AI marketing ROI justification 2026: A CFO playbook for Union Budget technology planning and Q1 martech decisions

Estimated reading time: ~10 minutes

Key Takeaways

- CFO-grade ROI requires baselines, hurdle rates (3–5×), and sub-6 month payback for Q1 pilots.

- Standardized ROI model for AI video quantifies conversion lift, cost avoidance, and incremental gross profit.

- Full TCO visibility must include integrations, security, change management, HITL, and audit retention.

- DPDP-aligned controls (consent sync, immutable logs, disclosures, residency) de-risk approvals and protect brand.

- Budget timing with Union Budget lets enterprises leverage infrastructure signals and subsidies to optimize martech spend.

As the Union Budget 2026–27 is tabled on February 1, Indian enterprises face a critical window for capital allocation. For finance leaders, AI marketing ROI justification 2026 has moved from a speculative exercise to a core requirement for fiscal year planning. CFOs must now balance aggressive digital transformation investment with the disciplined rigor of technology investment metrics to ensure every rupee spent on generative AI delivers measurable enterprise value.

This playbook provides the framework for CFOs, Finance Controllers, and CMO Ops to navigate the complexities of martech budget approval during this pivotal Q1 2026 window.

Executive Summary for CFOs

- The Decision: Allocate marketing technology budget for FY 2026–27 toward high-impact AI video personalization that aligns with the India AI Mission and DPDP compliance.

- The Hurdle: Apply a minimum ROI of 3–5× over 12–18 months, with a target payback period of less than 6 months for initial pilot-to-scale initiatives.

- The Context: Leverage the Union Budget 2026–27 technology priorities, including the ₹40,000 crore push for digital infrastructure, to optimize TCO and ensure long-term scalability.

AI marketing ROI justification 2026 — why it matters now

In the current fiscal planning Q1 2026 cycle, the definition of AI marketing ROI justification 2026 has evolved into a rigorous, CFO-grade process. It is no longer sufficient to cite “brand lift” or “engagement” as primary success indicators. Instead, finance leaders are demanding a quantification of payback, Internal Rate of Return (IRR), and strategic fit for all AI video marketing technology decisions.

The timing is critical. The Union Budget 2026–27 highlights emphasize massive tech enablement, including expanded allocations for the India AI Mission and deep-tech funding. CFOs who sync their martech investment windows to these policy signals can capitalize on improved digital public infrastructure and talent programs. However, a significant measurement gap remains; while 40% of enterprise applications are expected to integrate AI by the end of 2026, many lack disciplined ROI tracking.

To close this gap, CFOs must move beyond vanity metrics. Rigorous baselining and sensitivity analysis are required to justify the shift from traditional production to AI-driven personalization. This ensures that digital transformation investment is not just a line item but a driver of realized profitability.

Sources:

- Union Budget Speech 2026–27 (indiabudget.gov.in)

- PIB Budget Highlights 2026–27 (pib.gov.in)

- Gartner/industry: AI Adoption Trends 2026 (zigment.ai)

CFO framework for technology spend optimization

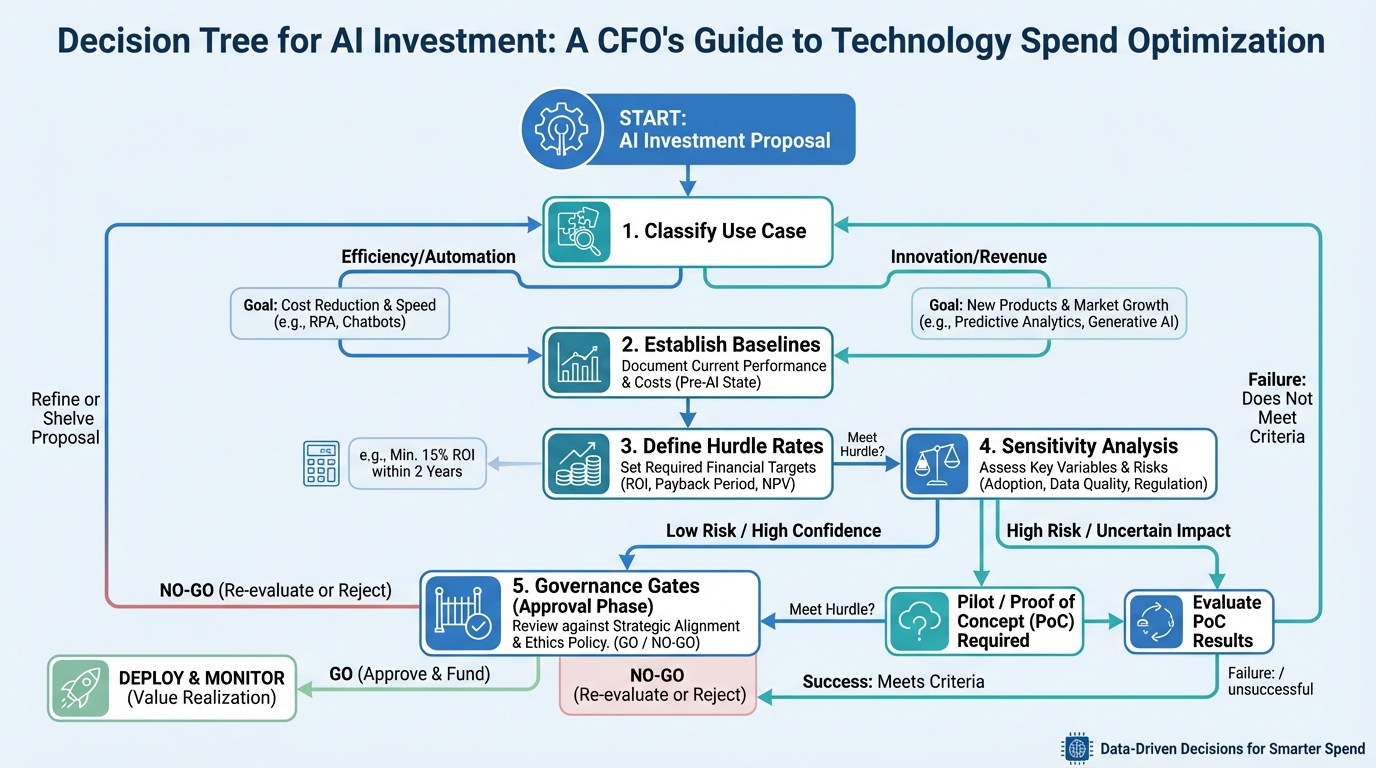

Effective technology spend optimization requires maximizing enterprise value by aligning AI investments with corporate hurdle rates and risk-adjusted Total Cost of Ownership (TCO). For CFOs, this means implementing a structured decision tree to prune waste and prioritize high-yield use cases.

The Decision Tree for AI Investment

- Classify Use Case: Categorize the initiative as Revenue Lift (e.g., conversion growth), Cost Efficiency (e.g., production savings), or Compliance/Risk Reduction (e.g., DPDP audit trails).

- Establish Baselines: Audit the last four quarters of performance. Key metrics include Cost Per Acquisition (CPA), Click-Through Rate (CTR), and creative cycle times.

- Define Hurdle Rates: Set a minimum ROI threshold of 3–5× over 18 months. For Q1 pilots, target a payback period of under 6 months to prove viability before scaling.

- Run Sensitivity Analysis: Model best, base, and worst-case scenarios for conversion lift and CAC reduction. This accounts for variables like data quality and adoption speed.

- Governance Gates: Establish clear milestones. A pre-pilot gate locks the baseline, while a mid-pilot review validates the signal before releasing the full scale-out budget.

By following this framework, finance teams can ensure that enterprise AI investment strategies are grounded in financial reality. The output for the Board should include a clear dependency map between IT integration and marketing outcomes, ensuring that technology investment metrics are visible at every level of the organization.

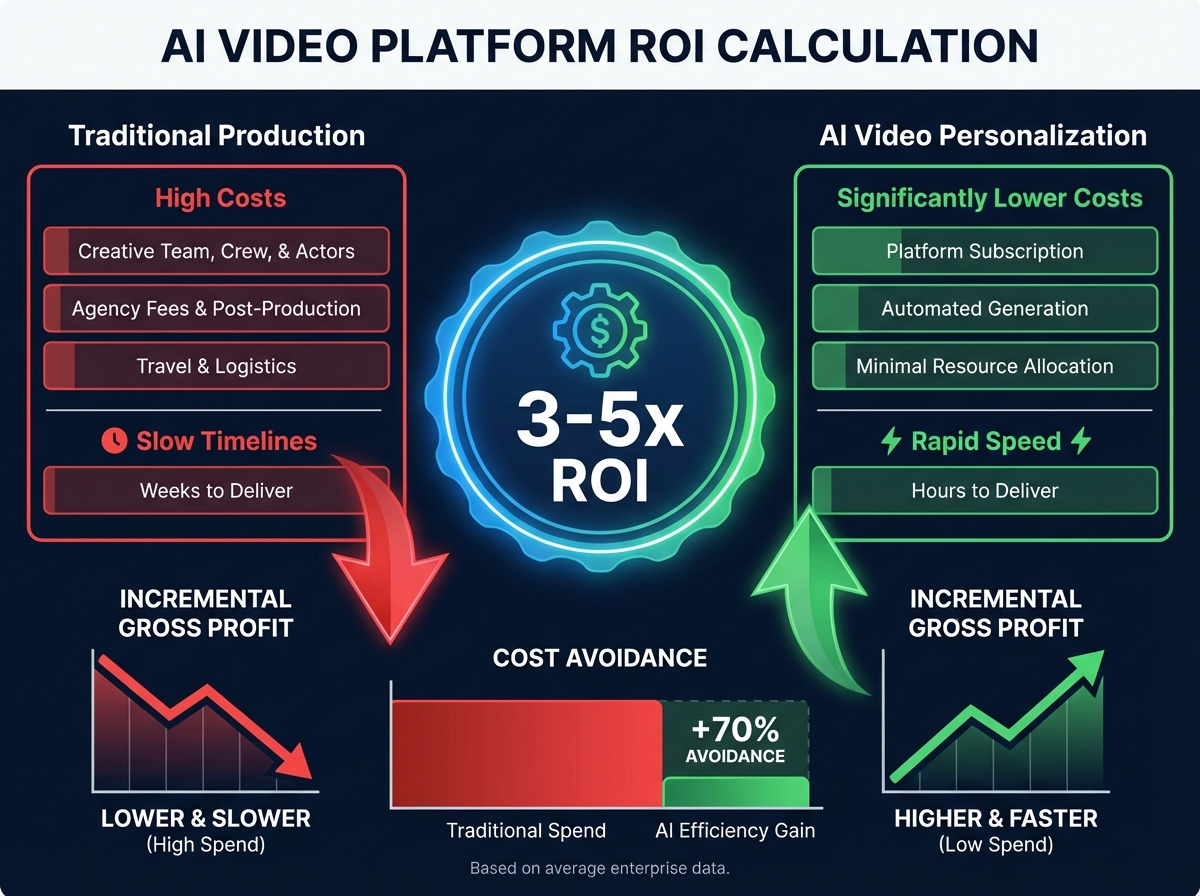

AI video platform ROI calculation — methodology and workbook

A standardized AI video platform ROI calculation is essential for quantifying the incremental revenue and cost avoidance generated by personalized video. This methodology moves beyond simple cost-per-video comparisons to look at the entire marketing funnel.

ROI Calculation Inputs

To build an accurate model, CFOs should require the following data points:

- Funnel Metrics: Current traffic by channel, conversion rates (CVR) from Lead to Win, and Average Order Value (AOV).

- Production Efficiency: Current costs for shooting, editing, and reshoots, alongside localization costs per language.

- Operational Load: Team hours spent on creative approvals, error rates in manual content, and current time-to-market for campaigns.

The Financial Model

The formula for ROI in this context is:

ROI = (Incremental Gross Profit + Cost Avoidance − Incremental Costs) / Incremental Costs

For example, if an enterprise avoids ₹50 lakhs in traditional production costs and generates ₹2 crores in incremental revenue through a 15% lift in conversion, the ROI becomes a powerful justification for marketing technology budget allocation.

Benefit Levers to Quantify

- Conversion Lift: Apply conservative scenarios (e.g., 5–10% lift) to model the impact of personalized celebrity videos on high-intent journeys like cart abandonment.

- Production Cost Avoidance: Calculate the savings from “virtual reshoots” where AI alters lines in existing footage, eliminating the need for expensive studio time.

- Time-to-Market Acceleration: Factor in the revenue gained by launching campaigns 30 days earlier due to automated AI editing and localization.

Sources:

Enterprise AI adoption costs and full TCO

Understanding enterprise AI adoption costs requires a comprehensive view of both one-time implementation expenses and recurring operational outlays. A common pitfall for CFOs is focusing solely on license fees while ignoring the “hidden” costs of integration and governance.

One-Time Implementation Costs

- Integrations: Connecting the AI video platform to existing CRMs (Salesforce, HubSpot) or WhatsApp Business APIs.

- Data & Compliance: Mapping consent policies to the DPDP framework and designing prompt/script systems that align with brand safety.

- Security Audits: Verification of ISO 27001 and SOC 2 compliance, alongside legal reviews of celebrity asset usage.

- Change Management: Training hours for marketing and ops teams to master the new AI-driven workflow.

Recurring Operational Costs

- Subscriptions & Compute: Monthly license fees plus any variable costs for GPU/compute and CDN storage for video hosting.

- Human-in-the-Loop (HITL): Ongoing costs for QA and manual moderation to ensure every generated video meets brand standards.

- Audit Trail Retention: The cost of maintaining immutable logs for compliance as required by Indian data regulations.

By visualizing these costs through a TCO waterfall—starting with initial setup and moving toward steady-state optimization—CFOs can better manage digital transformation investment and avoid mid-year budget shocks.

Union Budget technology planning — aligning martech to FY 2026–27 signals

The timing of Union Budget technology planning provides a unique opportunity for CFOs to align their martech roadmap with national priorities. The 2026–27 budget signals a clear shift toward AI-powered innovation as a blueprint for a $7 trillion economy.

Strategic Timing for Q1 2026

Enterprises should lock their AI pilots in Q1 to align with the February 1 budget announcements. This allows firms to take advantage of policy-enabled infrastructure, such as new data centers and digital public infrastructure (DPI) enhancements. The Ministry of Electronics and IT (MeitY) has seen significant budget increases for the India AI Mission, which CFOs should monitor to identify potential subsidies or talent development programs that can offset marketing automation budget planning costs.

Actionable Steps for Finance Leaders

- Monitor MeitY Circulars: Stay updated on the Expenditure Profile and SBE (Statement of Budget Estimates) to understand where infrastructure support is being funneled.

- Avoid Speculative Allocations: Only commit to scale-out budgets once official ministry allocations for AI infrastructure are confirmed.

- Leverage DPI: Use the expanding Digital Public Infrastructure to improve data residency and consent management, reducing the compliance burden on the enterprise.

Sources:

DPDP-aligned risk, compliance, and controls (India)

In the wake of the Digital Personal Data Protection (DPDP) Act, CFO marketing budget approval is now contingent on robust risk and compliance controls. For AI-driven video marketing, this means ensuring that every personalized interaction is lawful, consented, and auditable.

Essential Compliance Controls

- Consent Synchronization: Martech platforms must sync in real-time with the enterprise's central Consent Management Platform (CMP) to honor data principal rights.

- Immutable Audit Trails: Every video generated must have a log detailing who it was sent to, when it was created, and the specific data used for personalization.

- Synthetic Media Disclosure: Under DPDP guidance, all AI-generated or “deep-fake” style content must include clear watermarking or disclosures to prevent misinformation.

- Data Residency: Ensure that the AI vendor complies with Indian data residency requirements, particularly if processing sensitive customer information.

Platforms like TrueFan AI enable enterprises to meet these stringent requirements by providing built-in moderation, watermarking, and ISO-certified security protocols. This reduces the “compliance tax” on the marketing budget while protecting the brand from significant regulatory fines.

Sources:

CFO marketing budget approval — business case structure

To secure CFO marketing budget approval, the business case must be structured as a financial document, not a creative pitch. It should clearly outline the path from investment to cash flow.

The Executive Business Case Blueprint

- Problem & Baseline: Clearly state the current funnel inefficiencies and the cost of the status quo (e.g., “Manual video production limits us to 5 videos/month at ₹10L each”).

- Solution Scope: Define the use cases—such as hyper-personalized onboarding or collections nudges—and the channels (WhatsApp, Email) involved.

- Financial Model: Present the ROI, NPV, and IRR. Include a sensitivity tornado chart showing how variables like conversion lift impact the final numbers.

- Operational Model: Detail the RACI (Responsible, Accountable, Consulted, Informed) matrix and the adoption ramp for the internal team.

- Risk Mitigation: Highlight the DPDP controls and the vendor's security certifications.

Stakeholder Alignment Tactic

A highly effective tool for alignment is the use of budget approval stakeholder videos. These are 60–90 second, executive-ready personalized explainers sent to the Board or Procurement. They demonstrate the technology's power by using a celebrity or the CEO to walk through the business case, numbers, and governance in a format that is impossible to ignore.

Implementation roadmap — 30/60/90-day plan

Scaling AI video requires a phased approach that prioritizes technology spend optimization through rigorous governance gates.

Day 0–30: Foundation & Integration

- Finalize contracting and InfoSec reviews.

- Map data flows and consent policies to ensure DPDP compliance.

- Set up API integrations with CRM and WhatsApp Business.

Day 31–60: Pilot & Validation

- Execute a pilot on 1–2 priority journeys (e.g., cart abandonment).

- Run A/B tests to validate the conversion lift against the baseline.

- Draft the first budget approval stakeholder videos for the scale-out committee.

Day 61–90: Scale & Industrialize

- Make the scale-out decision based on pilot ROI and payback.

- Industrialize dashboards to track technology investment metrics in real-time.

- Finalize procurement for the full FY 2026–27 allocation.

Client capability alignment — TrueFan Enterprise fit (India-first)

When evaluating enterprise AI investment strategies, the platform's ability to scale within the Indian context is paramount. TrueFan AI provides a purpose-built enterprise stack that aligns directly with CFO requirements for ROI and compliance.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow brands to achieve hyper-localization at a fraction of traditional costs. For instance, Hero MotoCorp used the platform to deliver 2.4 million personalized festive greetings, a feat that would be physically and financially impossible through traditional production.

Solutions like TrueFan AI demonstrate ROI through:

- Virtual Reshoots: Eliminating the need for repeat celebrity sessions by using AI to edit lines and offers.

- Mass Personalization: Generating up to 354,000 unique videos in a single day, as seen with Zomato’s Mother’s Day campaign.

- Governance: Providing ISO 27001 and SOC 2 certified environments with built-in DPDP-aligned audit trails.

By mapping these capabilities to CFO outcomes—faster time-to-market, production cost avoidance, and measurable conversion lift—enterprises can justify their AI video platform ROI calculation and secure long-term budget support.

Download the CFO-grade AI video ROI calculator and TCO model.

Frequently Asked Questions

How do CFOs approach marketing technology budget allocation in 2026?

CFOs are moving toward a “pilot-to-scale” model. This involves setting technology investment metrics, including a 3–5× ROI hurdle and a payback period of under 6 months. The process begins with establishing clear baselines and ensuring all investments align with the DPDP compliance framework and the Union Budget's technology signals.

What are typical enterprise AI adoption costs and payback windows for AI video?

Enterprise AI adoption costs include one-time setup (integrations, security audits, training) and recurring fees (licenses, compute, governance). Typically, enterprises see a payback window of 3 to 9 months, depending on content volume and achieved conversion lift during the pilot phase.

How does Union Budget technology planning influence martech investments?

The Union Budget technology planning cycle dictates the availability of digital infrastructure and potential tax or subsidy benefits for AI adoption. In 2026, focus on the India AI Mission and digital public infrastructure means CFOs should prioritize vendors that leverage these national assets for better scalability and lower TCO.

What compliance controls are required under India’s DPDP for personalized video marketing?

Under the DPDP Act, enterprises must ensure explicit consent, maintain immutable audit trails for every video generated, and include synthetic media disclosures (watermarking). Vendors like TrueFan AI provide these controls natively, ensuring that CFO marketing budget approval is supported by a robust risk management strategy.

What is the role of budget approval stakeholder videos in the planning process?

These personalized, high-impact explainers align the Board and Procurement. By demonstrating the AI video technology firsthand, they provide a clear, 90-second summary of the business case, ROI projections, and compliance measures—significantly accelerating the approval cycle for fiscal planning in Q1 2026.