Financial Year-End Compliance Marketing 2026: The March 31 Urgency Playbook for BFSI

Estimated reading time: 14 min

Key Takeaways

- March 31 drives a high-velocity tax-saving window for BFSI; campaigns must balance urgency with strict compliance.

- Activate behavioral triggers (time, threshold, transactional, engagement, life-event) to reduce friction and boost conversions.

- Use personalized urgency videos and 80C calculators to turn complex choices into clear next steps.

- Implement enterprise guardrails (consent, suitability gating, audit trails) to protect customers and meet regulations.

- Measure with leading metrics (CTR, calculator completions) and lagging outcomes (ELSS/NPS funding, renewals) using multi-touch attribution.

The landscape of financial year-end compliance marketing 2026 represents a critical juncture for Banking, Financial Services, and Insurance (BFSI) institutions. As the March 31 deadline approaches, the orchestration of compliant, multi-channel, and automation-led campaigns becomes the primary driver for achieving annual targets. This period is characterized by a significant fiscal year-end investment rush, where taxpayers seek to optimize their liabilities through strategic instruments.

In India, the financial year concludes on March 31, making it the definitive cutoff for tax-saving investments under the prevailing regulatory framework. For BFSI marketers, this necessitates a sophisticated approach to “financial year-end compliance marketing 2026” that balances high-velocity conversion with stringent adherence to consent and suitability standards. Success in this window requires more than just visibility; it demands personalized behavioral interventions that guide customers through complex decision-making processes.

As digital adoption reaches new heights, with projected digital tax filings in India expected to exceed 100 million by the end of FY26, the competition for consumer attention is intensifying. Institutions must leverage advanced automation to deliver timely, relevant, and compliant messaging. This playbook outlines the strategic framework for executing high-impact March 31 tax deadline campaigns that drive measurable ROI while maintaining the highest standards of institutional integrity.

Navigating the Fiscal Year-End Investment Rush: Regulatory and Fiscal Context

Understanding the precise pillars of the Indian tax code is fundamental to any financial year-end compliance marketing 2026 strategy. For the 2025-26 assessment year, the distinction between the old and new tax regimes remains a pivotal messaging point. While the new regime offers simplified slabs, the old regime continues to provide significant deductions that fuel the year-end investment surge.

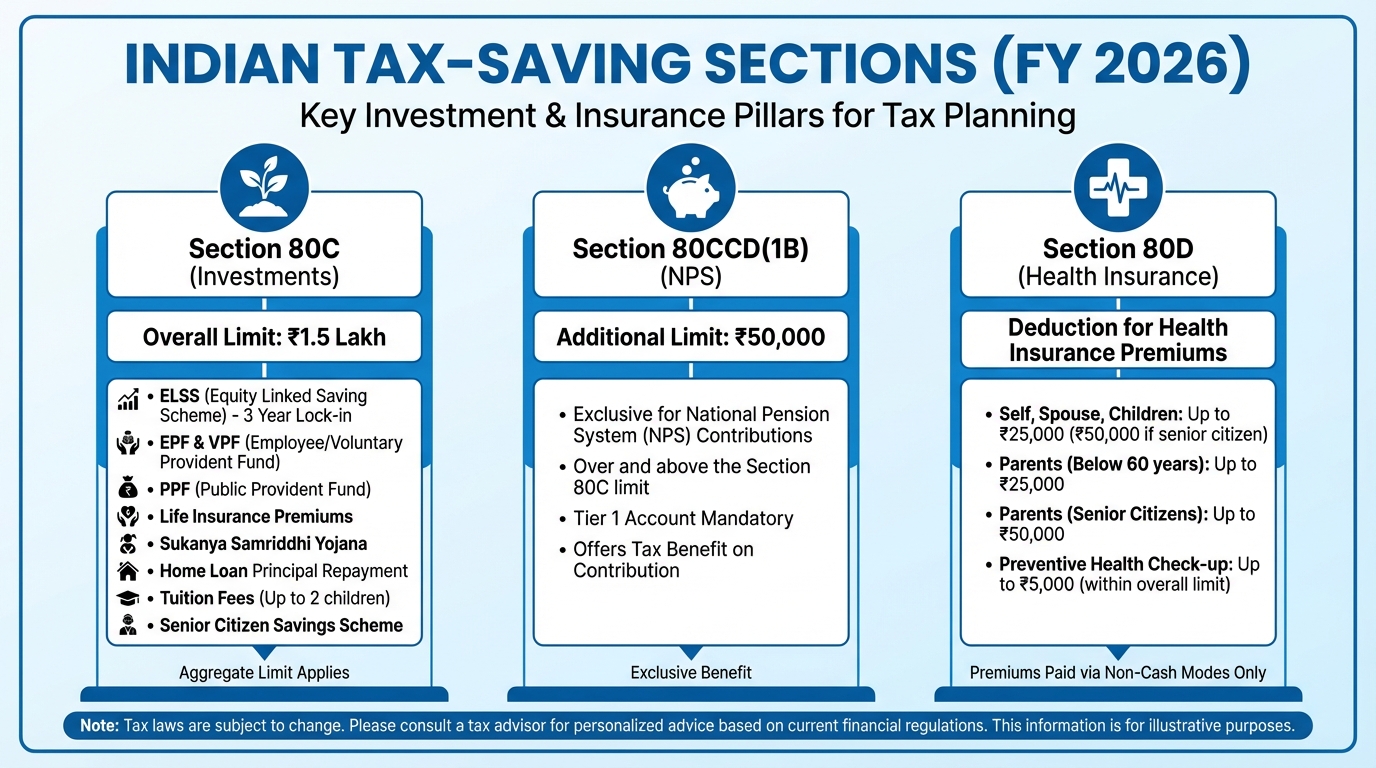

The primary vehicle for tax optimization remains Section 80C, which allows for a deduction of up to Rs 1.5 lakh on eligible investments. This includes Equity Linked Savings Schemes (ELSS), Public Provident Fund (PPF), and life insurance premiums. Additionally, Section 80CCD(1B) offers an exclusive deduction of up to Rs 50,000 for contributions to the National Pension System (NPS), providing a total potential deduction of Rs 2 lakh when combined with 80C.

Health insurance also plays a critical role under Section 80D, where deduction limits vary based on the age of the insured and their parents. Marketers must ensure that their tax saving product comparison tools accurately reflect these nuances. It is projected that by 2026, over 65% of retail investors will utilize automated calculators to determine their shortfall before committing capital.

Crucially, all investments must be processed and credited within the financial year to qualify for deductions. This creates a logistical bottleneck during the final week of March. Institutions must proactively communicate per-institution cut-off times to avoid customer dissatisfaction and compliance risks. Providing clear guidance on processing windows is a hallmark of a mature financial year-end compliance marketing 2026 strategy.

Source: Income Tax Department Official Calendar

Source: Section 80C and 80D Deduction Limits

Source: NPS Tax Benefit Explainer

Source: Old vs New Regime Comparison

The Architecture of March 31 Tax Deadline Campaigns: Behavioral Triggers

The efficacy of March 31 tax deadline campaigns relies on the strategic deployment of behavioral triggers. In a high-stakes environment, generic messaging fails to cut through the noise. Instead, BFSI marketers must utilize data-driven insights to identify specific customer needs and deliver interventions at the optimal moment of the “fiscal year-end investment rush.”

Time-based triggers are the most fundamental, utilizing a countdown methodology (T-60, T-30, T-7) to build healthy urgency. However, threshold triggers offer a deeper level of personalization. For instance, identifying customers whose 80C utilization is below 75% allows for targeted nudges that highlight the specific “tax-saving gap.” This level of precision transforms a standard promotion into a valuable financial advisory service.

Transactional triggers are equally vital for capturing lost opportunities. Abandoned ELSS purchases or incomplete NPS eKYC processes should trigger immediate, automated follow-ups. By 2026, real-time API integrations will allow institutions to respond to these events within seconds, significantly reducing drop-off rates. These automated workflows ensure that no potential investment is lost to friction or procrastination.

Engagement triggers, such as monitoring how much of an “investment urgency video automation” a user has watched, provide a signal of intent. If a user engages with a video but does not convert, a secondary trigger can deploy a 80C tax saving personalized calculator to simplify the final step. This sequential approach ensures that the customer journey is guided by their own actions and preferences.

Finally, life-event triggers—such as recent salary credits, bonuses, or nearing a senior citizen age bracket for 80D benefits—allow for highly contextualized messaging. By aligning marketing efforts with the customer's financial reality, institutions can foster trust and demonstrate a genuine understanding of the individual's needs. This behavioral sophistication is the cornerstone of modern financial year-end compliance marketing 2026.

Creative Toolkit: Leveraging Investment Urgency Video Automation

To dominate the 2026 landscape, BFSI institutions must move beyond static banners and generic emails. The modern creative toolkit is centered on investment urgency video automation and interactive assets that provide immediate, personalized value. These tools are designed to simplify complex financial decisions and drive action through visual storytelling.

Platforms like TrueFan AI enable marketers to render hyper-personalized urgency videos in under 30 seconds, featuring dynamic overlays that display the customer's name, their specific tax-saving shortfall, and a live countdown to the March 31 deadline. This level of personalization creates a sense of direct consultation, which is far more effective than traditional mass marketing.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow institutions to scale these efforts across diverse demographics. Whether targeting a first-time earner in a Tier 2 city or a seasoned HNI in a metro, the ability to deliver a message in the customer's preferred language and cultural context is a significant competitive advantage. This multilingual capability ensures that “compliance deadline countdown videos” are accessible and impactful for all segments.

Beyond video, 80C tax saving personalized calculators are essential for reducing cognitive load. These tools should be pre-filled with data from the CRM, such as current salary and existing insurance premiums, to show the user exactly what they need to invest to maximize their tax benefits. When embedded alongside a video, these calculators provide a seamless transition from awareness to execution.

Furthermore, “tax saving product comparison” widgets allow users to evaluate ELSS, NPS, and insurance options side-by-side. These widgets should include suitability gating, ensuring that high-risk products like ELSS are only promoted to customers with an appropriate risk profile. By integrating compliance and advisory into the creative experience, BFSI brands can protect their customers while achieving their commercial objectives.

Source: Digital Personalization Trends 2026

Source: Impact of Multilingual Marketing

Strategic Playbooks: ELSS, NPS, and Insurance Renewal Marketing

Executing a successful financial year-end compliance marketing 2026 strategy requires specialized playbooks for different product categories. Each instrument has unique benefits and regulatory requirements that must be reflected in the campaign logic.

For “ELSS mutual fund last-minute offers”, the focus should be on the dual benefit of wealth creation and tax savings. Since ELSS has a three-year lock-in—the shortest among 80C options—it is highly attractive to younger investors. Campaigns should trigger for customers with unused 80C limits and a moderate-to-high risk appetite. The flow should move from a personalized countdown video to an ELSS calculator, ending with a one-tap investment link.

The “NPS enrollment deadline videos” playbook targets the additional Rs 50,000 deduction under Section 80CCD(1B). This is a powerful hook for corporate employees who may have already exhausted their 80C limit. By highlighting the long-term retirement benefits and the immediate tax saving, institutions can drive high-value, long-term customer relationships. Integration with HRMS platforms can further streamline this process for corporate cohorts.

“Insurance renewal deadline marketing” is critical for maintaining policy persistency and ensuring customers don't lose their 80D benefits. Triggers should be set for policies nearing lapse or renewal in the final quarter. A personalized video showing the policy details, the premium amount, and the specific tax deduction eligible under 80D can significantly improve renewal rates. Including a direct WhatsApp payment link within the journey reduces friction during the “fiscal year-end investment rush.” Learn more

For High Net-worth Individuals, “HNI portfolio review campaigns” are the gold standard. These campaigns should focus on “year-end portfolio rebalancing” and tax-loss harvesting. Instead of a generic nudge, HNIs should receive a personalized video from their Relationship Manager (RM) inviting them to a “financial advisory consultation.” This high-touch, automated approach ensures that the institution's most valuable clients receive bespoke advice during the most critical time of the year.

Source: Section 80CCD(1B) NPS Benefits

Source: Section 80D Health Insurance Rules

Enterprise Guardrails: Security and Compliance in BFSI Marketing

In the realm of financial year-end compliance marketing 2026, security and regulatory adherence are not optional—they are the foundation of trust. BFSI institutions operate under strict oversight from bodies like SEBI, IRDAI, and RBI, necessitating a “compliance-first” architecture for all marketing automation.

Enterprise-grade controls must include ISO 27001 and SOC 2 certifications to ensure data integrity and privacy. Every piece of content, especially those generated through “investment urgency video automation,” must pass through a rigorous approval workflow. This includes legal and compliance gates to verify that all disclaimers are present and that no misleading claims are made. Automated content moderation can accelerate these approval cycles, allowing for rapid deployment during the peak March window.

Solutions like TrueFan AI demonstrate ROI through their ability to maintain these high standards while delivering hyper-personalization at scale. By providing role-based approvals, version control, and comprehensive audit logs, such platforms ensure that every “compliance deadline countdown video” sent is documented and verifiable. This is essential for meeting regulatory requirements regarding “fair-offer” policies and consumer protection. Explore the compliance guide

Consent management is another critical pillar. Institutions must respect DND (Do Not Disturb) registries and provide clear opt-in/opt-out mechanisms for high-frequency channels like WhatsApp and SMS. PII (Personally Identifiable Information) minimization and encryption at rest and in transit are mandatory to protect sensitive financial data. By 2026, the integration of zero-knowledge proofs and advanced encryption will be standard for secure document intake and “financial advisory consultations.”

Finally, suitability gating is paramount. No tax-saving product should be promoted without assessing the customer's risk profile and financial goals. For example, promoting ELSS to a risk-averse senior citizen without proper disclosure is a significant compliance risk. Automated workflows must include a “suitability check” step, ensuring that the “tax saving product comparison” provided is appropriate for the individual's specific circumstances.

Measurement and the 2026 Execution Roadmap

The success of March 31 tax deadline campaigns is measured through a combination of leading and lagging indicators. Leading metrics include click-through rates (CTR) on personalized videos, completion rates of “80C tax saving personalized calculators,” and the number of “financial advisory consultations” booked. These metrics provide real-time feedback on campaign resonance, allowing for mid-course corrections.

Lagging metrics focus on the bottom line: the total volume of funded ELSS and NPS accounts, the percentage of insurance renewals completed, and the incremental utilization of 80C/80D limits across the customer base. By 2026, multi-touch attribution models will be essential for understanding the journey from an initial “compliance deadline countdown video” to the final transaction, often involving multiple devices and human RM interventions.

The execution roadmap for financial year-end compliance marketing 2026 should follow a phased approach:

- T-60 to T-45 (Education Phase): Focus on awareness of the old vs. new tax regime. Deploy explainers on what qualifies under 80C, 80D, and 80CCD(1B).

- T-45 to T-21 (Threshold Phase): Identify customers with significant tax-saving gaps. Deploy personalized calculators and initial urgency videos. Initiate “corporate employee tax benefits” workflows through HRMS integrations.

- T-21 to T-8 (Intensification Phase): Increase the frequency of “compliance deadline countdown videos.” Prioritize “HNI portfolio review campaigns” and RM-led outreach.

- T-7 to T-1 (Peak Week): Final push with daily countdowns. Emphasize institution-specific cut-off times and provide one-tap investment flows for ELSS and NPS.

- T-0 (March 31): Real-time monitoring of processing queues. Shift messaging to “next-year planning” once cut-offs are passed.

By following this structured roadmap and leveraging advanced automation, BFSI marketers can navigate the complexities of the 2026 financial year-end with confidence, driving both customer value and institutional growth.

Disclaimer: Tax benefits are subject to prevailing laws and individual circumstances. Market-linked investments like ELSS are subject to market risks; please read all scheme-related documents carefully. Processing times for investments may vary by institution; ensure actions are completed well before the March 31 deadline to qualify for the current financial year. Information is accurate as of the 2025-26 fiscal context.

Frequently Asked Questions

What is the primary goal of financial year-end compliance marketing 2026?

The primary goal is to assist customers in maximizing their tax-saving potential under Section 80C, 80D, and 80CCD(1B) before the March 31 deadline, while ensuring all marketing activities are compliant with BFSI regulations and data privacy standards.

How does investment urgency video automation improve conversion rates?

By providing hyper-personalized data—such as the customer's specific tax shortfall and a real-time countdown—video automation creates a sense of relevance and urgency that static ads cannot match. This leads to higher engagement and faster decision-making during the “fiscal year-end investment rush.”

Can these tools support HNI portfolio review campaigns?

Yes. High-touch automation allows RMs to send personalized video summaries to HNIs, highlighting “year-end portfolio rebalancing” opportunities and inviting them to a “financial advisory consultation.” This combines the efficiency of automation with the prestige of personalized service.

What are key compliance requirements for March 31 tax deadline campaigns?

Key requirements include explicit consent for communication, clear risk disclaimers (especially for market-linked products like ELSS), suitability gating, and maintaining a full audit trail of all personalized content sent to customers.

How does TrueFan AI support BFSI institutions during the tax season?

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow for the rapid creation of compliant, hyper-personalized content. Its enterprise-grade security and API-triggered rendering make it an ideal partner for high-volume, high-stakes “financial year-end compliance marketing 2026” campaigns.

Can 80C calculators be embedded into video journeys?

Absolutely. The most effective campaigns embed 80C tax saving personalized calculators directly into the landing pages where the videos are hosted. This allows the user to calculate their exact need and take action immediately without leaving the experience.