Voice commerce vernacular India 2026: A CTO playbook for Hindi, Tamil, Bengali AI shopping with personalized video at scale

Estimated reading time: ~12 minutes

Key Takeaways

- India’s next 300–500M shoppers are vernacular-first, demanding Hindi, Tamil, and Bengali voice experiences.

- Conversational AI video personalization boosts trust and conversions versus voice- or text-only flows.

- A production-ready stack needs low WER and sub‑3s latency with cross-channel continuity (WhatsApp, IVR, smart speakers).

- Winning discoverability requires voice SEO in regional languages with FAQ/Speakable schema and dialect-specific content.

- Adopt a 90‑day pilot roadmap with rigorous ROI metrics (VTR, CTR-to-cart, ATC uplift, CAC/LTV) across language cohorts.

Voice commerce vernacular India 2026 isn’t optional—it’s where India’s next 300–500M shoppers transact across Hindi, Tamil, and Bengali. This playbook shows Digital Innovation teams exactly how to design, pilot, and scale vernacular voice shopping with conversational AI video personalization and voice-triggered personalized offers tailored for tier-2/3 markets. As the digital landscape shifts from “click-and-scroll” to “speak-and-see,” the ability to process complex linguistic nuances while delivering hyper-personalized visual responses will define the next generation of market leaders.

The 2026 Opportunity: Why voice commerce India 2026 is vernacular-first

The trajectory of the Indian digital economy indicates that by 2026, vernacular voice commerce will become the default interface for over 650 million regional users. This shift is driven by a projected $7.47 billion opportunity by 2030, supported by a massive infrastructure of 900 million smartphones expected to be active across the subcontinent by late 2025. Platforms like TrueFan AI enable enterprises to bridge the gap between voice intent and visual fulfillment, ensuring that the “Next Billion Users” find the trust they require in their native tongue.

Tier-2 and Tier-3 cities are no longer secondary markets; they are the primary engines of growth, leading adoption rates for voice-first interfaces. This surge is underpinned by a fundamental shift in regional voice shopping behavior, where users prioritize voice-over-typing due to its lower cognitive load and higher speed. Furthermore, the Indian government’s Bhashini mission is accelerating this transition by providing open-source language AI across 36+ Indian languages, effectively democratizing natural language commerce India for enterprises of all sizes.

The ecosystem readiness is further validated by the 67% growth in Alexa interactions within India, particularly in Hinglish and multilingual modes. Indian enterprises are moving beyond scripted, robotic IVR systems toward sophisticated, multilingual voice bots that can handle the fluidity of human conversation. For a CTO, the 2026 roadmap must prioritize this “vernacular-first” reality to capture the immense value residing in Bharat’s diverse linguistic landscape.

Sources:

- TrueFan AI: Voice commerce India 2026 strategies

- IAMAI–Kantar Report 2024

- IBEF: India’s internet users to exceed 900M by 2025

- Bhashini Mission: Vision and Mission

- Amazon India: Alexa interactions increased 67% in 2020

Designing natural language commerce India: Conversation design per language

Designing for natural language commerce India requires a departure from Western-centric UI/UX models. It demands a deep understanding of conversation design pillars that respect the linguistic diversity of Hindi, Tamil, and Bengali. For instance, Hindi voice search optimization must account for romanized queries and “Hinglish” code-mixing, where users might ask, “Mujhe 500 ke niche casual shoes dikhaiye.” The system must accurately map these intents to product discovery and price filters while returning audio-visual snippets that confirm the user's request.

Tamil conversational commerce AI presents unique challenges, particularly regarding honorifics and the distinction between formal and informal registers (நீங்கள் vs நீ). A successful implementation must handle transliteration and the common practice of mixing English product names with Tamil particles, such as “Diwali offer irukka? 1,000 ku keela rice cooker kaamikka.” Similarly, Bengali voice-activated offers must recognize soft imperative forms and specific numeral systems used during regional peaks like Durga Puja.

To ensure accessibility and trust, the design must incorporate fallback confirmations in both native script and audio. Short, dialect-specific shopping videos are essential here; they explain offer value and demonstrate products in a way that text never could. These videos must be optimized for low-bandwidth environments, ensuring that users in remote areas can still experience high-quality vernacular voice shopping personalization without latency issues.

Sources:

- TrueFan AI: Regional-language voice shopping

- IBEF: AI for local language inclusion

- BuildMyStore: Vernacular voice commerce and the next billion

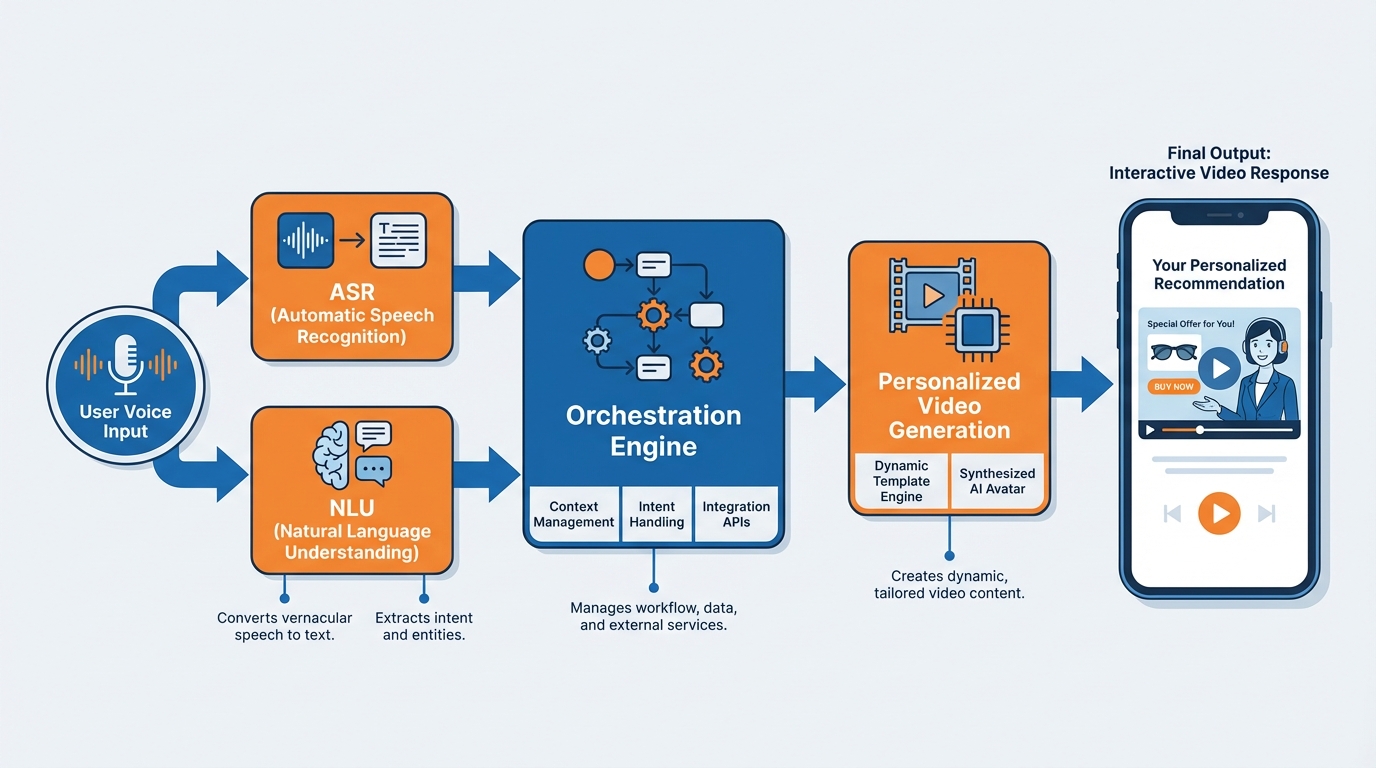

Tech architecture blueprint: A reference model for multilingual voice marketing automation

A robust architecture for multilingual voice marketing automation must manage high-concurrency ingress from WhatsApp voice notes, toll-free IVR, and smart speakers. The core ASR (Automatic Speech Recognition) and NLU (Natural Language Understanding) layers must target a Word Error Rate (WER) of ≤10–12% for Hindi and ≤12–14% for Tamil and Bengali. To maintain a “natural” feel, the end-to-end response latency—from the moment the user stops speaking to the moment the video or audio response begins—must not exceed 3.0 seconds.

The orchestration layer acts as the brain, routing intents to policy engines and offer generators. This is where TrueFan AI's 175+ language support and Personalised Celebrity Videos become a critical accelerator. By integrating a video response layer that generates conversational AI video personalization in real-time, enterprises can deliver a video that mentions the user's name, their nearest store, and a specific offer tailored to their purchase history. This level of personalization is rendered in under 30 seconds and delivered via adaptive bitrate to accommodate varying network speeds.

Furthermore, the architecture must support smart speaker video integration via APL (Alexa Presentation Language). When a user asks an Echo Show for a “sasta combo,” the system should not just speak the price but display a rich video card with a voice-triggered personalized offer. This cross-channel persistence ensures that a conversation started on a smart speaker can be seamlessly continued on WhatsApp, providing a unified and frictionless shopping journey.

Sources:

- TrueFan AI: Voice commerce India 2026 strategies

- Amazon: Alexa Hinglish multilingual mode

- Economic Times: Voice AI moves beyond scripts

Voice SEO regional languages: Discoverability and demand capture

Capturing demand in 2026 requires a sophisticated approach to voice SEO for regional languages. Unlike traditional text SEO, voice search is inherently long-tail and question-based. Enterprises must create extensive Q&A pairs in Hindi, Tamil, and Bengali that align with commerce intents. This includes localizing category pages and app store listings with native microcopy and audio snippets. For example, a Hindi SEO cluster might focus on “सबसे सस्ता [category] 2026,” while a Tamil cluster targets “EMI irukka [brand]?”

On-site content must be marked up with Speakable, FAQ, and HowTo schema to ensure search engines can parse and read back information through voice assistants. This discoverability extends to off-site local SEO, where vernacular Google Business Profiles and regional festival landing pages play a pivotal role. By optimizing for how people actually speak—including the use of romanized Hindi or Bengali in search queries—brands can capture high-intent traffic that competitors using standard translation tools will miss.

A critical coverage gap often missed by competitors is the integration of dialect-specific shopping videos directly into the search result experience. When a user searches via voice, providing a video response that speaks their specific dialect (e.g., Bhojpuri-influenced Hindi vs. Standard Hindi) significantly increases trust and click-through rates. This strategy ensures that the brand is not just visible but resonant with the local culture and linguistic habits of the shopper.

Sources:

- Skyram Technologies: Voice search in Indian ecommerce

- TrueFan AI: Voice commerce India 2026 strategies

Tier-2 voice adoption strategies: Acquisition and activation

Successful tier-2 voice adoption strategies focus on lowering the friction of entry. In many regional markets, the “missed call” remains a powerful tool; a user gives a missed call and receives a callback from a multilingual IVR or a WhatsApp message with a personalized video. QR codes at physical retail points can also trigger voice-activated offer explanations, bridging the gap between offline browsing and online transacting. These low-friction touchpoints are essential for reaching users who may be wary of complex app interfaces.

Trust-building is the second pillar of adoption. In Bharat, trust is often built through familiarity and social proof. Using branded caller IDs and providing an easy “agent handoff” option ensures that users feel secure. Moreover, celebrity-led video intros can humanize the AI experience. When a recognized face explains a return policy or a “Cash on Delivery” option in the user's mother tongue, the perceived risk of the transaction drops significantly.

Field and retail integration is another often-overlooked strategy. Store staff can be equipped with tools to trigger personalized videos to a shopper's phone while they are in the aisle. This “assisted commerce” model uses voice and video to provide the deep product knowledge that a busy salesperson might lack. By combining regional voice shopping behavior with physical presence, enterprises can create a hybrid model that maximizes both reach and conversion.

Sources:

- Financial Express: Rural India extends lead in internet usage

- IBEF: Indic languages driving internet growth

- Outlook Business: AI vernacular voices and local LLMs

Measurement and optimization: Defining voice assistant marketing ROI

Proving the value of voice initiatives requires a rigorous KPI framework. Digital Innovation teams must move beyond basic “interaction counts” to measure voice assistant marketing ROI through metrics like Video View-Through Rate (VTR), Click-Through Rate (CTR) to the cart, and actual conversion uplift. Solutions like TrueFan AI demonstrate ROI through significant increases in Add-to-Cart (ATC) rates when voice-triggered personalized offers are paired with high-quality video content compared to audio-only or text-only alternatives.

Experimentation is key to optimization. CTOs should run A/B tests comparing dialect variants, romanized vs. native script prompts, and the timing of agent handoffs. For instance, testing a Bengali voice-activated offer during Durga Puja against a generic English offer can provide clear data on the “vernacular premium.” Minimum sample sizes must be established for each language cohort to ensure statistical significance, with 2-week test cycles allowing for rapid iteration.

Offline attribution also plays a role in the ROI model. By using unique coupon codes generated within voice flows or tracking store POS tagging with campaign IDs, brands can measure the omnichannel impact of their voice commerce strategies. This comprehensive data set allows for the calculation of Customer Acquisition Cost (CAC) and Lifetime Value (LTV) specific to the vernacular voice segment, providing the financial justification needed for full-scale deployment.

Sources:

Governance, Privacy, and the 90-Day Roadmap

As enterprises scale natural language commerce India, governance and risk management become paramount. Explicit voice consent must be captured at the start of every interaction, and users must be clearly informed when they are interacting with AI-generated media. Data residency and PII (Personally Identifiable Information) minimization are critical, especially under emerging Indian data protection regulations. Utilizing ISO 27001 and SOC 2 compliant platforms ensures that the generation of dialect-specific shopping videos remains secure and brand-safe.

To operationalize these insights, a 90-day pilot roadmap is recommended:

- Weeks 0–2: Build vernacular corpora for one category (e.g., CPG) in a single tier-2 city. Define ROI baselines.

- Weeks 3–5: Implement key intents (discover, price, checkout) and produce initial video assets.

- Weeks 6–8: Go live on WhatsApp and IVR. Introduce smart speaker video integration for a subset of users.

- Weeks 9–12: Analyze results, expand to two additional languages (Tamil and Bengali), and refine the voice SEO regional languages strategy.

Frequently Asked Questions (FAQ)

1. How does voice commerce vernacular India 2026 differ from standard voice search?

Standard voice search often relies on simple translation, whereas the 2026 vernacular model incorporates code-mixing (Hinglish), dialect-specific nuances, and visual fulfillment through AI-generated videos. It is a full-funnel commerce experience rather than just an information retrieval tool.

2. What is the role of TrueFan AI in this ecosystem?

TrueFan AI provides the enterprise-grade infrastructure to generate hyper-personalized, multilingual shopping videos at scale. It allows brands to turn a single video shoot into millions of personalized variants that speak to the user's native dialect, significantly boosting engagement and trust.

3. Can these systems handle “Hinglish” or “Tanglish”?

Yes, modern NLU models are specifically trained on Indian code-mixed corpora. They can recognize English nouns (like “Mobile” or “Offer”) embedded within Hindi or Tamil sentence structures, ensuring a natural interaction for the user.

4. Is smart speaker video integration necessary for ROI?

While WhatsApp and mobile apps drive the highest volume, smart speaker video integration (like on the Echo Show) provides a high-intent, “lean-back” shopping experience that often results in higher average order values (AOV) for household and electronics categories.

5. How do we ensure the AI doesn't mispronounce regional names?

Advanced phoneme-based AI models, such as those used in TrueFan AI’s stack, are calibrated for Indian naming conventions across various states, ensuring that “Vijay” or “Ananya” are pronounced with the correct regional inflection, which is vital for building trust.

Conclusion

The transition to voice commerce vernacular India 2026 represents the most significant shift in the Indian retail landscape since the introduction of 4G. For the CTO and Digital Innovation leader, the challenge lies in moving beyond simple translation to a deep, culturally resonant “conversation-first” strategy. By combining sophisticated NLU, dialect-specific shopping videos, and a rigorous ROI-driven pilot, enterprises can unlock the massive potential of the regional Indian market. The future of commerce in India isn't just about being digital; it's about being audible, visual, and local.

Frequently Asked Questions

How does vernacular voice commerce differ from standard voice search?

Vernacular voice commerce goes beyond translation to handle code-mixing, dialectal patterns, and transaction flows. It pairs natural-language understanding with personalized video responses and offer fulfillment, delivering a full-funnel shopping experience instead of simple information retrieval.

What role does TrueFan AI play?

TrueFan AI powers large-scale, multilingual video personalization and voice journeys, enabling brands to auto-generate millions of variants in native dialects and distribute them across WhatsApp, IVR, and smart speakers for higher trust and conversion.

Can the system handle Hinglish or Tanglish?

Yes. Code-mixed ASR/NLU models recognize English nouns embedded in Hindi or Tamil grammar, mapping them accurately to product intents, filters, and personalized offer flows.

Is smart speaker video integration necessary for ROI?

It isn’t mandatory, but adding APL-driven video on devices like Echo Show often lifts average order value and complements WhatsApp-heavy volumes, creating a cohesive, cross-channel experience.

How do we ensure correct pronunciation of regional names?

Use phoneme-based TTS models tuned for Indian languages and names. Calibration with region-specific lexicons ensures accurate pronunciation that builds user trust and brand affinity.