Voice Commerce Vernacular India 2026: The Blueprint for Hindi, Tamil, and Bengali Market Dominance

Estimated reading time: ~9 minutes

Key Takeaways

- By 2026, vernacular-first users will drive voice-led commerce growth across Hindi, Tamil, and Bengali markets.

- Hello! UPI enables secure, end-to-end conversational payments, removing major checkout friction.

- Multimodal CX with voice-triggered personalized video answers significantly lifts CTR, CVR, and trust.

- Code-mixed intent handling (Hinglish, Tanglish, Bengalish) and dialect tuning are critical for accuracy and fairness.

- A 90-day pilot with clear ROI metrics (AOV, CVR, CAC) accelerates scale across Tier-2/3 cohorts.

Voice commerce vernacular India 2026 represents the definitive 2026 blueprint for deploying sophisticated, voice-activated shopping journeys across Hindi, Tamil, and Bengali linguistic ecosystems. This strategic framework leverages conversational AI personalization and voice-triggered video offers to effectively convert India’s next 650 million vernacular users. For leaders in Digital Innovation and Regional Expansion, this transition toward a voice-first Bharat is no longer optional but a prerequisite for maintaining competitive ROI in Tier-2 and Tier-3 markets.

1. The 2026 Inflection Point: Why Voice Commerce India 2026 is the New Standard

By 2026, the Indian digital landscape will have undergone a fundamental shift, with the internet user base projected to exceed 900 million. This growth is almost exclusively driven by Indic language speakers who view the internet through a vernacular-first lens rather than a secondary translation. As these users move beyond basic content consumption, their demand for seamless, natural language commerce experiences has reached a critical mass.

Current market pulses indicate that over 70% of Indian internet users now prefer interacting with platforms in their local languages. This preference has catalyzed a 35% year-on-year surge in voice search queries, particularly those with high commercial intent. In Tier-2 and Tier-3 cities, voice adoption is outpacing traditional text-based search, as it removes the cognitive load of typing in non-native scripts or struggling with English-centric interfaces.

The launch of NPCI’s “Hello! UPI” has been the final piece of the puzzle, enabling conversational payments that close the loop on voice-led transactions. This innovation reduces checkout friction by allowing users to authorize payments through voice commands, making the entire journey—from discovery to settlement—entirely hands-free. Consequently, brands failing to adapt their discovery and checkout flows to natural language commerce by 2026 risk total obsolescence in the regional growth sectors.

Sources:

- IBEF: India’s internet users to exceed 900 million in 2025

- NPCI Hello! UPI: Voice-enabled UPI payments

- Zuvy: Voice search and the regional language wave

2. Defining the Opportunity: How Vernacular Voice Shopping Lifts Conversion

Vernacular voice shopping is defined as an end-to-end commerce flow where users utilize their native language—including specific dialects and code-mixed variations—to discover, compare, and purchase products. Unlike traditional e-commerce, these systems respond with short, personalized conversational videos and tappable calls-to-action (CTAs). This multimodal approach reduces ambiguity and provides the visual reassurance necessary for high-value transactions in regional markets.

The primary advantage of voice commerce lies in its ability to resolve the “transliteration pain” associated with Indian languages. Users often struggle to type regional words using English keyboards, leading to search abandonment. Voice-activated systems bypass this hurdle, allowing for rapid product filtering by price, size, and brand through natural speech.

Furthermore, the integration of local accents and familiar dialects fosters a level of trust and comprehension that English-centric platforms cannot replicate. When a user hears a response in their own dialect, their confidence in product details, return policies, and warranty information increases significantly. This psychological comfort, combined with the ease of Hello! UPI, creates a frictionless path to purchase that directly correlates with higher conversion rates and lower customer acquisition costs.

Sources:

3. Linguistic Nuances: Hindi Voice Search Optimization and Regional Intent

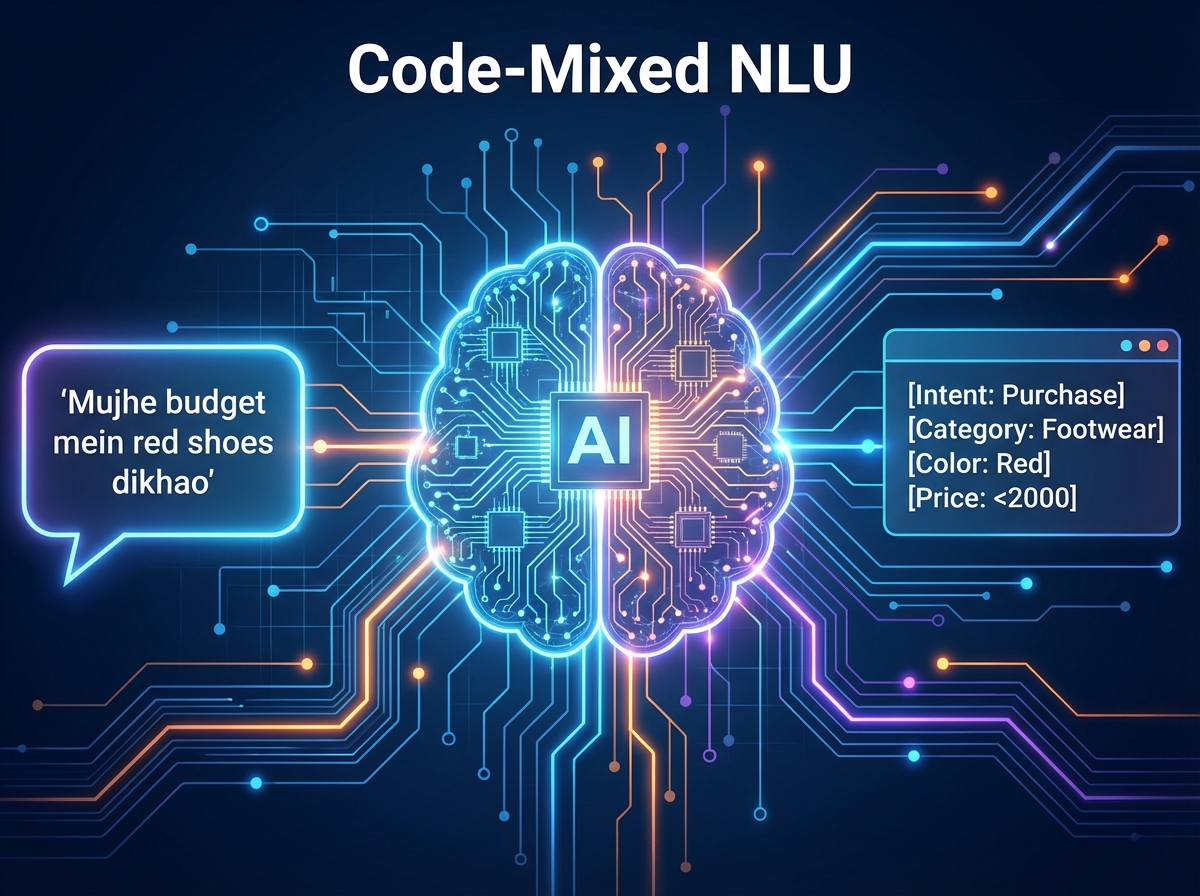

Designing for the Indian market requires a deep understanding of code-mixed behavior, where users blend their native tongue with English terms. For instance, a Hindi user might say, “Mujhe budget mein red running shoes dikhao ₹2000 ke andar,” seamlessly mixing Hindi syntax with English product descriptors. Hindi voice search optimization must account for these “Hinglish” patterns to ensure high intent recognition accuracy.

Similarly, Tamil and Bengali users exhibit unique “Tanglish” and “Benglish” patterns that require specialized Natural Language Understanding (NLU) models. A Tamil speaker might request, “Enakku size 8 white sneakers kaamikkunga, ₹2000-kku keezhe,” while a Bengali speaker might ask for “Ami budget e ₹1500 er jonne earphones chai, mic shoho.” These variations necessitate a robust slot-filling schema that can extract category, brand, and price constraints across multiple linguistic inputs.

Beyond basic language, brands must invest in dialect-specific shopping capabilities to avoid ASR (Automatic Speech Recognition) bias. This involves tuning models to recognize regional phonetics from areas like Coimbatore, Sylhet, or rural Bihar. By adapting the system's response tone and vocabulary to these regional nuances, brands can create a hyper-personalized experience that resonates with the user's cultural identity.

Sources:

4. The 2026 Stack: Smart Speaker Integration and Voice-Triggered Video Offers

The technology stack for 2026 voice commerce must bridge the gap between smart speakers, mobile apps, and ubiquitous messaging platforms like WhatsApp. Smart speaker integration allows users to initiate shopping intents through Alexa or Google Assistant, enabling hands-free reordering and order tracking. For example, a user can simply state, “Ask Brand Store for school shoes under ₹1500,” to trigger a curated selection process.

Platforms like TrueFan AI enable brands to transform these voice intents into highly engaging, 10-20 second personalized video responses. Instead of a robotic text-to-speech reply, the user receives a video in their chosen language featuring the specific product they requested, complete with their name and a contextual offer. These voice-triggered video offers are then delivered via WhatsApp or in-app widgets, providing a visual “proof of product” that drives immediate action.

The orchestration of these channels is critical for maintaining a cohesive user journey. While the initial discovery might happen via a voice command on a smart speaker, the final conversion often occurs on WhatsApp through a deep-linked CTA. This multi-channel approach ensures that the brand remains present throughout the consideration phase, using automated follow-ups and cart recovery messages in the user's preferred vernacular to maximize retention.

Sources:

5. Visibility and Authority: Voice SEO Regional Languages and Content Strategy

To capture the growing volume of vernacular queries, brands must implement a rigorous strategy for voice SEO regional languages. This involves optimizing structured data and on-page content so that Hindi, Tamil, and Bengali voice searches surface your products as the primary answer. Traditional SEO tactics are insufficient; voice search requires a focus on long-tail Q&A formats and phonetic transliterations that mirror how people actually speak.

Key tactics include implementing schema.org markup for FAQs, Products, and Offers in multiple local languages. Vernacular voice SEO strategies recommend content hubs for each target language, featuring audio snippets and short-form videos that answer common voice queries like “Which is the best budget smartphone for photography?” in Bengali or Tamil. These assets not only improve search rankings but also serve as the foundation for the conversational AI's response library.

TrueFan AI's 175+ language support and Personalised Celebrity Videos can be strategically utilized to create these high-authority content assets at scale. By generating thousands of localized video answers to common shopping queries, brands can dominate the SERPs for regional voice searches. Voice SEO for regional festivals further amplifies topical authority and seasonal conversion.

Sources:

6. Measuring Success: Voice Assistant Marketing ROI and Implementation

Quantifying the impact of voice initiatives is essential for enterprise-scale adoption. Voice assistant marketing ROI is calculated by measuring the incremental gross margin from voice-driven conversions against the total program costs. Attribution models must track the journey from the initial voice intent detection to the final purchase, tagging every interaction by language, dialect, and channel to identify the most profitable segments.

Solutions like TrueFan AI demonstrate ROI through significant uplifts in click-through rates (CTR) and conversion rates (CVR) compared to standard text-based or English-only campaigns. By analyzing KPIs such as Average Order Value (AOV) by language and the repeat purchase rate of vernacular cohorts, brands can refine their personalization logic. A successful 90-day pilot should focus on a specific category, such as footwear or grocery, across three core languages to establish a baseline for scaling.

The implementation roadmap begins with bootstrapping NLU models with synonym lists and dialect samples, followed by the creation of video templates. By day 45, brands should be running live A/B tests of voice-triggered video offers and integrating Hello! UPI for seamless checkouts. This iterative approach allows for the optimization of price framing and CTA styles based on real-time user feedback from Tier-2 and Tier-3 regions.

Sources:

7. Governance, Ethics, and Frequently Asked Questions

As voice commerce expands, maintaining enterprise-grade governance and data privacy is paramount. Brands must ensure explicit opt-ins for voice recording and personalized video delivery, maintaining clear audit trails for all linguistic and offer-based interactions. Security protocols, including ISO 27001 and SOC 2 compliance, are necessary to protect user PII and maintain trust in regional markets where digital skepticism may still exist.

Addressing dialect-specific shopping also requires a commitment to algorithmic fairness. Continuous sampling from diverse regional groups is necessary to retrain models and eliminate biases that might favor one accent over another. Human-in-the-loop QA processes should be employed to monitor edge cases and ensure that automated responses remain brand-safe and culturally appropriate across all 175+ supported languages.

Frequently Asked Questions

What is the primary driver for voice commerce vernacular India 2026?

The primary driver is the massive influx of 650 million vernacular-first internet users from Tier-2 and Tier-3 cities who prefer natural language interactions over traditional text-based interfaces.

How does voice-triggered video improve conversion rates?

Voice-triggered video provides immediate visual confirmation and personalized engagement in the user's native language, which builds trust and reduces the ambiguity often found in audio-only or text-only responses.

Can voice commerce handle complex queries in regional dialects?

Yes, by utilizing advanced NLU models and dialect-specific shopping optimizations, systems can now accurately interpret code-mixed languages like Hinglish and Tanglish, as well as regional phonetic variations.

How does TrueFan AI integrate with existing e-commerce stacks?

TrueFan AI integrates via API, connecting your intent recognition engine and offer management system to a real-time video rendering pipeline that delivers personalized content through WhatsApp or mobile apps.

Is voice payment secure for Indian consumers?

With the integration of NPCI’s Hello! UPI, voice payments are secured through multi-factor authentication and conversational confirmation steps, providing a safe and frictionless checkout experience.

What are the key KPIs for measuring voice assistant marketing ROI?

Key metrics include conversion rate lift for vernacular cohorts, AOV by language, cart recovery rates via voice-triggered video, and the overall reduction in customer acquisition costs (CAC).

Sources:

- TrueFan AI: Voter Engagement AI Videos (Governance/Ethics)

- BFSI ET: Voice command credit line and UPI launches

Frequently Asked Questions

How should brands start a 90-day voice commerce pilot?

Begin with one category across Hindi, Tamil, and Bengali. Bootstrap NLU with synonym lists and dialect samples, launch voice-triggered video templates, and integrate Hello! UPI. Measure CVR, AOV, and CAC shifts weekly to iterate.

What role does Hello! UPI play in voice-led checkout?

Hello! UPI enables secure, conversational payment authorization, reducing checkout friction and enabling hands-free completion from discovery to settlement.

How do you optimize for code-mixed queries like Hinglish and Tanglish?

Train NLU for slot-filling across mixed languages, add phonetic variations, and tune ASR for regional accents. Validate with human-in-the-loop QA to minimize bias and improve recall.

How do smart speakers and WhatsApp work together in the journey?

Discovery often starts via Alexa/Assistant, while personalized video responses and deep-linked CTAs are delivered on WhatsApp for conversion, with automated vernacular follow-ups for recovery.

Which metrics best prove voice assistant marketing ROI?

Track incremental gross margin, CVR lift vs. control, AOV by language, cohort repeat purchases, and voice-led cart recovery. Attribute by language, dialect, and channel.