 175+ language support and Personalised Celebrity Videos are particularly effective here, ensuring that complex policy details are understood by rural audiences in their native tongue.

EV, Manufacturing, and Defence

Indigenization momentum and new PLI tranches are the key signals for the manufacturing sector. Brands should deploy fiscal incentive communication videos that quantify the benefits of PLI for tier-1 and tier-2 suppliers. Budget-driven offer orchestration can also be used to align EV financing with new government incentives, driving higher conversion rates for green mobility products.

Healthcare and Pharma

The focus on domestic R&D and PLI continuity necessitates regulatory compliance video updates for pricing and formulation changes. Healthcare brands can also use government scheme enrollment marketing to guide MSMEs through the process of applying for R&D grants. Engaging healthcare professionals (HCPs) with personalized thank-you messages, as seen in Cipla's Doctor's Day campaign, can significantly strengthen B2B relationships.

SaaS, AI, and Cybersecurity

As the IT sector aims to contribute 10% to India's GDP by 2026, SaaS companies must adapt their messaging to reflect AI productivity and DPI incentives. Executive budget allocation industry insights briefings can help mid-market IT firms capture new grants and incentives. Rapid messaging tests and economic policy marketing adaptation are essential to stay relevant in this fast-moving sector.

5. Operationalizing the Framework with Generative AI

Solutions like TrueFan AI demonstrate ROI through hyper-personalization at scale, allowing brands to render millions of unique videos that address customers by name and context. This level of one-to-one marketing is particularly powerful during the post-budget period, where customers are seeking clarity on how new policies affect them personally. By integrating CRM data with real-time APIs, brands can trigger these videos the moment a user interacts with a budget calculator or eligibility checker.

Virtual reshoots and AI editing allow marketing teams to update specific lines in a video—such as a new tax limit or a revised scheme date—without the need for a new celebrity shoot. This agility is a game-changer for maintaining compliance as official circulars clarify budget announcements in the weeks following the speech. It ensures that the brand's messaging remains accurate and up-to-date without the traditional costs and delays of video production.

Security and compliance are non-negotiable for enterprise-grade AI applications. TrueFan AI maintains ISO 27001 and SOC 2 certifications, ensuring that customer data is protected and that all celebrity likenesses are used with explicit, contract-backed consent. Built-in moderation filters further protect the brand by blocking any unapproved or offensive content, making it a safe and scalable solution for highly regulated sectors like BFSI and healthcare.

The multilingual localization capability, supporting over 175 languages, ensures that budget-related campaigns can reach every corner of India. Whether it's a farmer in Punjab or a small business owner in Tamil Nadu, the ability to hear a trusted celebrity explain a new government scheme in their own language builds unparalleled trust. This localized approach is essential for driving the adoption of government schemes and financial products beyond metro cities.

Source: TrueFan Enterprise Product Document

Source: Zomato Mother's Day Case Study (354,000 videos in one day)

Source: Hero MotoCorp Festive Greetings (2.4 million personalized wishes)

6. Rollout Timeline: From Pre-Budget to Fiscal Year Planning

T-14 to T-1 (Pre-Budget Preparation)

The two weeks leading up to the budget should be spent building modular templates and wiring calculator endpoints. Legal teams must draft and pre-approve scripts for various potential scenarios, ensuring that disclaimers are ready for immediate use. This phase also involves pre-translating core variants into 5-8 major Indian languages and integrating CRM fields to trigger automated journeys.

T0 to T+2 Days (The Budget Window)

On Budget Day, the focus shifts to budget opportunity real-time marketing. As the Finance Minister speaks, teams should ingest signals and publish the first wave of sector-specific explainers. Interactive tax calculators should go live immediately, and compliance updates must be pushed for any rule changes that take effect instantly. Initial A/B tests on offers can help refine the messaging for the following weeks.

T+7 to T+90 (Expansion and Optimization)

In the month following the budget, brands should expand their campaigns to all priority sectors and launch full-scale government scheme enrollment marketing. As official circulars are released, scripts should be refreshed using virtual reshoots to maintain accuracy. By the 90-day mark, these campaigns should be integrated into fiscal year planning automation, with quarterly refreshes scheduled to align with ongoing policy shifts.

Measurement of these efforts should span the entire funnel, from awareness metrics like View-Through Rate (VTR) to conversion metrics like Cost Per Lead (CPL) and approval rates. Long-term success is measured by the lifetime value (LTV) of cohort-based users who were acquired through policy-linked incentives. This data-driven approach ensures that the marketing budget is always aligned with the most profitable sector opportunities.

Frequently Asked Questions

How can I ensure my budget-linked marketing remains compliant with new regulations?

Compliance is maintained through a combination of legal-approved scripts, real-time signal monitoring, and secure AI platforms. Using a solution like TrueFan AI ensures that all content is moderated and that celebrity avatars are used within strictly defined contractual boundaries, providing a full audit trail for every video generated.

What is the best way to explain complex tax slab changes to my customers?

The most effective method is tax reform calculator personalization. By allowing users to input their own financial data and then delivering a personalized video that explains their specific tax savings or liabilities, you provide immediate value and build significant brand trust. (personalized videos)

How quickly can I launch a campaign after the Union Budget 2026 announcement?

With a "newsroom" approach and pre-built modular templates, you can launch your first wave of campaigns within hours of the announcement. This budget opportunity real-time marketing approach allows you to capture consumer interest while it is at its peak.

Which sectors offer the most growth potential following the 2026 budget?

Based on current trends, DPI-led fintech, climate-resilient agritech, and export-oriented MSMEs offer significant opportunities. Infrastructure and EV manufacturing also remain strong due to continued government capex and PLI incentives.

Can personalized video campaigns work for rural audiences?

Yes, they are exceptionally effective when combined with multilingual localization. Addressing a user in their native language using a trusted celebrity or brand ambassador can simplify complex government schemes and drive higher enrollment rates in rural areas. (Personalised Celebrity Videos)

Disclaimer: This content is for informational purposes only and does not constitute legal or financial advice. For specific policy details, please refer to the official Union Budget 2026 documents and government notifications.

Source: Key Features of Budget 2025-2026

Source: PwC India Budget Expectations

Source: Deloitte India Budget Analysis

Source: India Briefing Tech/DPI