Salary account switching campaigns 2026: How BFSI wins appraisal season with personalized benefits calculators

Estimated reading time: ~10 minutes

Key Takeaways

- Appraisal timing in April–May is the highest-intent window to trigger salary account switch offers.

- Partnership-first growth via corporate payroll tie-ups reduces CAC and boosts account stickiness.

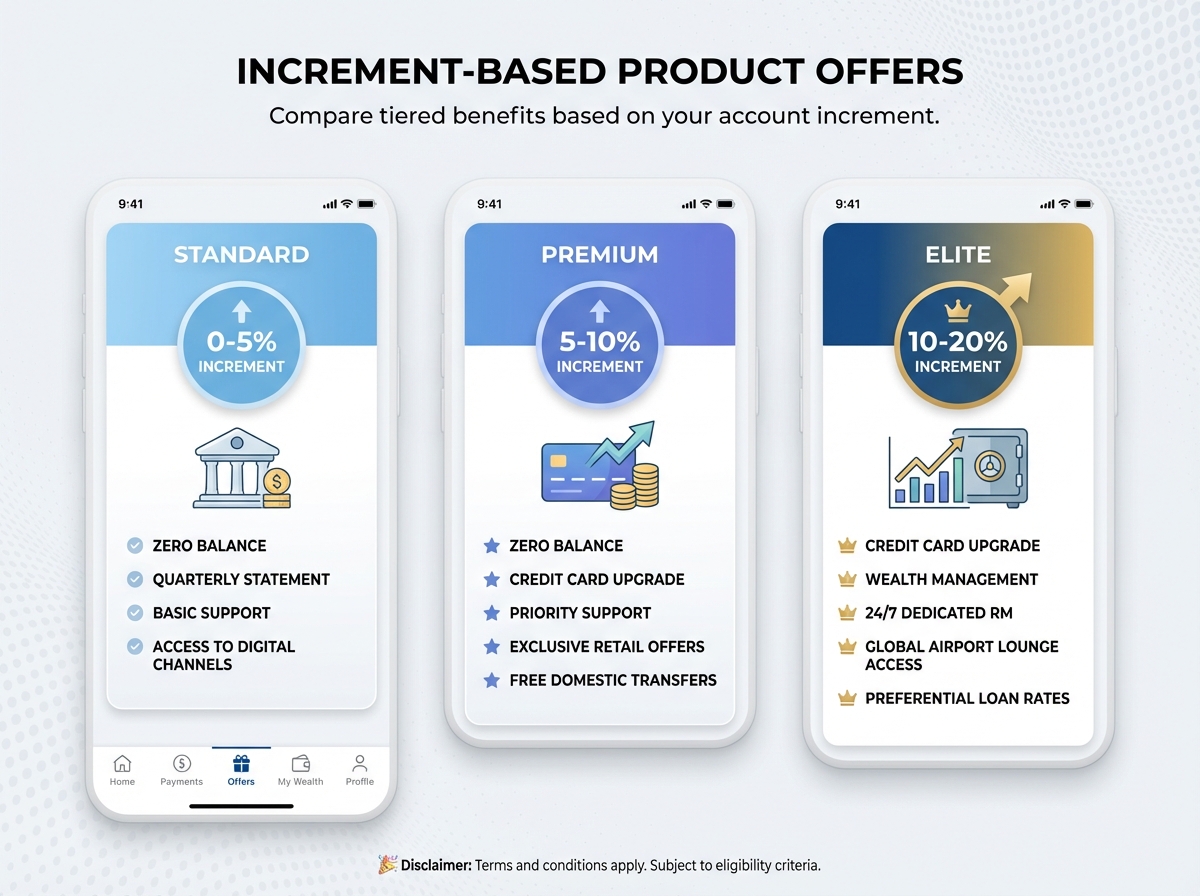

- Increment-based product offers align cards, loans, and wealth to the employee’s new CTC band.

- Interactive benefits calculators quantify Annual Switch Value and guide tax-saving structuring.

- Hyper-personalized video + automation increase conversion while meeting DPDP compliance.

To dominate the market, BFSI teams must deploy salary account switching campaigns 2026 with surgical precision during the critical April–May appraisal window. This period represents the highest-intent moment for salaried professionals as they re-evaluate their financial ecosystems following annual increments. By integrating hyper-personalized video, interactive benefits calculators, and automated corporate triggers, banks can transform a standard payroll pitch into a high-conversion acquisition engine.

The 2026 landscape is defined by a projected 9% average salary increment across India Inc., creating a massive pool of employees looking to optimize their new liquidity. Salary account switching campaigns 2026 leverage this "increment moment" to offer more than just a place to park money; they provide a comprehensive wealth and lifestyle upgrade. This guide details the exact framework for corporate bulk acquisition BFSI strategies, from calculator logic to AI-driven video orchestration.

The appraisal season opportunity: Intent signals and timing for appraisal season banking offers

The April–May window is the "Golden Quarter" for retail banking because it aligns perfectly with the distribution of appraisal letters and the first credit of revised salaries. Appraisal season banking offers succeed when they are timed to these specific intent signals, ensuring the bank is present at the exact moment an employee feels "wealthier" and more open to premium products.

Data from recent Aon studies indicates that India Inc. is projected to provide a 9% average salary increment in 2026, with top performers seeing jumps of 15–20%. This creates a variance in salary credit that acts as a primary trigger for increment-based product offers. Marketers must monitor four specific intent signals: HR announcements of payroll updates, salary credit variance of ≥10% compared to the trailing three-month median, CTC bracket jumps (e.g., crossing the 15 LPA threshold), and stable credit bureau scores.

Timing is everything; the campaign must launch in the "Pre-Appraisal Education" phase (March) and peak during the "Salary Credit Week" (late April). By parameterizing offers based on these 2026 increment projections, banks can move away from generic "zero balance" messaging toward high-value, bracket-specific incentives. This strategic alignment ensures that corporate bulk acquisition BFSI efforts are not just broad-based but hyper-targeted to the most profitable segments.

Sources:

- Economic Times: India Inc to give 9% salary increment in 2026 (Aon study)

- Aon Global: 2026 Salary Increase Planning Tips

Corporate bulk acquisition BFSI: Partnership-first growth and corporate tie-up banking benefits

The most efficient path to scale in 2026 is through deep-rooted payroll partnerships that offer exclusive corporate tie-up banking benefits. Rather than individual acquisition, corporate bulk acquisition BFSI focuses on the employer-employee relationship, utilizing the company’s internal communication channels to build trust. This approach reduces the cost of acquisition (CAC) while increasing the "stickiness" of the account through bundled services.

A successful payroll partnership marketing playbook involves co-branded landing pages and HR-led broadcasts via platforms like Microsoft Teams or Slack. On-site enrollment camps during appraisal letter distribution days remain highly effective, especially when paired with digital "Instant Account Opening" journeys. These partnerships should highlight zero balance account benefits, which remain a baseline expectation for Indian salaried employees across all sectors.

To outperform competitors, banks must benchmark their offerings against industry leaders. For instance, SBI, ICICI Bank, and Axis Bank provide tiered salary account variants that include personal accident insurance, air accidental cover, and preferential rates on lockers. By offering a "Corporate Premium" tier that includes these features plus dedicated relationship managers for high-CTC employees, banks can secure the entire payroll of a Tier-1 corporate entity.

Sources:

- ICICI Bank: Salary Account Benefits

- Axis Bank: Salary Account Overview

- SBI Salary Account Privileges

Offer architecture that converts switchers: Increment-based product offers and tax saving salary structuring

Converting a salary account switcher requires a multi-layered offer architecture that evolves based on the employee’s new CTC and increment band. Generic offers fail because they do not account for the specific financial needs of a person who just received a 15% raise. Increment-based product offers must be dynamic, calibrating credit limits, fee waivers, and wealth advisory based on the post-appraisal reality.

For employees in the 0–5% increment band, the focus should be on zero balance account benefits and immediate fee waivers for digital transactions (IMPS/NEFT/RTGS). For the 5–10% cohort, banks should trigger a credit card upgrade appraisal season offer, providing lifetime-free (LTF) upgrades to cards with better rewards for travel or dining. This segment is also prime for personal loan pre-approved offers with rate discounts of 50–100 bps, designed for immediate lifestyle upgrades.

High-growth employees (10–20% increment) represent the most lucrative segment for wealth management salary bracket upgrades. These users should be nudged toward SIP starter kits and tax saving salary structuring advice. Under the 2026 tax landscape, optimizing deductions under Section 80C, 80D, and 80CCD(1B) is a major pain point. By providing a tool that estimates tax outflow under both the old and new regimes, banks can position themselves as financial advisors rather than just service providers.

Sources:

Interactive benefits calculators: The decision engine for salary account switching campaigns 2026

The centerpiece of a high-intent campaign is the interactive benefits calculator, which serves as the primary decision engine for the user. In salary account switching campaigns 2026, the calculator must go beyond simple interest math to quantify the total annual net benefit of the switch. This includes savings from avoided fees, incremental reward points, and the value of pre-approved credit lines.

The "Increment-to-Benefit" calculator should take inputs such as current bank, new CTC, spending profile, and average monthly balance. The logic then computes the "Rewards Delta"—the difference between the new bank’s reward structure and the current one—and adds it to the "Savings Delta" from zero balance account benefits. This provides a tangible "Annual Switch Value" (e.g., ₹24,500) that makes the decision to switch rational and immediate.

Furthermore, a tax saving salary structuring estimator is essential for the 2026 appraisal season. This tool helps employees visualize how their new salary will be taxed and suggests product nudges like ELSS or NPS to minimize liability. By embedding these calculators into the corporate bulk acquisition BFSI journey, banks provide immediate utility, leading to higher application completion rates and better-qualified leads for the sales team.

Sources:

Creative engine: Hyper-personalized video at enterprise scale for employee banking package videos

In the digital-first environment of 2026, static emails are no longer sufficient to drive complex financial decisions. Employee banking package videos represent the next frontier in BFSI marketing, offering a 1:1 personalized explainer for every employee in a partner corporate. These videos dynamically pull data from the benefits calculator to show the user exactly what their new banking life looks like.

Platforms like TrueFan AI enable banks to generate thousands of these videos in minutes, featuring the employee's name, their specific increment band, and the exact increment-based product offers they qualify for. TrueFan AI's 175+ language support and Personalised Celebrity Videos ensure that the message resonates across diverse demographics, from entry-level associates to C-suite executives. This level of localization is critical for large-scale corporate bulk acquisition BFSI projects spanning multiple regions.

Additionally, salary advance personalization videos can be triggered near payday or when cashflow gaps are detected post-appraisal. These short, 20-30 second videos use AI-driven lip-sync and voice retention to explain safe-credit options and repayment dates in the user's preferred language. By delivering these assets via WhatsApp Business API or secure microsites, banks can achieve view-through rates (VTR) and click-through rates (CTR) that far exceed traditional display or email advertising.

Automation, compliance, and measurement: Orchestrating corporate salary credit automation

To execute salary account switching campaigns 2026 at scale, banks must implement corporate salary credit automation. This involves integrating HRMS or payroll data with the bank’s marketing automation platform to trigger personalized journeys the moment an appraisal letter is issued. Automation ensures that the right offer—whether it’s a credit card upgrade appraisal season or a wealth management nudge—reaches the user at the peak of their intent.

Compliance is a non-negotiable pillar of this orchestration. With the Digital Personal Data Protection Act (DPDP) 2023 in full effect, banks must ensure explicit consent for every personalization variable used in employee banking package videos. For a practical playbook, see DPDP-compliant personalization strategies. Data minimization is key; only the necessary CTC brackets and language preferences should be processed. All financial promotions must clearly disclose APR ranges, eligibility criteria, and T&Cs to avoid product mis-selling and regulatory friction.

Measurement of these campaigns should focus on the full funnel, from video VTR to the number of funded salary accounts. Key Performance Indicators (KPIs) include the "Switch Conversion Rate" and the "Cross-sell Uptake" for personal loan pre-approved offers. By using A/B testing for different increment-banded creatives and virtual reshoots to swap fee-waiver lines, marketing teams can optimize their ROI in real-time throughout the April–May window.

Sources:

Conclusion: Dominating the 2026 Salary Switch Market

The success of salary account switching campaigns 2026 hinges on the ability to provide immediate, personalized value during the appraisal window. By combining the analytical power of interactive benefits calculators with the emotional engagement of employee banking package videos, BFSI brands can capture high-intent switchers more effectively than ever before. This integrated approach not only drives corporate bulk acquisition BFSI but also sets the stage for long-term wealth management and cross-sell opportunities.

As India Inc. prepares for a 9% increment cycle, the banks that win will be those that automate their outreach through corporate salary credit automation and respect the new privacy standards of the DPDP Act. The goal is to move beyond transaction-based marketing and toward a partnership-led model that supports the employee's entire financial journey. By deploying these strategies, your institution can turn the 2026 appraisal season into a record-breaking period for new-to-bank salary acquisitions.

Recommended Internal Links

- Interactive Video Data Capture: DPDP-Compliant 2026

- Interactive Video Data Capture: DPDP-Compliant Guide 2026

- DPDP Compliant Personalization: Privacy-First Marketing

- WhatsApp Business Commerce Automation 2026: Growth Playbook

- Boost Conversions with Tax Saving ROI Calculators in 2026

Frequently Asked Questions

What is a salary account and how is it different from a regular savings account?

A salary account is a specialized savings account designated for recurring salary credits from an employer. Unlike regular accounts, they often come with zero balance account benefits, meaning there is no requirement to maintain a minimum monthly balance. They also feature negotiated corporate tie-up banking benefits such as free unlimited ATM withdrawals, higher insurance covers, and preferential rates on lockers.

How do I switch my salary account during the 2026 appraisal season?

To switch, first open your new account with the bank offering the best appraisal season banking offers. Once the account is active, submit a "Salary Account Change" letter or update your details on your company’s HRMS portal. Ensure you update any existing NACH/ECS mandates for EMIs or SIPs to the new account to avoid bounce charges. Most banks now offer digital assistance to help migrate these mandates seamlessly.

Are the tax saving salary structuring suggestions provided by calculators legally binding?

No, the tax saving salary structuring suggestions generated by interactive calculators are for illustrative purposes only. They are based on user inputs and the prevailing tax limits for the 2026 financial year. These tools are designed to help you visualize potential savings but do not constitute professional tax or legal advice. Always consult with a certified tax advisor before making significant changes to your salary structure.

How does TrueFan AI help in salary account switching campaigns?

Solutions like TrueFan AI demonstrate ROI through hyper-personalized video content that explains complex banking benefits in a simple, engaging format. By using AI to create 1:1 videos for thousands of employees, banks can significantly increase engagement and conversion rates compared to static communication methods.

What are the benefits of increment-based product offers?

Increment-based product offers are tailored to your new financial status after an appraisal. For example, if your CTC moves to a higher bracket, you may automatically qualify for a wealth management salary bracket upgrade or a credit card upgrade appraisal season with higher limits and better rewards. These offers ensure that your banking relationship grows in tandem with your career progression.