Union Budget 2026 marketing strategies: Real-time, policy-aligned acquisition playbooks for Indian enterprises

Estimated reading time: 11 minutes

Key Takeaways

- Adopt a Zero-Day approach with real-time budget marketing triggered by PIB notifications and official PDFs.

- Use budget impact assessment and tax reform calculator videos to translate policy into personalized actions and conversions.

- Automate subsidy eligibility and guide users with scheme enrollment flows to capture post-budget demand.

- Run budget-driven offer orchestration to align incentives with policy changes during the Budget Day “Golden Hours.”

- Implement a 30/60/90-day fiscal plan to sustain momentum and keep regulatory compliance up to date.

The annual unveiling of the Union Budget on February 1st represents the single most significant spike in consumer and business attention within the Indian economy. For enterprise brands, the ability to translate complex policy shifts into immediate, personalized customer journeys is no longer a luxury but a competitive necessity. By deploying sophisticated Union Budget 2026 marketing strategies, organizations can pivot from passive observation to active market capture within hours of the Finance Minister’s speech.

The transition toward a “Viksit Bharat” necessitates a move beyond generic social media posts. Success in 2026 requires a “Zero-Day” approach, where real-time budget marketing and budget-driven offer orchestration are integrated directly into enterprise CRM and CDP stacks. This playbook outlines how to leverage budget impact assessment videos and tax reform calculator videos to unlock outsized acquisition impact across every major sector.

Real-time budget marketing: The Zero-Day acquisition framework

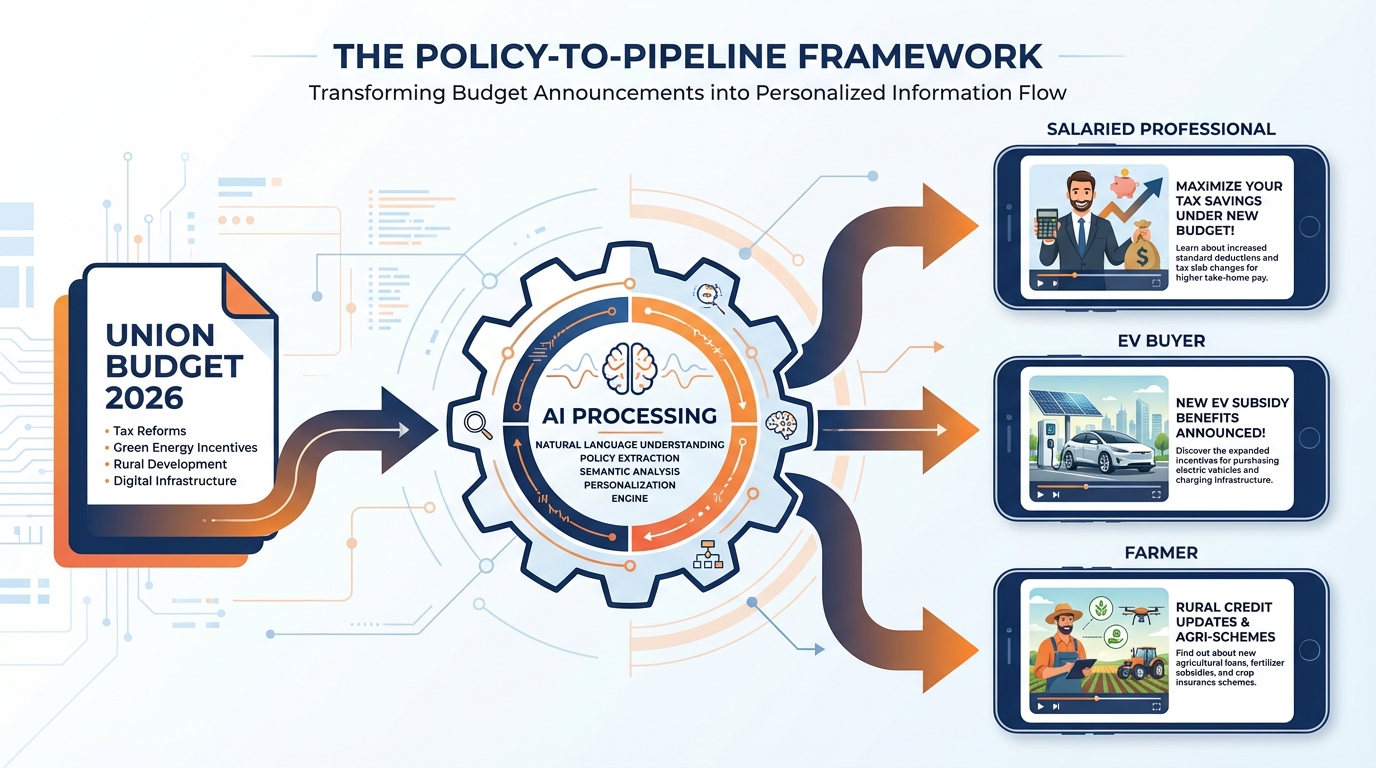

The traditional marketing lag—where brands take days to analyze policy and weeks to launch campaigns—is a relic of the past. In 2026, the digital backbone of India enables a policy-to-pipeline execution model that functions in near real-time. Real-time budget marketing involves orchestrating multi-channel campaigns triggered by official PIB notifications and ministry PDFs within minutes of their release.

Enterprises must prepare for a massive surge in search intent as citizens look for “Budget explained in simple words.” Platforms like TrueFan AI enable brands to ingest these complex regulatory updates and output personalized video content at a scale previously thought impossible. By automating the parsing of tax slabs and subsidy caps, brands can deliver relevant information to millions of users while the news is still trending.

The 2026 fiscal landscape is expected to prioritize digital infrastructure and Data Policy Infrastructure (DPI) driven services. This means your marketing infrastructure must be as robust as the national digital backbone. Implementing fiscal year planning automation allows your team to pre-map data fields—such as “new_80C_cap” or “EV_subsidy_rate”—to dynamic content tokens, ensuring that when the numbers are announced, your creative assets update across app, web, and WhatsApp instantly.

Source: Economic Times: Digital infrastructure for Viksit Bharat

Source: Swastika: Union Budget 2026 explained in simple words

Budget impact assessment videos: Personalizing policy for the masses

One of the primary challenges of any Union Budget is the “translation gap”—the distance between a macro-economic policy and its micro-economic impact on an individual’s wallet. Budget impact assessment videos solve this by providing auto-generated, data-driven summaries for specific user segments. Whether the user is a salaried professional, a high-net-worth individual (HNI), or a rural farmer, the video content should answer one question: “What does this mean for me?”

These videos utilize dynamic scenes and voiceovers to break down sector-specific budget benefits. For a BFSI brand, this might mean a video explaining how new tax slabs increase a customer's disposable income, followed by a personalized investment recommendation. For an E-commerce platform, it could highlight how changes in customs duties have lowered the price of specific electronics categories.

To achieve this at an enterprise level, the creative library must be modular. By preparing templates in 8–12 priority languages before February 1st, brands can ensure they reach the “Bharat” audience effectively. This level of economic policy personalization builds deep trust, as customers perceive the brand as a helpful advisor rather than just a vendor. The goal is to move the user from “awareness of the budget” to “action based on the budget” in a single, frictionless video journey.

Source: PwC India: Union Budget 2026 insights

Source: TrueFan Blog: Union Budget 2026 Sector Opportunities

Tax reform calculator videos: Driving high-intent conversions

In the BFSI and Fintech sectors, the “Tax Calculator” is the most visited tool during the month of February. However, static calculators often suffer from high abandonment rates. Tax reform calculator videos represent the next evolution of this tool, converting user inputs—such as income, regime choice, and 80C/80D deductions—into a tailored video output that explains their tax liability and suggests “next-best-actions.”

These interactive, API-fed videos provide a visual representation of a user’s fiscal health. If the Budget 2026 introduces a simplified tax regime with higher rebates, the video can instantly demonstrate the savings a user would accrue by switching. This is a prime example of policy change customer acquisition, where the utility of the tool serves as the lead magnet.

TrueFan AI's 175+ language support and Personalised Celebrity Videos can be integrated into these calculator flows to add a layer of engagement that static forms cannot match. Imagine a celebrity or a trusted financial expert narrating a user’s specific tax savings in their native tongue. This approach not only increases the completion rate of the calculator but also significantly boosts the conversion rate for products like ELSS, NPS, or health insurance top-ups that are tied to the new tax laws.

Source: Deloitte India: Budget expectations 2026

Source: Outlook Business: Budget 2026 expectations live updates

Subsidy eligibility automation: Capturing post-budget sector opportunities

For sectors like Auto (EV), Energy, and MSME lending, the Union Budget often brings new subsidies or credit guarantee schemes. Subsidy eligibility automation allows brands to instantly qualify their existing database against new government criteria. If the 2026 Budget expands the FAME III scheme or introduces new rooftop solar incentives, brands can trigger automated workflows to notify eligible users.

This process moves beyond simple notification. By launching government scheme enrollment campaigns, brands can guide users through the multi-step application process using video explainers and WhatsApp-based reminders. For an EV manufacturer, this might involve a video that calculates the “on-road price delta” after the new subsidy, followed by a “Book a Test Drive” CTA.

This strategy is particularly effective for post-budget sector opportunities in the MSME space. With the government likely to enhance credit guarantees to spur domestic manufacturing, B2B SaaS and Fintech lenders can use eligibility automation to offer pre-approved credit lines. By being the first to inform a business owner of their eligibility, a brand secures a significant first-mover advantage in the acquisition funnel.

Source: Moneycontrol: Union Budget 2026 and the GCC ecosystem

Source: Times of India: How Budget 2026 can insulate India’s growth story

Budget-driven offer orchestration: Aligning incentives with policy

The most sophisticated Union Budget 2026 marketing strategies rely on a rules engine that turns policy announcements into timed, sector-specific offers. Budget-driven offer orchestration ensures that your promotional strategy is reactive to the fiscal environment. For instance, if the budget increases the deduction limit for health insurance premiums, an insurer could instantly launch a “15-day premium holiday” offer to capitalize on the increased demand.

This orchestration requires a pre-approved “policy-to-offer” matrix. Marketing teams should define scenarios such as: “IF EV subsidy continues, THEN offer a 5% exchange bonus.” This allows the brand to go live with relevant offers while competitors are still in internal meetings. These offers should be distributed across all touchpoints, including DOOH (Digital Out-Of-Home) near physical stores or dealerships, to capture offline intent.

Solutions like TrueFan AI demonstrate ROI through their ability to deliver these personalized, offer-led videos with less than 30-second rendering latency. This speed is critical during the “Golden Hours” of Budget Day (T+0 to T+6), when consumer curiosity is at its peak. By combining fiscal incentive communication with real-time delivery, brands can achieve a significantly lower CAC (Customer Acquisition Cost) compared to evergreen campaigns.

Source: BestMediaInfo: The ad industry is asking for certainty

Source: Outlook Business: Healthcare and MSME expectations

Sector-specific budget benefits: Deep-dive playbooks for 2026

To maximize the impact of your Union Budget 2026 marketing strategies, it is essential to tailor your approach to the specific nuances of your industry. Each sector will face unique regulatory compliance updates and opportunities.

BFSI and Fintech

The focus here is on tax simplification and financial inclusion. Use tax reform calculator videos to drive immediate investment in ELSS and NPS. Focus on policy change customer acquisition by targeting salaried individuals who stand to benefit from new rebate structures. Ensure all communications are updated with the latest budget allocation industry insights to position your brand as a thought leader.

Auto and EV

With the push for green infrastructure, subsidy eligibility automation is your strongest tool. Create budget impact assessment videos that simplify the complex math of subsidies, road tax waivers, and PLI benefits for the end consumer. This transparency reduces the friction in the high-value purchase journey of an electric vehicle.

E-commerce and Retail

Monitor changes in GST and import duties. Use real-time budget marketing to update pricing banners and launch “Budget Special” sales on categories where duties have been slashed. For MSME sellers on your platform, provide regulatory compliance updates via video to help them navigate new credit or tax rules, fostering long-term loyalty.

Healthcare and Insurance

If the budget introduces higher deductions under Section 80D or expands healthcare inclusion schemes, use fiscal incentive communication to drive policy upgrades. Budget impact assessment videos can help policyholders understand how new regulations affect their coverage and premiums, ensuring compliance while driving upsells.

GCC and IT Services

For the Global Capability Center (GCC) ecosystem, the budget may offer innovation incentives or compliance clarity. Use economic policy personalization on your talent acquisition pages to highlight how these policies make your organization a stable and growth-oriented place to work. This helps in building a high-quality talent pipeline in a competitive market.

Source: PwC India: Sectoral expectations for 2026

Source: Moneycontrol: GCC ecosystem insights

Fiscal year planning automation: The 30/60/90-day roadmap

The impact of the Union Budget extends far beyond February 1st. A robust fiscal year planning automation strategy ensures that the initial momentum is sustained throughout the quarter.

- Days 0–7 (The Sprint): Deploy real-time budget marketing modules. Focus on high-impact budget impact assessment videos and tax reform calculator videos. Update all landing pages with the latest regulatory compliance updates.

- Days 8–30 (The Deep-Dive): Build a comprehensive content hub aggregating budget allocation industry insights. Launch retargeting campaigns using economic policy personalization to reach users who engaged with your budget tools but didn't convert.

- Days 31–90 (The Institutionalization): Evolve your rule sets as the Finance Bill passes into law. Refresh government scheme enrollment campaigns for long-tail subsidies. Use early data to refine your policy change customer acquisition models for the rest of the fiscal year.

By following this structured roadmap, enterprises can ensure they don't just “ride the wave” of the budget but actually build a sustainable pipeline of informed, high-value customers.

Source: Deloitte India: Post-budget analysis frameworks

Source: TrueFan Blog: Post-budget sector opportunities

Regulatory compliance updates and FAQ

Navigating the aftermath of a Union Budget requires strict adherence to new regulations. Enterprises must ensure that their regulatory compliance updates are reflected in every piece of marketing collateral to avoid legal pitfalls and maintain consumer trust.

Frequently Asked Questions

1. How quickly can we launch budget-driven marketing campaigns?

With a pre-configured real-time budget marketing stack, brands can go live within 3 to 6 hours of the budget speech. This involves using pre-approved templates that are populated with live data via API.

2. What are the most effective channels for budget communication?

WhatsApp Business API and in-app notifications are the most effective for personalized delivery. For broader reach, YouTube pre-rolls and DOOH (Digital Out-Of-Home) using economic policy personalization are highly recommended.

3. How do budget impact assessment videos improve conversion?

These videos reduce cognitive load for the consumer. By showing exactly how a policy affects their specific financial situation, you remove the “uncertainty” barrier, leading to higher trust and faster decision-making.

4. Can TrueFan AI handle the scale of a Budget Day surge?

Yes, TrueFan AI is designed for enterprise-grade scale, capable of rendering millions of personalized videos with low latency. Its integration with CRM systems ensures that the right video reaches the right user at the right time.

5. How should we handle changes in the Finance Bill after the initial announcement?

Your fiscal year planning automation should include a “refresh” cycle. Once the Finance Bill is passed or notifications are issued, the rules engine should automatically update the data tokens in your evergreen videos and calculators.

6. What KPIs should we track for budget-aligned campaigns?

Key metrics include CTR (Click-Through Rate) on personalized videos, CVR (Conversion Rate) on tax calculators, and the delta in CAC (Customer Acquisition Cost) compared to non-budget periods. Additionally, track “Eligibility Completion Rates” for subsidy-related journeys.

Frequently Asked Questions

How do we prepare creative assets before Budget Day?

Build modular templates in multiple languages and map dynamic data tokens (e.g., new_80C_cap) so creatives auto-update across app, web, and WhatsApp once numbers are announced.

What data sources should fuel real-time updates?

Use authenticated feeds from PIB releases, ministry PDFs, and verified media summaries. Pipe them into your CDP to trigger journeys with appropriate consent and governance.

Which segments see the fastest uplift during Budget Week?

Salaried professionals exploring tax changes, MSMEs evaluating credit or subsidy eligibility, and shoppers in categories impacted by customs/GST revisions show the highest intent.

How can offers be aligned with policy changes safely?

Define a pre-approved policy-to-offer matrix with compliance sign-offs. Automate start/stop conditions to ensure promotions activate only when qualified criteria are met.

What metrics best reflect Budget campaign ROI?

Track CTR/CVR for personalized videos and calculators, CAC deltas vs. baseline, eligibility completion rates for schemes, and T+0 to T+6 hour performance during Golden Hours.