B2B fiscal year-end procurement 2026: A Q4 Video Playbook to Accelerate Enterprise Deals Before March 31

Estimated reading time: ~10 minutes

Key Takeaways

- March 31 is immovable in India’s fiscal calendar, creating Q4 urgency to commit budgets or lose them.

- Use role-specific video sequences to align CFO, CTO/CISO, CMO, Legal, and Procurement on value, risk, and speed.

- WhatsApp + Digital Sales Rooms ensure high engagement and auditable trails for enterprise buyers.

- Deploy RFP automation and compliance videos to compress legal, security, and procurement cycles.

- Execute a December–March playbook with timed escalations, proofs, and executive nudges to close before March 31.

The landscape of B2B fiscal year-end procurement 2026 in India is defined by a singular, immovable deadline: March 31. Because the Indian financial year operates on an April 1 to March 31 cycle, the final quarter (January to March) represents a high-stakes window where enterprise budgets must be committed or risk being forfeited.

For sales and marketing leaders, this period demands more than just persistence; it requires a strategic orchestration of content that addresses the “use-it-or-lose-it” mentality of procurement departments. Modern enterprise buying has evolved into a complex, multi-stakeholder journey involving 6 to 10 distinct decision-makers, each with unique risk thresholds and evaluation criteria.

To compress sales cycles and secure budget utilization, teams must leverage role-specific video sequences that map directly to the procurement committee’s workflow. This playbook provides a comprehensive framework for using personalized video to build consensus, mitigate risk, and unlock enterprise funds before the fiscal clock runs out.

1. The Reality of B2B Fiscal Year-End Procurement 2026 in India

The Indian enterprise market operates under a rigid fiscal structure where unutilized budgets typically lapse at the end of March. This creates a surge in fiscal deadline marketing B2B activities as organizations scramble to allocate remaining funds toward high-impact digital transformations.

In 2026, procurement is no longer a back-office function but a strategic orchestrator of value. Trends indicate that AI-native procurement operating models have moved from experimental pilots to embedded systems that prioritize predictive purchasing and end-to-end automation.

Buying groups are simultaneously expanding, with Forrester reporting that the state of business buying now requires consensus across a broader array of executive sponsors to reduce perceived risk. This complexity means that a single “one-size-fits-all” pitch deck is insufficient for triggering late-stage approvals during the Q4 crunch.

Sellers must recognize these enterprise buying urgency triggers and respond with role-specific proof points. Whether it is a CFO scrutinizing the payback window or a CISO evaluating data residency, the ability to provide asynchronous, high-fidelity information is the key to decision-maker consensus building.

Sources:

- Government of India Financial Year Guidance: MEA Guidebook

- PIB Export Reporting FY: Press Information Bureau

- Future of B2B Sales and DSRs: SuperAGI

- 2026 Procurement Trends: Kodiak Hub

- Procurement Automation 2026: Vroozi

- State of Business Buying 2026: Forrester

2. Multi-Stakeholder Urgency Mapping for Decision-Maker Consensus

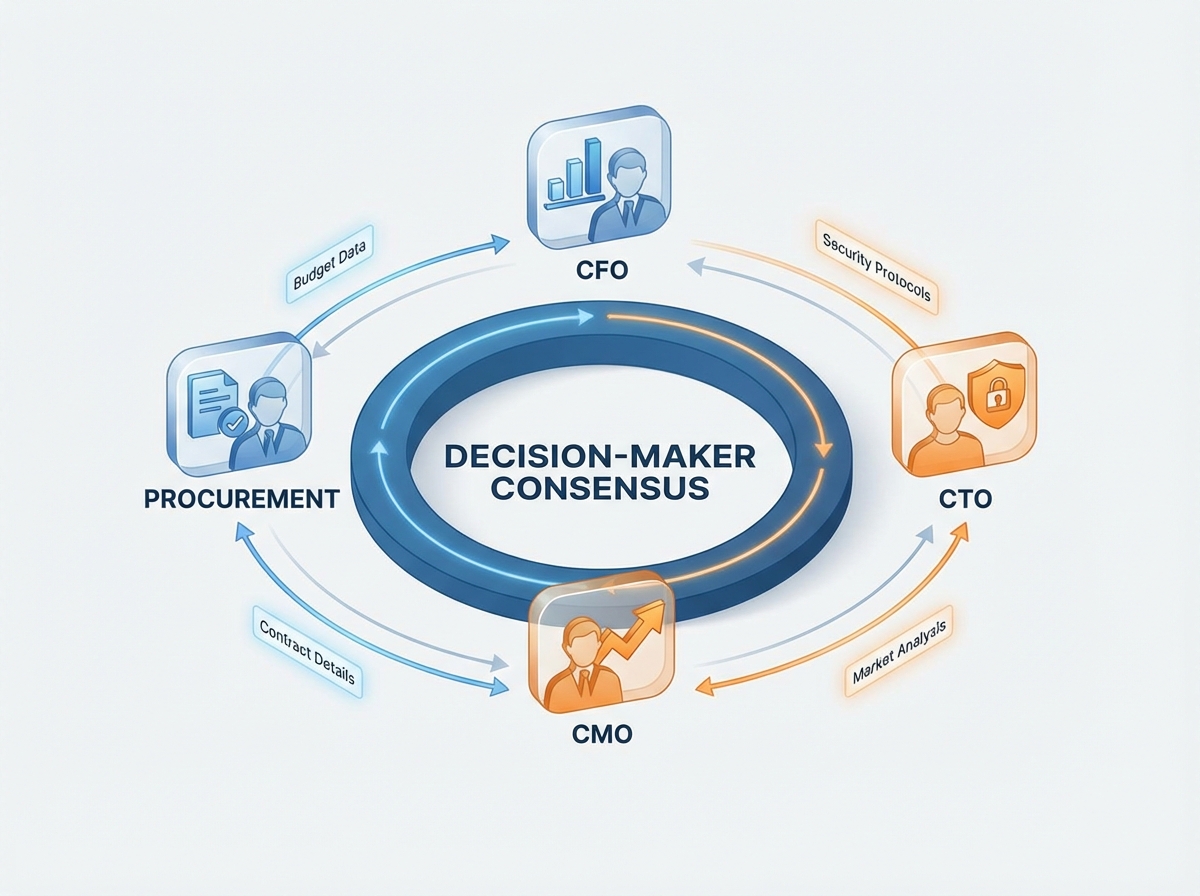

To navigate the B2B fiscal year-end procurement 2026 cycle, teams must implement multi-stakeholder urgency mapping. This process involves identifying the 6–10 decision-makers within an account and aligning content to their specific KPIs and fiscal-year timing triggers.

The CFO is primarily concerned with value proof and budget logic. They require quantification of OPEX vs. CAPEX impact and a clear demonstration that the payback period aligns with the upcoming fiscal year’s goals.

The CTO and CISO focus on integration and risk mitigation. Their triggers include SSO/SCIM readiness, data residency compliance, and the availability of a sandbox environment for rapid testing before the March 31 sign-off.

The CMO or Business Unit Sponsor seeks revenue acceleration. They need to see how a Q4 pilot can lead to attributable lift in the next fiscal year, often requiring creative agility and channel-specific proof like WhatsApp engagement metrics.

Procurement and Legal stakeholders act as the final gatekeepers. Their focus is on vendor due diligence, RFP response mapping, and ensuring that all Service Level Agreements (SLAs) and Data Processing Addendums (DPAs) are finalized without delaying the PO.

By building an urgency matrix that crosses these roles with specific triggers—such as budget expiry or compliance greenlights—sales teams can deliver the exact proof artifact needed to move the deal forward. This level of CFO CTO CMO aligned messaging ensures that no single stakeholder becomes a bottleneck in the final weeks of the quarter.

3. Architecting Enterprise Budget Utilization Videos for Q4

As the March 31 deadline approaches, enterprise budget utilization videos become the most effective tool for maintaining momentum. These are hyper-personalized, role-specific assets that translate complex business cases into digestible, stakeholder-aligned clips.

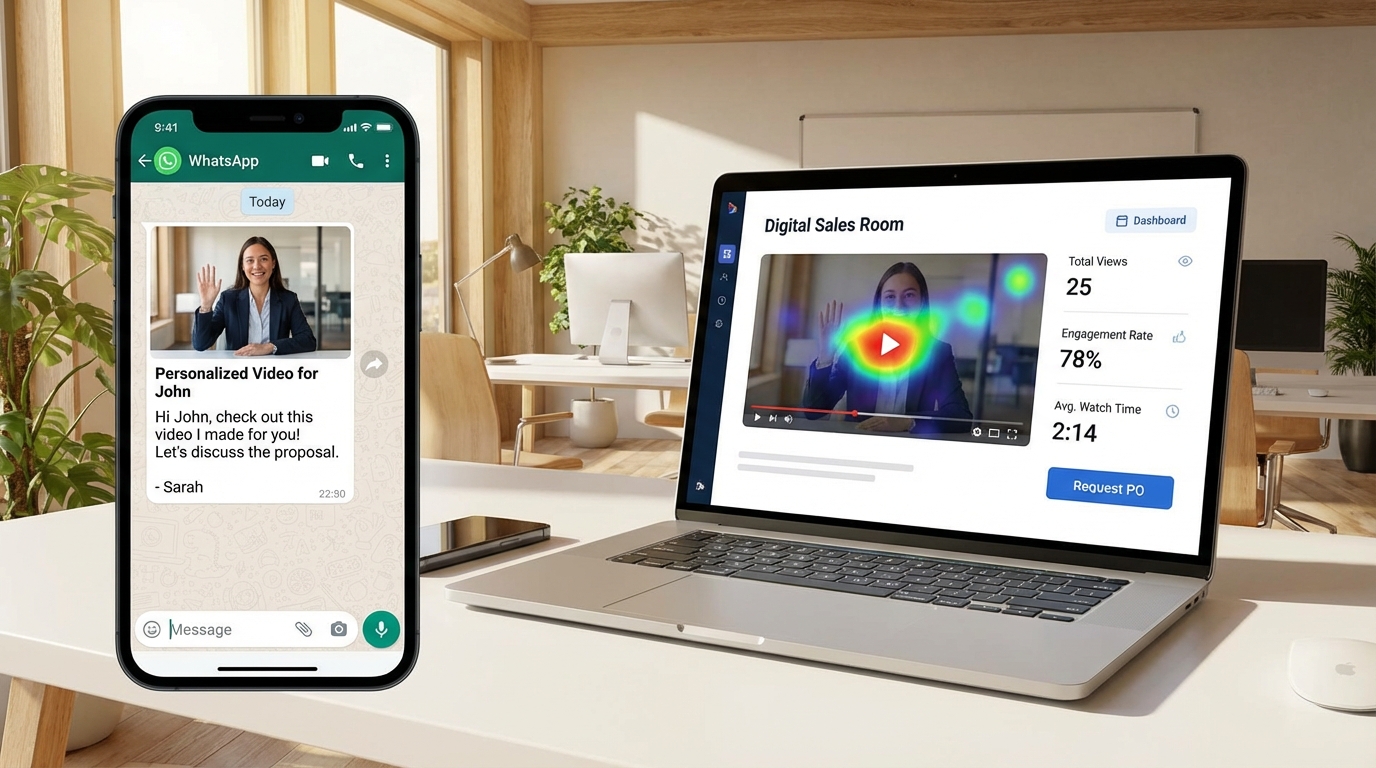

In the Indian context, the delivery channel is as important as the content itself. Leveraging the WhatsApp Business API allows for a 98% open rate, ensuring that busy executives see the message immediately, while Digital Sales Rooms (DSRs) provide a centralized hub for tracking multi-stakeholder engagement.

Platforms like TrueFan AI enable organizations to generate these personalized video sequences at an enterprise scale. By automating the creation of role-based variants, sales teams can deliver a CFO-specific ROI analysis and a CTO-specific security overview simultaneously.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow for deep localization and engagement, ensuring that regional stakeholders feel a direct connection to the value proposition. This is particularly critical in diverse markets where language-aligned messaging can accelerate trust.

The asset blueprint should include 45–90 second clips for each persona. The CFO variant should focus on budget line utilization logic, while the Procurement variant should provide a condensed map of RFP requirements to de-risk the final selection.

A typical 10–14 day sequence might begin with a kickoff alignment video, followed by a compliance assurance clip, and culminate in an executive sponsor nudge. This structured approach to procurement committee video engagement ensures that the solution remains top-of-mind as the fiscal year closes.

Sources:

4. Q4 Deal Acceleration Strategies and Budget Expiry Campaigns

To successfully execute Q4 deal acceleration strategies, teams must launch budget expiry urgency campaigns that explicitly reference the March 31 deadline. These campaigns are designed to provide clear, low-friction next steps that move a prospect from “interested” to “contracted.”

One highly effective tactic is vendor selection personalization. By creating competitive differentiation presentations in video format, you can contrast your solution’s KPIs and risk posture directly against the status quo or incumbent providers.

These videos should address the “last-mile” concerns of the CFO and Procurement. A side-by-side comparison of implementation time, total cost of ownership, and risk mitigations can provide the final justification needed for a late-quarter budget reallocation.

Executive sponsor escalations are another critical component. A 30–45 second video from your company’s executive to the buyer’s executive can humanize the partnership and address high-level strategic alignment that lower-level stakeholders might overlook.

The Call to Action (CTA) in these videos must be explicit. Instead of a generic “let’s connect,” suggest a practical next step: “Approve the 4-week pilot starting February 15 to ensure the PO is processed before the March 31 fiscal deadline.”

By focusing on enterprise buying urgency triggers, these strategies help procurement committees overcome “analysis paralysis.” The goal is to make the path to purchase as transparent and risk-free as possible during the highest-pressure weeks of the year.

5. De-risking the Close: RFP Automation and Procurement Compliance Videos

The final hurdles in B2B fiscal year-end procurement 2026 are often found in the legal and compliance review stages. To compress these cycles, organizations are turning to RFP response video automation and specialized compliance content.

RFP response video automation involves creating templated, requirement-by-requirement video walk-throughs. Each clip addresses a specific requirement ID, providing a summary of the response and a link to the supporting evidence, which reduces the back-and-forth between technical teams.

Contract negotiation support videos can also be used to explain clause trade-offs and business rationales. A short video explaining a liability cap or data retention policy can humanize a legal redline and help the buyer’s legal team reach a consensus faster.

Furthermore, procurement compliance videos are essential for addressing data security, privacy, and content moderation. These auditable explainers cover ISO 27001 and SOC 2 attestations, ensuring that the vendor meets all enterprise-grade requirements.

Solutions like TrueFan AI demonstrate ROI through their ability to provide these compliance-ready assets with built-in moderation and legal usage controls. Their enterprise-grade posture ensures that all data handling meets the stringent requirements of global procurement departments.

By automating the delivery of these “boring but critical” details through video, sales teams can clear the path for the final signature. This proactive approach to procurement compliance videos demonstrates a level of maturity that reassures stakeholders during the final Q4 push.

6. The Execution Playbook: From December Planning to March 31 Close

Success in B2B fiscal year-end procurement 2026 requires a disciplined timeline. The following execution playbook outlines the critical milestones from December through the March 31 deadline.

December: Foundation and Mapping

The first two weeks of December should be dedicated to a persona mapping workshop and the creation of an urgency matrix. Collect all security and compliance collateral and begin drafting scripts for the role-specific video variants.

In the latter half of December, produce the master videos and configure templates with dynamic variables. This is the time to connect CRM triggers and pilot the internal send to executive sponsors to ensure alignment before the January launch.

January: Launch and Evidence

Launch Wave 1 of the campaign to primary stakeholders. Monitor analytics such as watch time and WhatsApp open rates to identify which stakeholders are most engaged. Run micro-trials to generate role-specific proof that can be fed back into the video sequence.

February: Differentiation and Compliance

Launch Wave 2, focusing on competitive differentiation presentations. Deliver the RFP response video automation assets and publish the procurement compliance videos to the Digital Sales Room. This is the month to schedule executive sponsor nudges to clear any mid-level blockers.

March: The Final Push

The first three weeks of March are for deadline pushes and contract negotiation support videos. Hold daily stand-ups to clear any remaining procurement hurdles. In the final week, execute final escalations and prepare the close-won packaging for a smooth handover to the implementation team.

By following this structured timeline, teams can ensure that procurement committee video engagement remains high throughout the quarter, leading to a successful budget capture before the fiscal year ends. For CFO sign-off and budget logic, see technology spend and ROI guidance.

7. FAQ: Navigating the 2026 Fiscal Year-End

Q1: Why is the March 31 deadline so critical for B2B procurement in India?

The Indian financial year runs from April 1 to March 31. Most enterprise budgets are “use-it-or-lose-it,” meaning funds not legally committed by March 31 are typically returned to the general corporate pool, making Q4 the most intensive buying period.

Q2: How many stakeholders are typically involved in an enterprise procurement committee in 2026?

Current trends show that enterprise buying groups have expanded to include 6 to 10 stakeholders. This usually includes representatives from Finance (CFO), Technology (CTO), Security (CISO), Marketing (CMO), Legal, and Strategic Sourcing.

Q3: What role does video play in accelerating the procurement process?

Video serves as an asynchronous tool for decision-maker consensus building. It allows stakeholders to review complex ROI data, security postures, and implementation plans on their own schedule, reducing the need for multiple alignment meetings.

Q4: How can we ensure our Q4 video campaigns are compliant with enterprise security standards?

Enterprise-grade video platforms should offer ISO 27001 and SOC 2 certifications. Using a platform like TrueFan AI ensures that your enterprise budget utilization videos are delivered via secure, auditable channels with built-in content moderation.

Q5: What are the most effective delivery channels for Q4 deal acceleration in India?

While email remains the standard for audit trails, the WhatsApp Business API is increasingly dominant for executive engagement due to its 98% open rate. Combining WhatsApp with personalized Digital Sales Rooms (DSRs) provides the best balance of urgency and professional documentation. For WhatsApp execution patterns, see tactics and guidance.

Strategic Conclusion

The race to the March 31 deadline in B2B fiscal year-end procurement 2026 is won by those who can most effectively align their value proposition with the diverse needs of the buying committee. By implementing multi-stakeholder urgency mapping and deploying enterprise budget utilization videos, sales teams can cut through the Q4 noise.

The integration of personalized, role-specific video content—from RFP automation to competitive differentiation—provides the clarity and trust required to unlock “use-it-or-lose-it” budgets. As procurement becomes more AI-driven and risk-averse, the ability to deliver high-fidelity, compliant, and localized information will be the ultimate differentiator for enterprise success.

Frequently Asked Questions

Why is March 31 critical for Indian B2B procurement?

India’s financial year ends on March 31. Most enterprises operate on “use-it-or-lose-it” budget policies, so funds not committed by that date typically lapse, creating Q4 urgency.

How many stakeholders are involved in 2026 enterprise buying decisions?

Typically 6–10, spanning Finance (CFO), Technology (CTO), Security (CISO), Marketing (CMO), Legal, and Procurement. Consensus-building content is essential to avoid late-stage stalls.

How do personalized videos accelerate Q4 deals?

They deliver role-specific ROI, security, and implementation proof asynchronously, reducing meetings and aligning stakeholders faster with clear, high-fidelity evidence.

What channels work best—WhatsApp or email?

Use WhatsApp for immediacy and high open rates, paired with Digital Sales Rooms for centralized, auditable engagement. Email remains useful for formal trails.

How can we handle compliance and legal reviews quickly?

Provide RFP response automation and compliance explainer videos (e.g., ISO 27001, SOC 2) to cut review cycles and resolve redlines with clear, on-demand context.