Corporate Financial Wellness 2026 for India’s HR Leaders: Appraisal-Season Campaigns that Lift Benefits ROI and Retention

Estimated reading time: ~14 minutes

Key Takeaways

- Use appraisal season as a high-attention window to drive benefit literacy, tax compliance, and adoption.

- Automate tax planning and HRA with HRIS–payroll integrations to shrink helpdesk load and errors.

- Lift ROI with payroll deduction marketing that enables one-click SIPs, insurance, and NPS top-ups.

- Increase conversions via hyper-personalized, vernacular videos mapped to role, city, and salary band.

- Scale impact through secure BFSI partnerships, governance, and real-time content updates.

The landscape of corporate financial wellness 2026 has shifted from a secondary “perk” to a board-level strategic imperative for India’s leading enterprises. As the March–April appraisal season approaches, HR leaders and BFSI partners face the critical challenge of reducing employee financial stress while simultaneously increasing the adoption of complex benefit structures. This playbook provides a turnkey, payroll-integrated framework designed to transform appraisal cycles into high-impact engagement windows that deliver measurable ROI and long-term talent retention.

In the current fiscal environment, the traditional “salary slip” communication is no longer sufficient to satisfy a workforce navigating high inflation and complex tax transitions. Modern employees demand clarity on their net take-home pay, especially with the default shift toward the New Tax Regime and the evolving nuances of Section 80C and 80CCD(1B). By implementing a data-driven financial wellness strategy, organizations can automate tax planning, optimize HRA claims, and foster a culture of fiscal responsibility that resonates across diverse employee cohorts.

Strategic alignment between HR, payroll, and BFSI partners is the cornerstone of this 2026 vision. By leveraging hyper-personalized communication tools, companies can move beyond generic emails to deliver role-specific, vernacular content that simplifies financial decision-making. This approach not only reduces the administrative burden on HR teams during the high-volume FY-end window but also ensures that every employee feels supported in their journey toward financial security.

Sources:

The Strategic Imperative of Employee Benefit Communication and Literacy

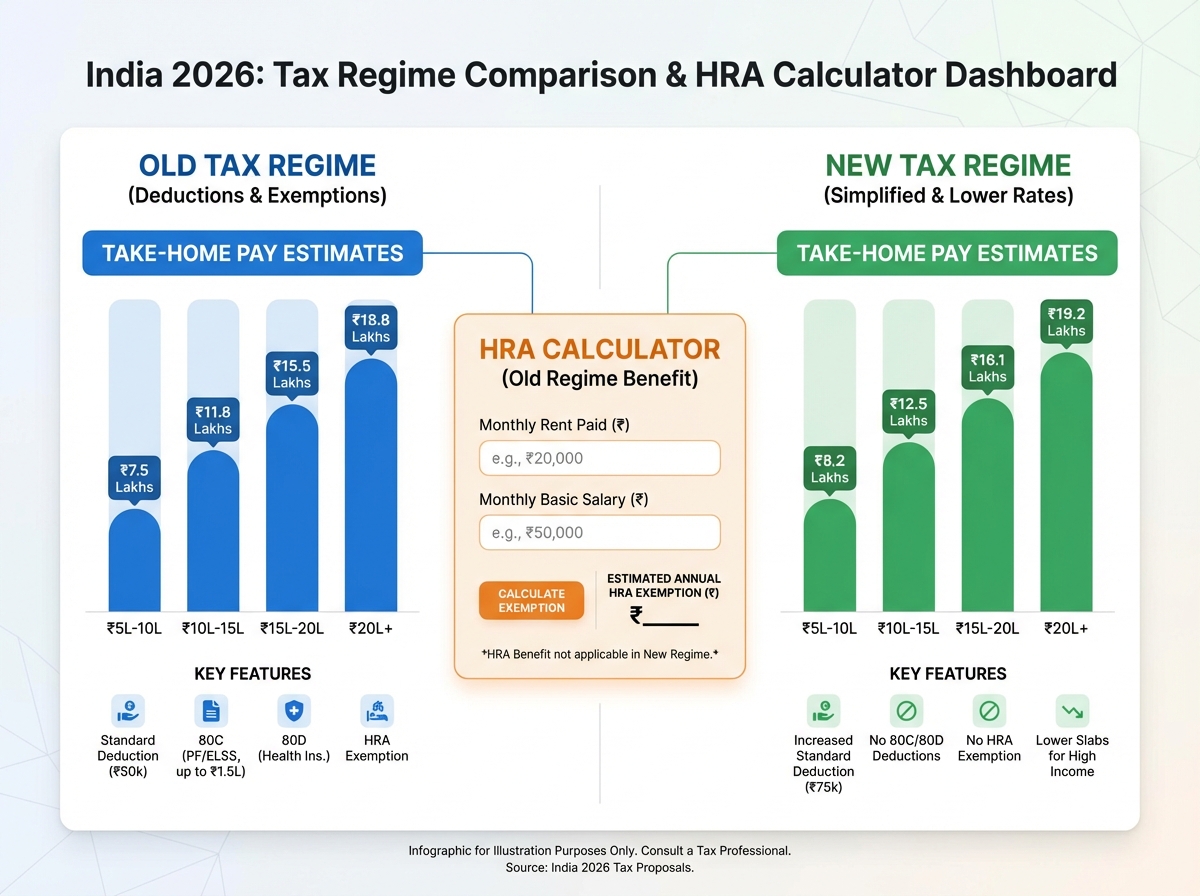

Effective employee benefit communication is the primary vehicle for driving participation in corporate wellness programs. In 2026, the “one-size-fits-all” newsletter has been replaced by workplace financial literacy videos that are short, vernacular, and segmented by city and role. These 60–90 second modules break down intimidating topics like the difference between Old and New tax regimes, the mechanics of HRA, and the long-term benefits of SIPs.

Platforms like TrueFan AI enable HR departments to deploy these videos at scale, ensuring that a factory worker in Tamil Nadu and a software engineer in Bengaluru receive the same high-quality financial education in their preferred language. By integrating these videos into the Learning Management System (LMS) with associated quizzes, HR can track “literacy lift” and identify cohorts that may require additional support. This proactive education reduces financial stress management B2B hurdles by preventing last-minute tax-filing panics.

Beyond education, the communication strategy must be timed to the “moments that matter.” During the appraisal cycle, the issuance of a revision letter is the peak moment of employee attention. Delivering a personalized video that explains the new CTC structure alongside the literacy modules ensures that the information is both relevant and actionable. This synergy between timing and content is what differentiates a standard benefits package from a world-class financial wellness program.

Sources:

- People Matters: Why financial wellbeing needs to be in the leader’s radar in 2026

- Income Tax Department: New vs Old tax regime FAQs

Streamlining Employee Tax Planning Automation and HRA Optimization

The complexity of the Indian tax code, particularly the nuances of HRA optimization campaigns, often leads to a surge in HR helpdesk tickets during March. Employee tax planning automation is the solution to this seasonal bottleneck. By integrating HRIS and payroll data, organizations can create automated workflows that guide employees through the declaration process, validate proofs in real-time, and provide instant feedback on regime selection.

For HRA u/s 10(13A), the automation engine should calculate the “least of” the three standard criteria: actual HRA received, rent paid minus 10% of salary, or 40/50% of basic salary. By providing employees with a personalized calculator within their salary planning journey, HR can help them understand the exact impact of their rent receipts on their net pay. This transparency builds trust and ensures that employees are maximizing their legal tax savings without over-relying on manual HR intervention.

Furthermore, the default status of the New Tax Regime for AY 2025–26 requires a robust communication effort to explain the limited deductions available compared to the Old Regime. Automated nudges should remind employees of the 80C investment deadlines and the 80CCD(1B) NPS deduction window, specifically highlighting the Rs 50,000 additional deduction for NPS. When these reminders are coupled with a “one-click” declaration interface, the rate of on-time and accurate submissions increases by up to 40%, significantly easing the payroll freeze period.

Sources:

- Income Tax Department: ITR Validation Rules for AY 2025-26

- Income Tax Department: New vs Old tax regime FAQs

Maximizing ROI with Appraisal Season Investment Campaigns and Retirement Planning

Appraisal season investment campaigns are the most effective way to transition employees from passive earners to active wealth creators. By focusing on retirement planning employee videos, HR can illustrate the power of compounding through EPF, VPF, and NPS. These videos should not just be generic explainers; they must be personalized to show how a small increase in a monthly SIP or a voluntary NPS contribution can lead to a significantly larger corpus at retirement.

The 2026 trend in India shows a growing interest in “auto-escalation” features, where a portion of an employee's salary increment is automatically diverted into a retirement fund. Communicating this option through engaging visuals helps overcome the “present bias” that often prevents employees from saving for the future. Highlighting the specific tax benefits of Section 80CCD(1B) serves as a powerful nudge for employees to utilize the full Rs 50,000 deduction window before the March 31st deadline.

To ensure high engagement, these campaigns should be segmented by risk profile and age. A younger employee might receive content focused on ELSS and equity-linked SIPs, while an employee closer to retirement receives information on debt funds and liquid assets for an emergency corpus. This level of granular targeting ensures that the advice is relevant to the individual's life stage, thereby increasing the likelihood of a “call to action” (CTA) click and subsequent investment.

Sources:

Driving Conversions via Payroll Deduction Marketing and Salary Account Acquisition

The “last mile” of financial wellness is the ease of execution. Payroll deduction marketing allows employees to set up SIPs, insurance premiums, and NPS top-ups directly from their monthly salary, creating a “set and forget” mechanism for wealth building. Solutions like TrueFan AI demonstrate ROI through increased participation rates by embedding “Activate via Payroll” buttons directly within personalized video content, removing the friction of navigating multiple banking portals.

For BFSI partners, the appraisal season is the prime window for salary account acquisition and upgrades. By offering segmented incentives—such as zero-balance premium accounts or UPI-linked rewards—banks can capture a larger share of the employee's financial life. Hyper-personalized onboarding videos that greet the employee by name and mention their specific salary band and city-based offers have been shown to increase account opening rates by over 15% compared to generic email blasts.

Corporate group insurance offers also see a significant uptick when marketed through payroll integration. Explaining complex riders, such as OPD add-ons or critical illness covers, through simple comparison visuals helps employees make informed decisions during the appraisal window. When the premium is deducted at the source, the perceived “cost” is lower, and the convenience factor ensures that more employees opt for higher coverage levels, providing better protection for the workforce and reducing the company's liability in health-related crises.

Sources:

- People Matters: Why financial wellbeing needs to be in the leader’s radar in 2026

- ETHRWorld—ADP: Future of Pay in India

Scaling Personalization through Corporate Tie-Up Personalization and Partnerships

Achieving corporate tie-up personalization at an enterprise scale requires a robust technology stack that can handle thousands of unique data points simultaneously. TrueFan AI's 175+ language support and Personalised Celebrity Videos allow organizations to deliver a VIP-like experience to every employee, regardless of their location or role. This level of personalization is not just a “nice-to-have”; it is a critical driver of engagement in a 2026 market where attention is the most valuable currency.

The operating model for these corporate wellness partnerships must be built on a foundation of data security and joint governance. A steering committee comprising HR, Payroll, IT, and the BFSI partner ensures that content is compliant, data exchange is secure (ISO 27001/SOC 2), and the ROI is tracked against pre-defined KPIs. This collaborative approach allows for “virtual reshoots” and AI-driven editing, enabling HR to update messaging in real-time as tax laws or corporate policies evolve during the appraisal cycle.

Finally, professional wealth management marketing should be integrated into the program to provide employees with access to SEBI-registered advisors. By offering multilingual webinars and “office hours” during the peak March–April period, companies can provide the human touch that often complements automated tools. This holistic approach—combining high-tech personalization with high-touch expert advice—ensures that the corporate financial wellness 2026 strategy is both scalable and deeply impactful.

Sources:

- People Matters: Big shifts that will reshape work in 2026

- Income Tax Department: ITR Validation Rules for AY 2025-26

Conclusion: Securing the Future of the Indian Workforce

The transition to a comprehensive corporate financial wellness 2026 model is no longer optional for Indian enterprises aiming to lead in talent management. By strategically utilizing the appraisal season as a launchpad for personalized education, automated tax planning, and frictionless payroll investments, HR leaders can deliver a benefits package that truly resonates with the modern employee. The integration of high-authority data, vernacular communication, and robust BFSI partnerships creates a win-win ecosystem where employees achieve financial peace of mind and organizations see a tangible boost in productivity and retention. As we move toward the March financial year-end 2026 campaign deadline, the time to deploy these modular, data-driven campaigns is now.

Recommended Internal Links

- Financial Wellness Video Campaigns 2026: Corporate Guide

- 80C investment personalized videos for March 31 tax rush

- NPS Enrollment Deadline Videos: Drive Urgency in 2026

- January 2026 insurance renewal automation strategies

- Financial Year-End Marketing 2026: High-ROI Campaign Ideas

- WhatsApp Catalog Video Marketing: Automation Strategies

Frequently Asked Questions

How can we automate employee tax planning during the 2026 appraisal season?

Automation is achieved by integrating your HRIS with a specialized tax planning engine that supports the AY 2025–26 rules. This system should offer a guided journey for employees to compare the Old vs. New tax regimes, validate 80C/80CCD(1B) declarations in real-time, and provide automated reminders for proof submission. Linking to the official Income Tax Department FAQs within the tool ensures employees have access to verified information, reducing the query load on HR teams.

What are the best practices for payroll deduction marketing in India?

The most successful payroll deduction programs prioritize transparency, consent, and ease of revocation. Best practices include embedding “one-click” activation CTAs in personalized videos, providing clear T&Cs regarding the reversibility of deductions, and ensuring that the employee's net pay impact is clearly visualized before they opt-in. According to the ETHRWorld Future of Pay context, holistic wellness is best achieved when these deductions are tied to long-term goals like NPS or insurance upgrades.

How does TrueFan AI help in personalizing corporate tie-ups for salary accounts?

TrueFan AI uses advanced AI-driven video synthesis to create thousands of personalized videos that address employees by name and present offers tailored to their specific salary band and location. This allows BFSI partners to offer a “private banking” experience to the entire workforce. The platform ensures privacy by using PII minimization and secure API integrations, meaning sensitive data is only used for the render and never stored longer than necessary.

What is the correct way to calculate HRA and manage proofs for AY 2025-26?

HRA computation u/s 10(13A) remains the least of: 1) Actual HRA received, 2) Rent paid minus 10% of basic salary, or 3) 50% of basic (for metros) or 40% (for non-metros). For AY 2025-26, HR teams must ensure that employees provide the landlord's PAN if the annual rent exceeds Rs 1 lakh. Automated platforms can help manage this by flagging missing PANs and validating rent receipts against the ITR validation rules to ensure compliance.

How can we measure the ROI of a corporate financial wellness 2026 program?

ROI should be measured across three dimensions: Engagement (video completion rates, quiz scores), Conversion (increase in NPS contributions, insurance uptake, salary account openings), and Operational Efficiency (reduction in HR tickets, on-time tax declarations). Leading organizations also track the correlation between program participation and employee retention rates, often seeing a significant lift in loyalty among employees who feel the company is actively invested in their financial security.