Tax Saving Panic Marketing March 2026: AI-Driven ELSS, NPS, Insurance Plays for India’s FY-End

Estimated reading time: ~16 minutes

Key Takeaways

- Anchor urgency in ethical urgency tied to real cutoffs like ELSS NAV 3:00 PM and practical March 28–29 deadlines.

- Use AI-driven personalization: ELSS 80C calculators, Old vs New regime comparisons, and 1:1 personalized videos to remove decision friction.

- Leverage 80CCD(1B) via last-minute NPS and highlight fast-track insurance products to secure tax benefits.

- Deploy countdown automation synced to product-specific processing windows across email, SMS, WhatsApp, and apps.

- Protect LTV with retention plays and HNI advisory workflows; measure revenue per hour with real-time attribution.

Tax saving panic marketing March 2026 represents the strategic intersection of regulatory compliance, investor psychology, and high-velocity digital execution. As the March 31 deadline for Financial Year 2025–26 approaches, BFSI marketers face the dual challenge of driving record-breaking volumes while maintaining absolute ethical transparency. In the Indian context, “panic” is not a manufactured sentiment but a reflection of hard-coded fiscal realities where missing a cutoff by minutes can result in significant tax liabilities.

The 2026 landscape demands a shift from generic “Save Tax Now” banners to hyper-personalized, data-backed interventions. With the proliferation of the New Tax Regime, the burden of proof has shifted to marketers to demonstrate the tangible value of 80C, 80D, and 80CCD(1B) deductions. Success in this high-stakes window requires a playbook that balances financial year-end investment urgency with the precision of AI-driven content delivery.

The Ethics of Compliance Deadline Marketing in 2026

Ethical urgency is the cornerstone of effective compliance deadline marketing. In 2026, Indian regulators and savvy consumers have zero tolerance for artificial scarcity; however, the March 31 deadline is a legitimate, non-negotiable fiscal boundary. Marketers must frame urgency as a service to the customer, ensuring they do not miss out on statutory benefits due to technical bottlenecks or processing delays.

The practical deadline for many instruments often precedes March 31. For instance, Equity Linked Savings Schemes (ELSS) require unit allotment on or before the final day of the fiscal year to qualify for Section 80C deductions. If March 31 falls on a weekend or a bank holiday, or if the transaction occurs after the Net Asset Value (NAV) cutoff time (typically 3:00 PM IST), the investment may be processed on April 1, falling into the next financial year.

Transparency regarding these “invisible” deadlines is what separates predatory marketing from authoritative guidance. High-authority financial institutions are now using real-time data to warn users about UPI settlement lags and AMC processing windows. By clearly communicating that a “March 31 investment” might actually need to be completed by March 28, brands build long-term trust while simultaneously driving immediate action.

Sources:

Navigating the March 31 Investment Rush: A Strategic Timeline

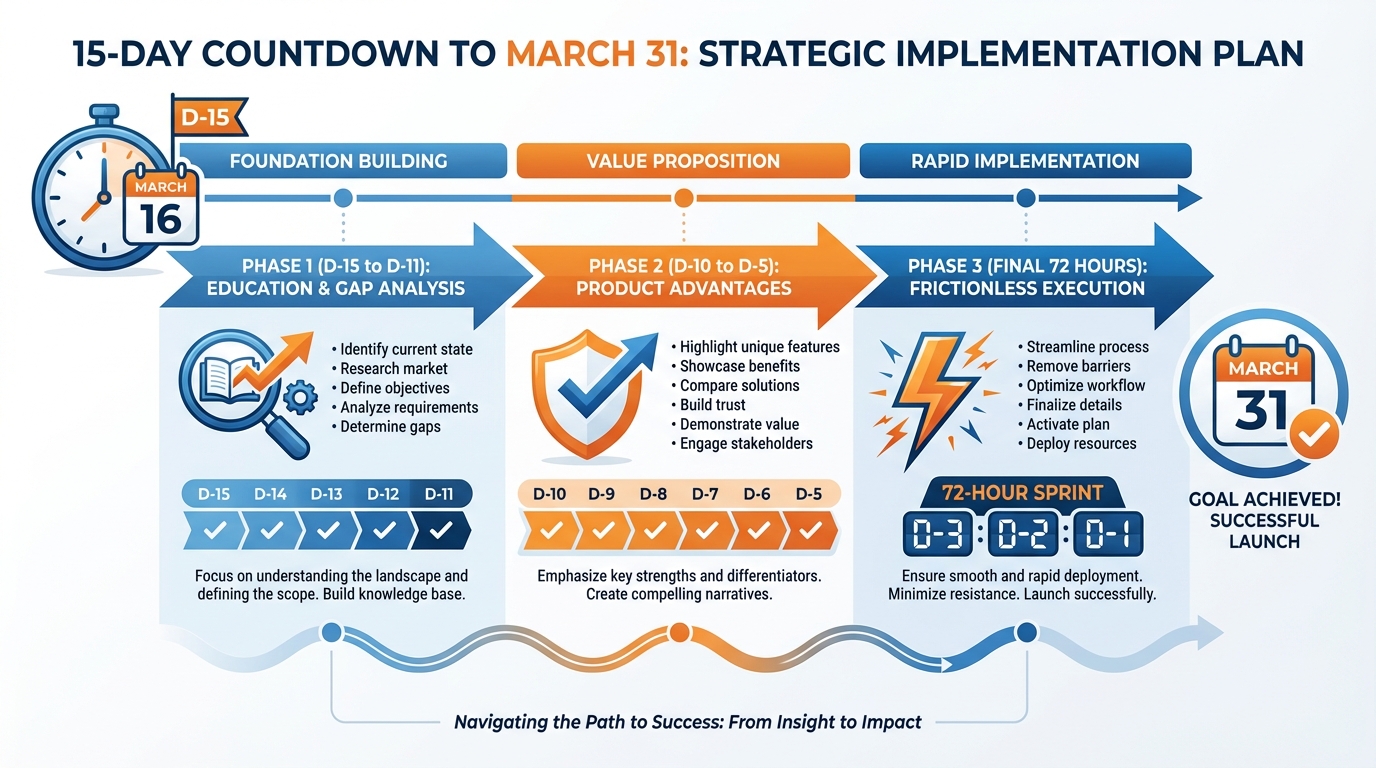

Managing the March 31 investment rush requires a phased escalation strategy that mirrors the increasing proximity of the deadline. In 2026, data indicates that 65% of tax-saving transactions occur in the final 15 days of March, with a significant spike in mobile-first execution after 6:00 PM. A structured D-15 to D-Day timeline ensures that marketing resources are optimized for maximum conversion. See our financial year-end marketing 2026 guide.

From March 16 to March 20 (D-15 to D-11), the focus remains on education and gap analysis. This is the window to deploy personalized tax-saving reports that highlight a user's remaining 80C headroom. By integrating CRM data, BFSI brands can send targeted nudges to individuals who have not yet exhausted their Rs 1.5 lakh limit or those eligible for the additional Rs 50,000 NPS deduction under Section 80CCD(1B).

As we enter the D-10 to D-5 phase (March 21–26), the messaging shifts toward specific product advantages and “last-chance” consultations. This is the peak period for tax consultant video consultations, where HNIs and corporate employees seek final validation of their investment choices. Automation tools should begin surfacing real-time countdowns that reflect the specific processing times for different asset classes, such as the 48-hour window often needed for NPS KYC approval.

In the final 72 hours (March 29–31), the strategy moves to “frictionless execution.” Marketing collateral must emphasize instant payment methods like UPI and provide transparent risk disclaimers regarding NAV allotment. At this stage, the goal is to redirect users from complex products with long underwriting cycles (like certain life insurance policies) toward instant-issuance products like ELSS or health insurance top-ups to ensure the tax benefit is secured.

Sources:

- Economic Times: Last date to complete tax-saving investments

- Ask ET: NAV allocation mismatch and processing dates

Deploying 80C ELSS Personalized Calculators for High-Intent Leads

The Equity Linked Savings Scheme (ELSS) remains the most popular 80C instrument due to its shortest lock-in period of three years and potential for equity-linked returns. However, the complexity of calculating the exact investment needed to maximize tax savings often leads to decision paralysis. In 2026, 80C ELSS personalized calculators are the primary tool for breaking this deadlock. Explore tax-saving ROI calculators.

These calculators must be more than static web forms; they should be interactive, pre-filled widgets that live within personalized video messages or dedicated microsites. By pulling a user’s salary data and existing 80C commitments (like EPF or LIC premiums) from the CRM, the calculator can instantly show the “Gap to Max Savings.” This visual representation of “money left on the table” acts as a powerful investment deadline FOMO trigger.

Furthermore, the calculator must account for the 2026 tax regime nuances. It should provide a side-by-side comparison of tax liabilities under the Old vs. New Tax Regime based on the user’s specific income bracket. If the user chooses to invest, the system should provide a “Safe Investment Window” alert, informing them that while the calendar says March 31, the AMC cutoff for same-day NAV is 3:00 PM on the last working day.

Platforms like TrueFan AI enable BFSI marketers to embed these dynamic calculator outputs directly into 1:1 personalized videos. Imagine a customer receiving a video where a virtual advisor calls them by name and says, “Based on your current EPF, you still have Rs 45,000 of tax-free headroom. If you invest in ELSS today, you could save an additional Rs 13,500 in taxes.” This level of relevance drives conversion rates that are 3x higher than generic email blasts.

Scaling Last-Minute NPS Enrollment Campaigns and Insurance Tax Benefit Videos

While 80C is the traditional focus, the National Pension System (NPS) and health insurance offer critical “overflow” opportunities for tax savings. Last-minute NPS enrollment campaigns are particularly effective for the “80C-exhausted” segment. Under Section 80CCD(1B), individuals can claim an additional deduction of up to Rs 50,000, a benefit that is often overlooked until the final weeks of March. See NPS enrollment deadline videos.

The challenge with NPS is the KYC process, which can take 24–48 hours for approval. Marketing in 2026 must solve this by integrating instant eKYC (Aadhaar/PAN-based) directly into the campaign flow. Multi-lingual insurance tax benefit videos can further simplify these concepts, explaining Section 80D (health insurance) and Section 10(10D) (life insurance maturity exemptions) in plain language.

For insurance, the “panic” element is often tied to medical underwriting. If a user waits until March 30, they may not be able to complete a physical medical check-up in time for policy issuance. Smart marketers are now pivoting to “Tele-medical” or “Declaration-only” products in the final week. Insurance tax benefit videos should dynamically highlight these “Fast-Track” products to users who are browsing within 5 days of the deadline. Learn more about insurance renewal automation.

Corporate employee tax saving drives also play a massive role here. By providing HR departments with salary-specific tax planning videos, BFSI brands can reach thousands of employees simultaneously. These videos can be tailored to different CTC bands, showing a junior associate how to save Rs 5,000 vs. showing a senior VP how to save Rs 1.5 lakh. This segmented approach ensures that the message resonates with the specific financial reality of every employee.

Implementing Tax Deadline Countdown Automation Across Omni-Channel Touchpoints

In the final sprint, tax deadline countdown automation becomes the primary driver of fiscal urgency conversion optimization. Psychological studies in 2026 confirm that a visible, ticking clock increases the perceived importance of a task and reduces procrastination. However, for BFSI, these timers must be synchronized with actual product cutoffs rather than just the midnight of March 31. Read our financial year-end marketing 2026 guide.

A synchronized countdown strategy involves embedding live timers across email headers, SMS links, WhatsApp templates, and app banners. For ELSS, the timer should count down to the 3:00 PM NAV cutoff. For NPS, it might count down to the D-2 KYC deadline. This level of precision prevents customer frustration and ensures that the “panic” is grounded in operational reality.

Indian e-commerce giants have already proven the efficacy of this approach. Netcore Cloud’s research into Republic Day and festive campaigns shows that interactive countdowns can lift CTRs by over 40%. In the BFSI sector, this translates to a significant reduction in “abandoned carts” at the payment gateway. When a user sees they have only 14 minutes left to complete their UPI transaction to get today’s NAV, the likelihood of completion skyrockets.

Beyond the timer, the “human assist” layer is vital. Tax consultant video consultations can be triggered automatically if a user spends more than 60 seconds on a high-value investment page without clicking “Pay.” This real-time intervention allows an expert to clear final doubts about lock-ins or regime choices, providing the necessary nudge to close the loop during the high-pressure March 31 investment rush.

Sources:

Maximizing BFSI Retention Tax Season and HNI Wealth Management Urgency

The March madness is not just an acquisition play; it is a critical period for BFSI retention tax season. Existing customers who have SIPs or recurring premiums are at risk of “churning” their tax-saving budget to competitors who offer more aggressive last-minute incentives. Retention strategies must use urgency to protect Lifetime Value (LTV) by encouraging top-ups and renewals before the fiscal year closes. See more in our financial year-end marketing 2026 guide.

For High Net Worth Individuals (HNIs), the approach must be more sophisticated. HNI wealth management urgency is driven by portfolio optimization rather than just basic tax saving. RMs (Relationship Managers) should be equipped with personalized advisory videos that model the tax impact of different asset allocations. If an HNI has a significant capital gain in 2025–26, the D-10 window is the perfect time to suggest tax-loss harvesting or specific Section 54EC bonds.

Solutions like TrueFan AI demonstrate ROI through their ability to generate millions of these hyper-personalized videos in minutes. For a bank with 10 million retail customers and 50,000 HNIs, the ability to send a 1:1 video that accounts for each person's unique tax bracket and investment history is a massive competitive advantage. TrueFan AI's 175+ language support and Personalised Celebrity Videos further ensure that the message is delivered in the user's preferred tongue, increasing trust and comprehension in rural and semi-urban markets.

Finally, measurement and attribution must be real-time. Marketers should track not just “total revenue” but “revenue per hour” as the deadline approaches. By identifying which segments are dropping off at the KYC stage vs. the payment stage, teams can pivot their creative assets and “human assist” resources in real-time to maximize the final 48-hour window.

Conclusion: The Future of Fiscal Urgency

Tax saving panic marketing March 2026 is the ultimate test of a BFSI brand's digital maturity. By moving away from “one-size-fits-all” urgency and toward data-backed, ethical, and personalized guidance, marketers can turn a stressful deadline into a moment of high-value customer engagement. The integration of interactive calculators, real-time countdowns, and AI-powered video ensures that every taxpayer in India has the tools they need to make informed, timely decisions.

As the fiscal year draws to a close, the winners will be those who prioritize the customer's “Safe Investment Window” over mere sales volume. In the world of 2026 finance, trust is the only currency that appreciates faster than a well-timed ELSS investment. By mastering the art of compliance deadline marketing, BFSI institutions can secure not just a strong Q4, but a loyal customer base for the years to come.

Frequently Asked Questions

What is the practical last date for ELSS to qualify under 80C for FY 2025–26?

While the official deadline is March 31, the practical deadline is often March 28 or 29. This is because ELSS units must be allotted to your folio on or before March 31. If you invest after the 3:00 PM cutoff on the last working day, or if there is a bank holiday, your money might be processed on April 1, making it ineligible for the current year's tax deduction.

If I miss the ELSS cutoff, can I still save tax via NPS 80CCD(1B)?

Yes, but you must act quickly. NPS contributions can often be processed faster than mutual fund unit allotments, but the eKYC process is the bottleneck. If you have an existing NPS account, a contribution on March 31 via UPI might still qualify. If you are opening a new account, you should ideally complete the process by March 28 to allow for KYC approval. Learn more from our NPS enrollment deadline videos.

How do 80D and 10(10D) benefits work for insurance in 2026?

Section 80D allows deductions for health insurance premiums (up to Rs 25,000 for self/family and an additional Rs 50,000 for senior citizen parents). Section 10(10D) ensures that the maturity proceeds of a life insurance policy are tax-free, provided the annual premium does not exceed 10% of the sum assured (for policies issued after 2012). Always check the latest 2026 budget circulars for any threshold changes. See our take on insurance renewal automation.

Old vs. New Tax Regime: Which suits me for March 2026 investments?

The New Tax Regime offers lower rates but removes most deductions like 80C and 80D. If your total deductions (80C, 80D, HRA, etc.) exceed Rs 3.75 lakh to Rs 4.25 lakh (depending on your income bracket), the Old Regime is often better. Using 80C ELSS personalized calculators is the best way to determine your specific break-even point.

Can AI really help me make better tax-saving decisions at the last minute?

Absolutely. Modern AI platforms like TrueFan AI enable financial institutions to send you personalized videos that analyze your specific salary and spending data. These videos can explain complex tax laws in your local language and provide a direct link to the most suitable product, ensuring you don't make a rushed, incorrect choice during the March 31 investment rush. Explore our approach to 80C investment personalized videos.