Tax saving panic marketing 2026: AI video nudges and calculators that convert India’s March 31 investment rush

Estimated reading time: ~9 minutes

Key Takeaways

- Use AI-powered personalized videos to convert India’s March 31 tax rush with timely, relevant nudges.

- 80C ELSS calculators with real-time payroll data and buffer reminders reduce last-minute processing risk.

- NPS 80CCD(1B) campaigns target the extra Rs 50,000 deduction with countdown automation and instant eKYC flows.

- Insurance tax benefit videos simplify 80D/80C choices under pressure with interactive “Coverage vs Tax” visuals.

- Behavioral FOMO triggers and an enterprise-grade stack enable high-scale, multilingual conversions.

As tax saving panic marketing 2026 peaks, BFSI leaders can turn the March 31 investment rush into conversions with AI-powered behavioral nudge videos, 80C ELSS personalized calculators, and investment deadline FOMO triggers. The final quarter of the Indian financial year is no longer just a period of administrative compliance; it has evolved into a high-stakes digital battleground where speed, personalization, and psychological triggers determine market share.

In 2026, the Indian BFSI sector is projected to see a 22% increase in digital-first tax investments compared to 2024, driven by a younger, mobile-native workforce. For CMOs and Wealth Management Directors, the challenge is clear: how to break through the noise of a thousand generic “Save Tax” emails and deliver a message that resonates at an individual level.

The distinction between the Financial Year (FY) and Assessment Year (AY) remains a point of confusion for many, but for marketers, the focus is strictly on the March 31 deadline. This date marks the hard cutoff for investments under Section 80C, 80D, and 80CCD(1B) to be eligible for deductions in the current tax cycle.

Sources:

- Tata AIG: Difference between Assessment Year and Financial Year

- Deloitte Banking Outlook: Digital Investment Trends 2026

80C ELSS personalized calculators that drive action

Equity Linked Savings Schemes (ELSS) remain the most popular 80C instrument due to their shortest lock-in period and potential for equity-linked returns. However, the March 31 investment rush often leads to hasty decisions or, worse, missed deadlines due to processing lags.

To combat this, leading financial institutions are deploying 80C ELSS personalized calculators that do more than just math. These tools ingest real-time data from payroll systems or bank statements to show a user exactly how much “headroom” they have left in their Rs 1.5 lakh limit.

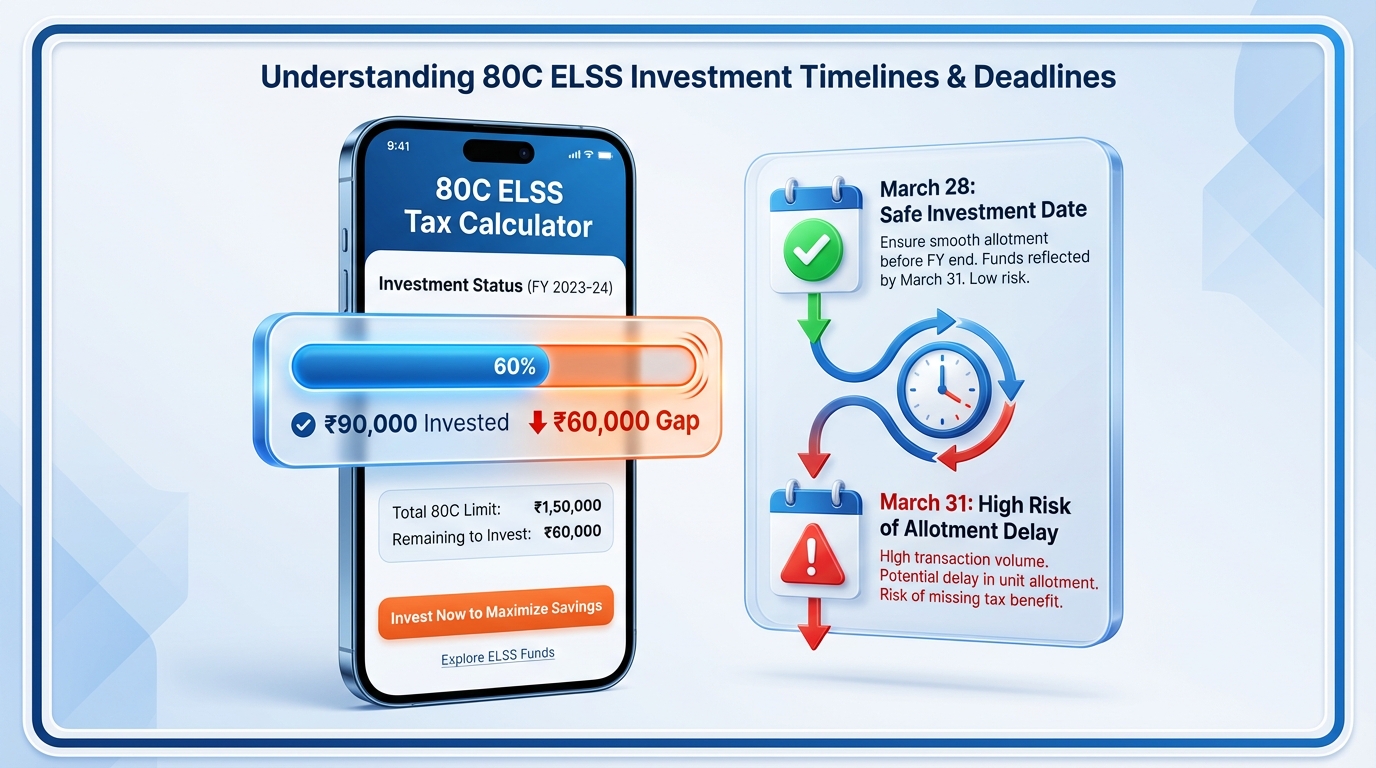

A critical 2026 trend is the “Processing Buffer Nudge.” Since mutual fund units must be allotted by March 31 to qualify for tax benefits, investments made after March 28 often risk falling into the next financial year due to NAV timing and bank settlement cycles. March 31 investment rush

Salary-specific tax planning videos are now being paired with these calculators. Imagine a video where a virtual advisor says: “Hi Rahul, based on your current 80C utilization of Rs 90,000, you are missing out on saving Rs 18,000 in taxes. Invest Rs 60,000 in ELSS before March 28 to maximize your take-home pay.”

This level of granularity transforms a generic marketing message into a personalized financial consultation. Platforms like TrueFan AI enable brands to generate millions of these personalized video messages, ensuring that every customer feels seen and advised rather than just targeted.

Sources:

- Times of India: ELSS deadline advisory—invest by March 28

- ClearTax: Section 80C and 80D deduction guide

Last-minute NPS enrollment campaigns to close the 80CCD(1B) gap

The National Pension System (NPS) offers a unique “extra” benefit that is often overlooked until the final weeks of March. Under Section 80CCD(1B), taxpayers can claim an additional deduction of up to Rs 50,000, which is over and above the Rs 1.5 lakh limit of Section 80C.

Last-minute NPS enrollment campaigns in 2026 are leveraging tax deadline countdown automation to target this specific gap. By identifying customers who have already exhausted their 80C limit but haven’t touched their NPS quota, banks can trigger hyper-focused nudges.

The corporate angle is equally potent. Employer contributions under Section 80CCD(2) provide a tax-efficient way for companies to enhance employee compensation without increasing the tax burden. In 2026, we see a surge in “Corporate NPS Drives” where HR portals integrate directly with BFSI APIs to facilitate instant Tier I account opening.

Digital KYC has reduced the onboarding time for NPS to under three minutes. When combined with a personalized video explaining the long-term compounding benefits of NPS alongside the immediate tax saving, conversion rates have been shown to jump by 35% in the final sprint to March 31.

Sources:

Insurance tax benefit videos that simplify choices under pressure

Health insurance (Section 80D) and Life insurance (Section 80C) are often the “panic buys” of late March. The complexity of choosing between term plans, ULIPs, or critical illness riders often leads to analysis paralysis during the March 31 investment rush.

Insurance tax benefit videos solve this by simplifying the decision-making process into a “Coverage vs. Tax” visual. In 2026, BFSI leaders are using interactive video formats that allow users to toggle their age and family size to see instant premium quotes and the corresponding tax savings.

For instance, a video might highlight that a premium of Rs 25,000 for a senior citizen parent’s health insurance doesn’t just provide medical security—it also reduces taxable income by that exact amount under Section 80D. This dual-value proposition is critical for fiscal urgency conversion optimization.

Compliance remains a cornerstone of these campaigns. Every video nudge in 2026 must include IRDAI-mandated disclaimers and clear notes that tax benefits are subject to the chosen regime (Old vs. New). The goal is to provide clarity, not just a sales pitch, ensuring long-term BFSI retention tax season success.

Sources:

- Kotak Life: Tax saving checklist before March 31

- IndusInd Nippon Life: March money moves for tax savings

- Axis Max Life: Term insurance tax benefits

Behavioral science and investment deadline FOMO triggers

The psychology of the “March Rush” is rooted in loss aversion. Investors aren’t just looking to save money; they are terrified of “losing” their hard-earned income to taxes. Investment deadline FOMO triggers tap into this primal urge with precision.

In 2026, social proof has become a dominant tactic. Messaging like “14,500 professionals in your city have already secured their 80C benefits today” creates a sense of community action. This is paired with “Micro-deadlines”—reminding users that while the government deadline is March 31, their company’s payroll proof submission deadline might be March 15.

Missing an HR proof deadline doesn’t mean the tax benefit is lost forever, but it does mean a significant hit to March and April take-home pay as TDS is deducted. The “Cashflow Nudge” is a powerful motivator: “Don’t wait for a refund in July; keep your cash in your pocket in March.”

TrueFan AI’s 175+ language support and Personalised Celebrity Videos allow these behavioral nudges to be delivered in the user’s native tongue, significantly increasing the emotional resonance of the message. A celebrity reminding a user in Marathi or Bengali about their tax deadline feels like a friendly advice rather than a corporate alert.

Sources:

HNI Wealth Management and Corporate Employee Tax Saving Drives

For High Net Worth Individuals (HNIs), the March deadline is less about basic 80C and more about portfolio optimization and capital gains set-off. HNI wealth management urgency requires a “white-glove” digital approach.

Concierge playbooks for 2026 include tax consultant video consultations where the RM (Relationship Manager) sends a personalized video summary of the client’s tax-saving opportunities. These videos often include a one-click “Book a Call” button that syncs with the RM’s calendar, ensuring immediate engagement.

On the other end of the spectrum, corporate employee tax saving drives are being executed at an enterprise scale. By partnering with HR tech platforms, BFSI brands can trigger nudges based on the specific “Form 12BB” status of an employee. If an employee hasn’t uploaded ELSS proofs by the internal deadline, an automated video nudge is triggered to offer an instant investment solution.

This “B2B2C” approach ensures that the financial institution is present at the exact moment of the user’s highest need. It transforms the bank from a mere service provider into a proactive financial partner, which is essential for BFSI retention tax season metrics.

Sources:

Enterprise Stack: How TrueFan AI powers the surge

Executing a tax saving panic marketing 2026 campaign for millions of users requires a robust, secure, and low-latency technical stack. The surge in traffic during the final week of March can crash standard marketing automation tools.

Solutions like TrueFan AI demonstrate ROI through their ability to render personalized videos in under 30 seconds. This speed is crucial for real-time triggers, such as sending a video immediately after a user interacts with an 80C ELSS personalized calculator.

The enterprise stack must handle:

- Data Ingestion: Seamlessly pulling salary, age, and current investment data from CRMs via secure APIs.

- Multilingual Rendering: Automatically generating the video in the user’s preferred language with perfect lip-sync.

- Security & Compliance: Ensuring ISO 27001 and SOC 2 standards are met, especially when handling sensitive financial data.

- Omnichannel Delivery: Distributing the video via WhatsApp, SMS, Email, and in-app banners with personalized thumbnails.

In 2026, the “21-Day Sprint” has become the industry standard for March marketing. This involves a week of data auditing, a week of pilot testing with A/B variants of FOMO triggers, and a final 7-day “Blitz” where cadence is increased to daily nudges for high-intent segments.

Sources:

- TrueFan AI: Video personalization ROI metrics

- TrueFan AI: Batch video creation and automation

- TrueFan AI: Enterprise security and platform overview

Conclusion: Winning the March 31 Investment Rush

The March 31 investment rush of 2026 is a test of a BFSI brand’s digital maturity. It is no longer enough to offer the right product; you must offer the right advice, at the right time, in the right language, and with the right psychological nudge.

By integrating 80C ELSS personalized calculators, last-minute NPS enrollment campaigns, and insurance tax benefit videos into a cohesive, AI-driven strategy, BFSI leaders can maximize conversions while providing genuine value to their customers. The shift from “Panic Marketing” to “Personalized Guidance” is the hallmark of a market leader in 2026.

As you prepare for the upcoming fiscal year-end, remember that every data point in your CRM is an opportunity to save a customer money and build lifelong loyalty. The technology to do this at scale is here—the only question is how fast you can deploy it.

Sources:

- Times of India: ELSS processing caution—invest by March 28

- NPS Trust: Official benefits

- Kotak Life: Insurance checklist

Frequently Asked Questions

What is tax saving panic marketing 2026, and how is it different from prior years?

Tax saving panic marketing 2026 refers to the strategic use of hyper-personalized AI content and real-time data to convert the traditional year-end investment rush. Unlike previous years, 2026 focuses on “nudge-based” marketing where tools like TrueFan AI deliver celebrity-led, language-specific advice rather than generic “Save Tax” banners.

Do I need to invest in ELSS by March 31 or earlier due to processing times?

While the legal deadline is March 31, experts strongly advise investing by March 28. This is because mutual fund units must be allotted to your account by the 31st to qualify for tax benefits. Delays in bank transfers or NAV processing can push your investment into the next financial year if you wait until the final 48 hours. March 31 investment rush

How do last-minute NPS enrollment campaigns ensure 80CCD(1B) deduction?

These campaigns use tax deadline countdown automation to identify users who haven’t utilized their additional Rs 50,000 NPS limit. By providing a direct, pre-filled link to the NPS Tier I registration page, banks can facilitate instant account opening and contribution, ensuring the deduction is locked in before the FY ends.

Can insurance premiums paid in March count for 80D this FY?

Yes, as long as the premium is paid and the policy is issued on or before March 31. Many insurers now offer “Instant Issuance” for standard health and term plans during the March rush to ensure customers don’t miss out on their 80D or 80C benefits.

What if employees miss their company’s internal HR proof deadlines?

If an employee misses the internal deadline (often mid-March), the employer will deduct higher TDS from the March salary. However, the employee can still make the investment by March 31 and claim the refund while filing their Income Tax Return (ITR). Corporate employee tax saving drives aim to prevent this cashflow hit by nudging employees to act before the internal cutoff.

How do salary-specific tax planning videos improve conversion?

These videos use dynamic data to show a user their specific tax-saving potential based on their income bracket and current investments. By visualizing the “Tax Saved” versus “Tax Lost,” these videos create a much stronger incentive to act compared to static advertisements.