Digital arrest scam prevention India 2026: Personalized video education to protect elderly and tier-2/3 customers

Estimated reading time: ~14 minutes

Key Takeaways

- “Digital arrest” scams weaponize fear with deepfake-enabled impersonation and continuous video coercion, disproportionately harming elderly and tier-2/3 users.

- RBI-aligned education via real-time, in-product video warnings reduces liability and prevents fraud before authorization.

- Security awareness automation delivers just-in-time, vernacular, personalized videos triggered by high-risk events.

- Vernacular celebrity-led messages from trusted voices drive higher recall and faster reporting (1930/NCRP).

- A 90-day blueprint and trust-signal reinforcement across channels builds a durable human firewall.

Digital arrest scam prevention India 2026 has become the most critical frontier for BFSI compliance and customer protection teams as sophisticated social engineering reaches an all-time high. In early 2026, the Indian cyber landscape witnessed a staggering surge in “digital arrest” cases, a fraudulent tactic where criminals impersonate law enforcement to extort massive sums from unsuspecting citizens.

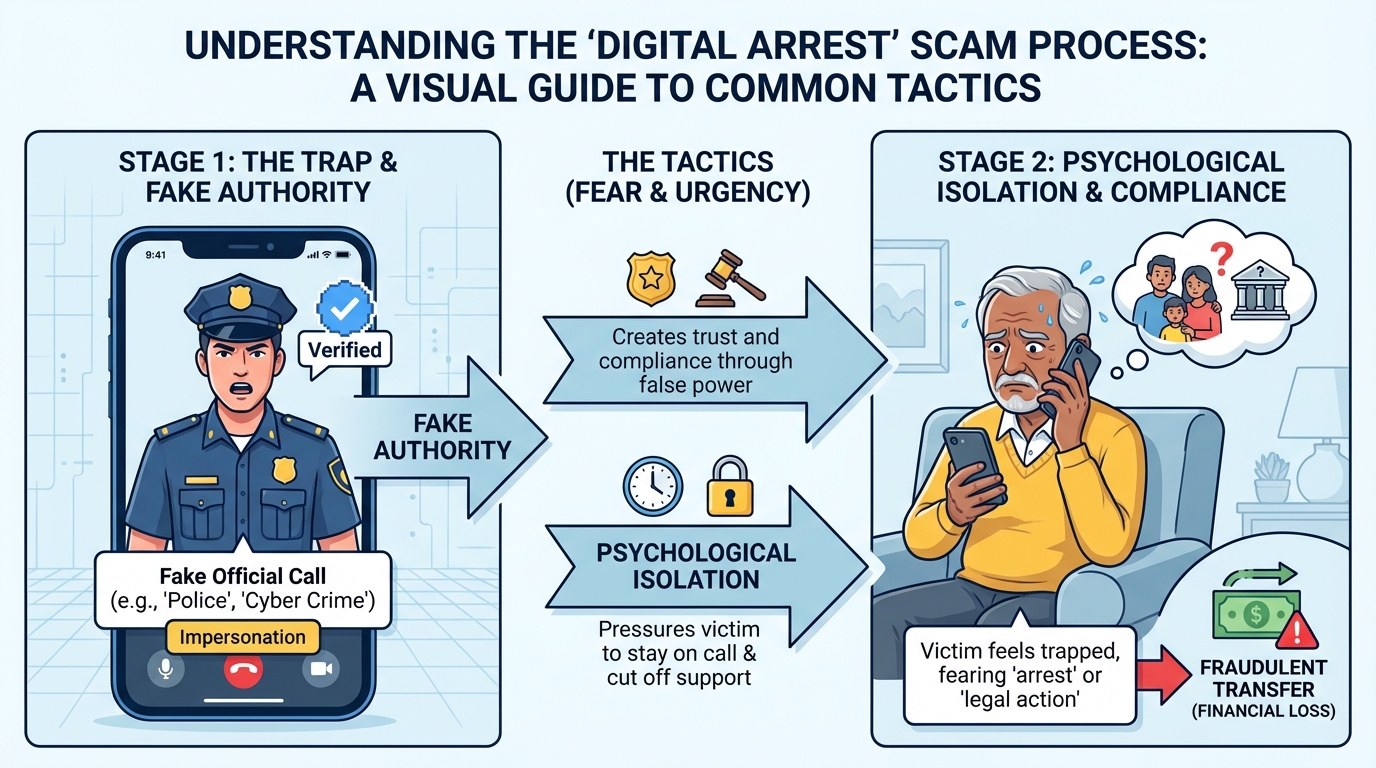

A digital arrest scam is a psychological operation where fraudsters use video calls to place victims under “virtual detention,” claiming they are involved in money laundering or narcotics. These criminals often spoof official backgrounds and use fabricated IDs to create a sense of absolute authority and fear.

Recent data from the 2025 Digital Banking Fraud Trends in India report indicates that fraud cases tripled over the previous year, with digital arrest emerging as the most prevalent scam type. This crisis has disproportionately affected retirees and first-time digital users in tier-2 and tier-3 cities who may lack deep familiarity with legal protocols.

The thesis for 2026 is clear: BFSI institutions must transition from static text warnings to automated, personalized, and vernacular customer protection video education. By leveraging security awareness automation India, banks can deliver just-in-time interventions that measurably reduce victimization among vulnerable demographics.

Sources:

1. The Modus Operandi: Vulnerable customer protection in 2026

The anatomy of a digital arrest scam in 2026 involves a multi-stage psychological breakdown designed to isolate the victim from their support systems. It typically begins with a spoofed call claiming a parcel containing illegal substances has been intercepted in the victim's name.

The victim is then “transferred” to a fake officer from the CBI, Narcotics Bureau, or State Police via a WhatsApp or Telegram video call. These fraudsters use sophisticated deepfake technology to mimic the voices and appearances of real high-ranking officials, making the deception nearly impossible to detect for the untrained eye.

Once the “digital arrest” is initiated, the victim is told they must remain on camera 24/7 and are forbidden from contacting family members or their bank. This state of constant supervision is used to coerce “verification transfers,” where victims are told to move their funds to “government-monitored” accounts for auditing.

In January 2026, a high-profile case in Delhi saw an elderly businesswoman duped of ₹6.9 crore after being kept under virtual surveillance for several days. Another case in Pune involved an elderly man losing ₹17 lakh to a similar scheme, highlighting that no geography is immune to these organized rings.

Vulnerable customer protection now requires understanding these 2026 markers: longer call durations, multi-actor handoffs, and the use of mule accounts for rapid fund dispersal. Fraudsters often target individuals with significant savings, such as NRIs or retired government employees, who are more likely to comply with perceived legal authority.

Sources:

2. Compliance and RBI Standards: Customer protection video education

The Reserve Bank of India (RBI) has reinforced its “Limiting Liability of Customers” circular, placing a heavy burden on banks to provide robust educational frameworks. Under these guidelines, banks are obligated to provide 24/7 reporting channels and ensure customers are aware of their rights regarding unauthorized transactions.

Customer protection video education is no longer an optional marketing add-on; it is a compliance necessity for meeting the “due diligence” standards set by the regulator. Banks must demonstrate that they have taken proactive steps to educate high-risk segments, particularly those over the age of 60.

If a customer reports a fraud within three working days, their liability is often zero, provided the bank cannot prove negligence. However, the goal of 2026 BFSI strategy is to prevent the transaction from occurring in the first place through real-time, behavior-triggered alerts.

Standardizing in-product reporting is a key requirement, where “Report Fraud” buttons are prominently displayed during high-value transfers. These buttons should ideally trigger a short, authoritative video explaining that no Indian law enforcement agency will ever demand money over a video call.

Furthermore, coordination with the Indian Cyber Crime Coordination Centre (I4C) and the National Cybercrime Reporting Portal (NCRP) is essential for rapid response. Banks that integrate 1930 helpline details into their digital safety video campaigns see a significantly higher rate of successful fund freezing.

Sources:

- RBI: Limiting Liability of Customers in Unauthorised Electronic Banking Transactions

- I4C: National Cybercrime Reporting Portal (NCRP)

- SBI: Cyber Security Awareness

3. The Shift to Automation: Security awareness automation India

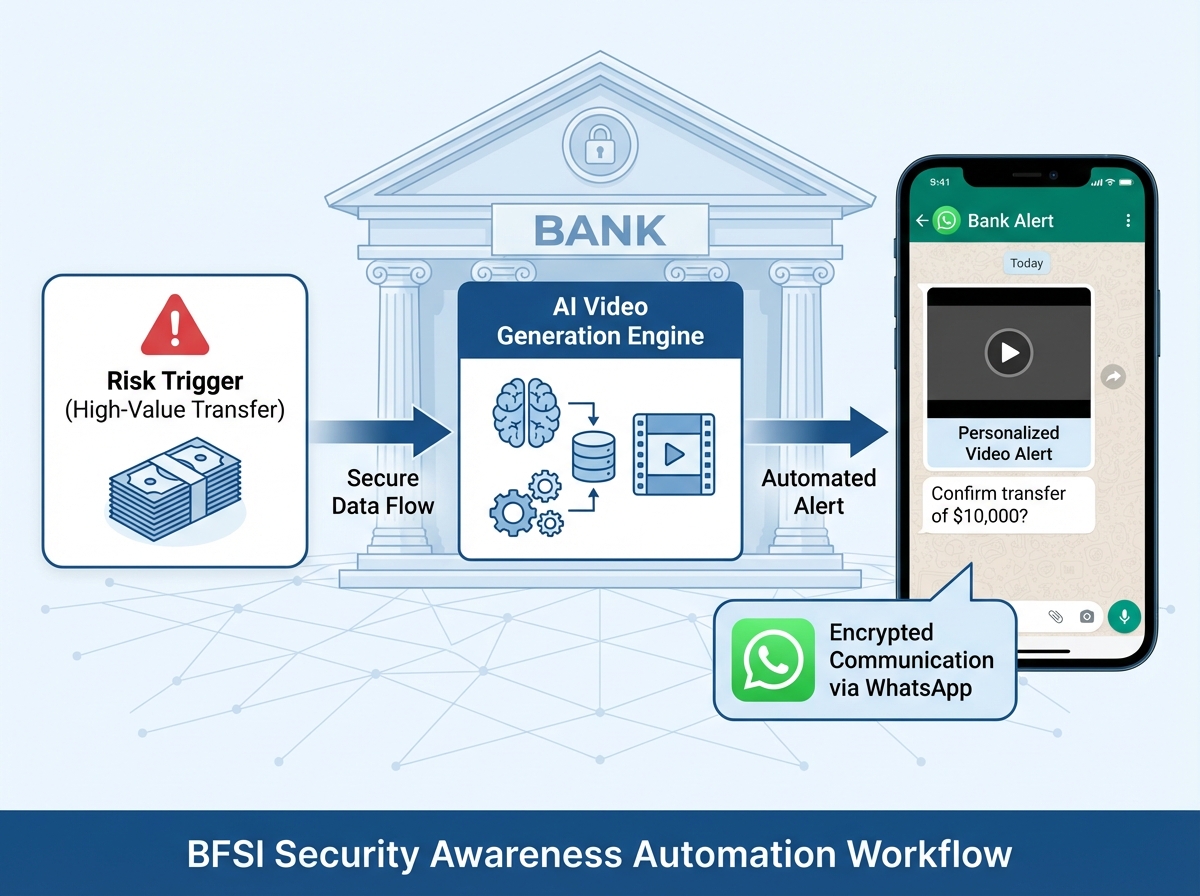

In 2026, manual awareness campaigns are insufficient to counter the speed of AI-driven fraud; the industry has shifted toward security awareness automation India. This involves a governed pipeline that ingests risk events—such as unusual login locations or attempts to add new payees—and instantly generates context-matched education.

The architecture of such a system relies on a Complex Event Processing (CEP) engine that scores risks in real-time. When a high-risk event is detected, the system selects a pre-approved template and binds it with the customer's specific data to create a personalized intervention.

Platforms like TrueFan AI enable BFSI institutions to scale this hyper-personalization by generating high-quality video content that addresses the customer by name and in their preferred language. This “just-in-time” education is delivered via WhatsApp or SMS, ensuring the customer sees the warning before they authorize a fraudulent transfer.

Governance is a critical component of this automation, requiring that all templated content receive legal and compliance sign-off. Audit logs must be maintained to prove that the bank attempted to warn the customer, which is vital for regulatory reporting and liability disputes.

Automation also allows for “virtual reshoots,” where messaging can be updated instantly to reflect new scam scripts without the need for expensive production cycles. This agility ensures that the bank's defense mechanisms evolve as quickly as the tactics used by digital arrest syndicates.

Sources:

4. Personalization and Vernacular Reach: Fraud awareness video campaigns

Fraud awareness video campaigns in 2026 must solve the “comprehension gap” that exists in traditional text-based warnings. Research shows that elderly customers and those in tier-2 cities have a 40% higher recall rate when information is presented in their native tongue with visual cues.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow banks to use trusted voices to deliver life-saving security advice. When a recognizable figure explains the “hang up-verify-report” protocol in Marathi or Bengali, the emotional impact and trust levels are significantly higher than a generic SMS.

Vernacular fraud prevention content must prioritize the top 12 Indian languages to ensure no customer is left behind. These videos should be optimized for WhatsApp delivery, with file sizes under 3MB and clear, clickable Call-to-Action (CTA) buttons for the 1930 helpline.

Personalization extends beyond just the name; it includes referencing the customer's specific city or branch to ground the message in reality. For example, a video might say, “Mr. Sharma, your Pune branch will never ask for your OTP over a video call,” creating a localized trust signal.

Anti-phishing personalized alerts can also be triggered when a customer clicks on a simulated phishing link or a suspicious external URL. These micro-learning moments are far more effective at changing behavior than annual compliance training, as they occur at the point of potential failure.

Sources:

5. Strategic Implementation: Tier-2 city scam awareness

Tier-2 city scam awareness requires a multi-channel approach that combines digital precision with community-level trust. While WhatsApp is the primary delivery vehicle, banks should also leverage branch-level screenings and local radio partnerships to reach those who are less digitally active.

Elderly customer protection videos should feature large fonts (18pt+), high-contrast colors, and a slower-paced voiceover to ensure clarity. The content must explicitly state that “Digital Arrest” is not a legal concept in India and that official procedures always involve physical summons.

A 90-day pilot blueprint for BFSI leaders begins with defining high-risk segments, such as customers over 60 with high-value savings accounts. By week six, institutions should have integrated their fraud triggers with an automated video rendering engine to begin limited rollout.

Solutions like TrueFan AI demonstrate ROI through a measurable reduction in successful scam attempts and an increase in proactive reporting via the bank's app. During the pilot phase, A/B testing different CTAs—such as “Call 1930” versus “Contact Branch Manager”—can help optimize the intervention for maximum effectiveness.

Measurement of success should include “Trust Lift” surveys and a reduction in the time-lag between a scam attempt and the customer reporting it. In 2026, the goal is to create a “human firewall” where every customer is equipped with the knowledge to identify and deflect a digital arrest attempt instantly.

Sources:

6. Trust-Building Security Campaigns and Trust Signal Reinforcement

Trust-building security campaigns are the final layer of defense, ensuring that the bank's legitimate communications are distinguishable from fraud. This involves consistent use of brand colors, verified sender handles on WhatsApp, and the inclusion of official RBI or CERT-In references in every video.

Trust signal reinforcement marketing places security reminders at every high-friction point in the customer journey. Banners near UPI and NEFT transfer pages should link directly to short video explainers, reinforcing the “No bank demands money on a call” rule.

For the elderly, these campaigns should also target their caregivers, encouraging them to share the educational videos with their parents or grandparents. This “family-circle” approach ensures that the most vulnerable individuals have a secondary layer of protection through informed relatives.

Operating models must include strict data minimization and consent-first messaging to maintain customer trust. Every personalized video generated must adhere to ISO 27001 and SOC 2 standards (secure video personalization practices), ensuring that customer data is never compromised during the personalization process.

By the end of 2026, the standard for BFSI excellence will be defined by how well an institution protects its customers' peace of mind. Implementing an automated, video-first strategy is the only way to stay ahead of the sophisticated syndicates operating the digital arrest scams of tomorrow.

Sources:

Conclusion In 2026, the imperative for BFSI leaders is to operationalize digital arrest scam prevention India 2026 through a combination of vernacular, personalized, and automated video education. By moving beyond static warnings and embracing trust-building security campaigns, institutions can protect their most vulnerable customers from the devastating financial and psychological impact of these scams. We invite Compliance and Customer Protection leaders to book a 30-minute enterprise demo to launch a customer protection video education pilot in 90 days and secure their customer base for the future.

Frequently Asked Questions

What exactly is a “digital arrest” and is it legal in India?

There is no legal concept of “digital arrest” in Indian law. Law enforcement agencies like the CBI, Police, or ED will never arrest a person over a video call or demand money to “clear” their name. If someone claims to be placing you under digital arrest, it is a 100% certainty that they are a fraudster.

How can I verify if a person on a video call is a real police officer?

Real officers will never conduct an investigation or “arrest” via WhatsApp or Skype. They will always issue a physical summons or visit your residence in person with a valid warrant. Hang up immediately and call the official number of the police station they claim to be from to verify their identity.

What should I do if I have already transferred money to a scammer?

Immediately call the National Cybercrime Helpline at 1930 or visit the National Cybercrime Reporting Portal to file a complaint. The first two hours are the “Golden Hour” where there is a high chance of freezing the funds before the scammer can withdraw them. Also, notify your bank's fraud department immediately to block your accounts.

Why are personalized videos more effective than SMS alerts for fraud prevention?

Personalized videos, such as those created by platforms like TrueFan AI, capture attention more effectively and are easier for elderly users to understand. By using the customer's name and native language, these videos break through the “alert fatigue” caused by generic text messages, making the warning feel urgent and relevant.

How can BFSI institutions implement security awareness automation India?

Banks can integrate their fraud detection systems with AI video platforms to trigger automated alerts. When a suspicious activity is detected, the system can instantly send a personalized video to the customer's WhatsApp, explaining the specific risk and providing a clear “Report” button to prevent the fraud from succeeding.