UAE ESG Compliance: Your 2026 Reporting Roadmap, Green Bonds in Abu Dhabi, and Carbon Credit Trading in Dubai

Estimated reading time: ~14 minutes

Key Takeaways

- UAE ESG Compliance becomes mandatory by 2026, with 2025 data underpinning disclosures and potential penalties for non-compliance.

- A credible sustainable finance framework aligned to ADGM and UAE taxonomy unlocks lower-cost institutional capital.

- Green bonds Abu Dhabi issuance requires SPOs, impact reporting, and clear use-of-proceeds governance.

- Carbon credit trading in Dubai complements hard-to-abate decarbonization, with integrity ensured via the National Register and regulated exchanges.

- Deploy robust MRV systems and assurance-ready ESG data governance across Scope 1–3 to meet ISSB-aligned requirements.

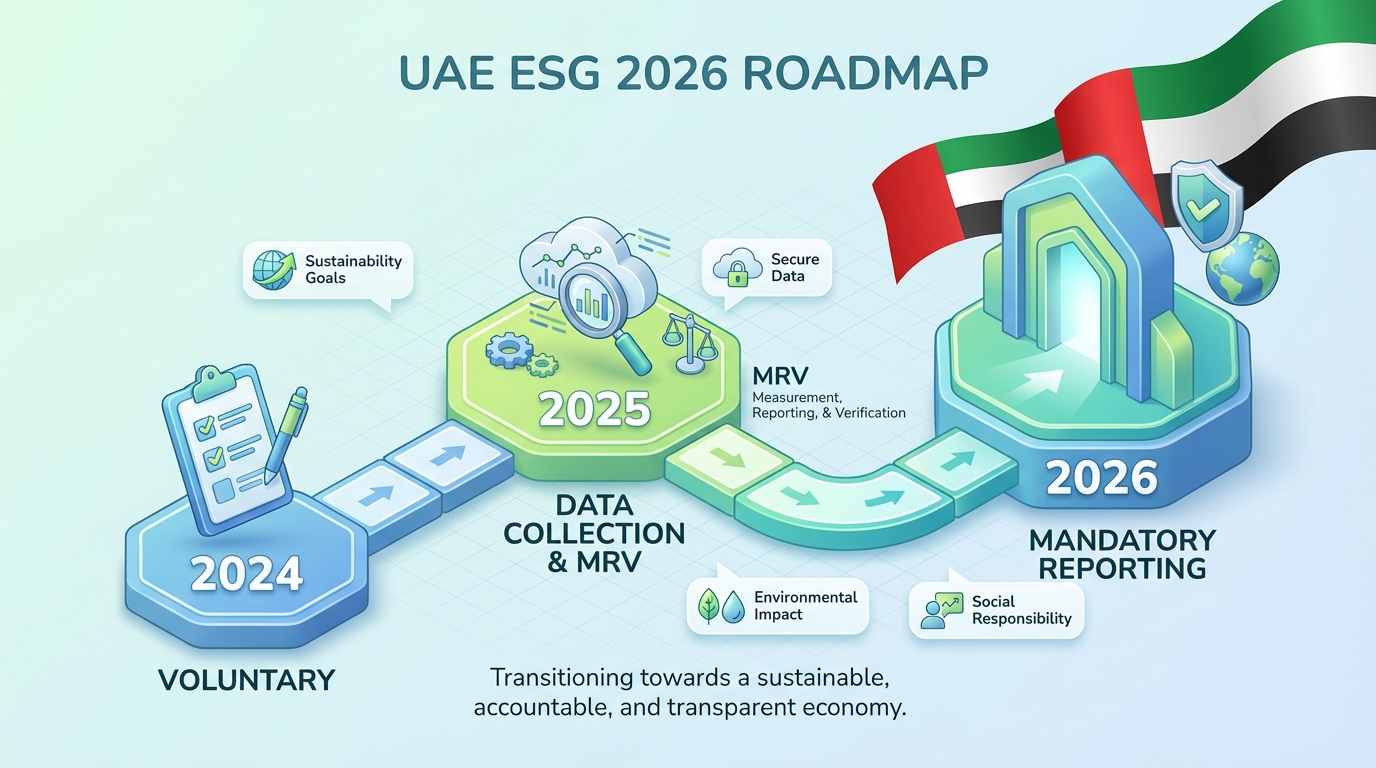

The landscape of UAE ESG Compliance is undergoing a seismic shift as the nation moves from voluntary disclosures to a mandatory, enforceable regulatory environment. By 2026, enterprises operating within the Emirates must align with a rigorous sustainable finance framework to maintain market access and secure institutional capital. This transition, anchored by the 2026 reporting horizon, requires organizations to integrate ESG reporting UAE 2026 protocols, leverage Green bonds Abu Dhabi insights for transition financing, and utilize carbon credit trading in Dubai guidance platforms to manage residual emissions.

Section 1: The Mandatory Shift Toward UAE ESG Compliance and Why 2026 is the Critical Deadline

UAE ESG Compliance is no longer a peripheral corporate social responsibility (CSR) initiative; it is a core regulatory requirement defined by the obligation to measure, manage, and disclose material sustainability risks. This framework aligns with international baselines, specifically the International Sustainability Standards Board (ISSB) IFRS S1 and S2, which focus on general sustainability-related financial disclosures and climate-related disclosures, respectively. For UAE-based entities, the shift toward mandatory reporting by 2026 signifies that data captured during the 2025 fiscal year will form the basis of public and regulator-facing disclosures due by mid-2026.

The regulatory trajectory is clear: the UAE Climate Law and exchange-specific rules from the Abu Dhabi Securities Exchange (ADX) and Dubai Financial Market (DFM) are converging. Enterprises must prepare for a regime where annual emissions reporting, decarbonization plans, and climate risk assessments are submitted through designated government Measurement, Reporting, and Verification (MRV) platforms. Failure to comply by the 2026 window is expected to trigger enforcement mechanisms, including financial penalties and restricted access to public tenders, as the UAE seeks to solidify its position as a global leader in the green economy.

To achieve robust UAE ESG Compliance, businesses must treat ESG data with the same rigor as financial reporting. This involves establishing internal controls, maintaining clear audit trails, and preparing for limited assurance—and eventually reasonable assurance—by third-party auditors. The scope of compliance initially prioritizes Scope 1 (direct) and Scope 2 (purchased energy) emissions, with Scope 3 (value chain) requirements being phased in based on sector materiality and organizational size.

Sources:

- UAE ESG Risk Revolution: Mandatory Climate Reporting Framework for 2026 and Beyond

- ESG Obligations for Private Companies under UAE Climate Law

- ESG Considerations in the UAE: What Businesses Need to Know for 2026

- UAE Sets New Global Benchmark with Enforceable ESG Law

- ESG Reporting and Biodiesel Compliance Strategy

- ISO 14001 and ESG Compliance Preparation for 2026

- Rise of ESG Consultancies as Companies Rush for Sustainability Tags

Section 2: Implementing a Sustainable Finance Framework to Unlock Institutional Capital

A comprehensive sustainable finance framework serves as the strategic bridge between an enterprise’s ESG performance and its ability to attract low-cost capital. In the UAE, this framework is increasingly dictated by the Abu Dhabi Global Market (ADGM) Sustainable Finance Regulatory Framework and the evolving UAE Sustainable Finance Taxonomy. For a CFO or Treasurer, implementing this framework means mapping eligible green or social activities, defining Key Performance Indicators (KPIs), and establishing a governance structure for the management of proceeds.

The ADGM’s framework, enhanced in 2024, provides a regulated environment for green funds, climate transition funds, and sustainability-linked instruments. By aligning with these standards, UAE enterprises can reduce “greenwashing” risks and enhance investor confidence. The UAE Sustainable Finance Working Group is also harmonizing classification systems to ensure that local green assets are recognizable to international investors, thereby shortening the due diligence cycle for cross-border participation.

For enterprises aiming for UAE ESG Compliance, the framework must include a Second-Party Opinion (SPO) to validate the credibility of their green claims. This external verification is essential for issuers of Green bonds Abu Dhabi, as it confirms that the use of proceeds aligns with the International Capital Market Association (ICMA) Green Bond Principles. By mapping capital expenditures (CAPEX) and operating expenditures (OPEX) to transition plans, companies can demonstrate a clear pathway to net-zero, making them more attractive to the growing pool of ESG-mandated assets.

Sources:

- ADGM Sustainable Finance Regulatory Framework

- UAE Sustainable Finance Working Group Taxonomy Development

- The Resilience of the ESG Movement Amid Global Shifts

Section 3: ESG Reporting UAE 2026: Technical Requirements and Data Governance

The technical core of ESG reporting UAE 2026 is built upon the four pillars of the ISSB: Governance, Strategy, Risk Management, and Metrics/Targets. Governance requires the disclosure of board-level oversight of sustainability risks and how management is held accountable through remuneration linkages. Strategy demands that enterprises conduct qualitative and quantitative resilience testing against various climate scenarios, ensuring that their business models can withstand the physical and transition risks of a warming world.

Risk management under the UAE ESG Compliance regime involves identifying and assessing risks across the entire value chain, including supplier-related vulnerabilities. To meet the 2026 requirements, enterprises must deploy sophisticated MRV systems to track activity data, select appropriate emissions factors, and maintain data lineage. This level of granularity is necessary to satisfy the GHG Protocol or ISO 14064 standards, which are the benchmarks for emissions accounting in the region.

Actionable Readiness Checklist for 2026

- 0–30 Days: Conduct a regulatory scoping exercise and refresh your materiality assessment to identify high-impact ESG topics.

- 30–90 Days: Implement MRV tooling to automate data collection, define your 2025 emissions baseline, and update board mandates.

- 90–180 Days: Perform a “dry-run” of your ESG disclosures, initiate external assurance scoping, and design an investor communications plan.

By mid-2026, listed entities on the ADX and DFM will be required to file comprehensive reports that include intensity metrics (e.g., emissions per unit of revenue) and progress against mid-term targets. Private companies, while currently facing fewer direct mandates, are increasingly being pulled into the compliance net through “Scope 3” requirements from their larger, listed customers and lenders.

Sources:

- ADX ESG Disclosure Guidance for Listed Companies

- DFM ESG Reporting Guide and Unified Metrics

- ISSB Adoption and the Rise of ESG Services

Section 4: Green Bonds Abu Dhabi: Financing the Transition to a Low-Carbon Economy

Green bonds Abu Dhabi have emerged as a premier instrument for financing large-scale sustainability projects in the Middle East. A green bond is a fixed-income instrument where the proceeds are exclusively applied to finance or re-finance eligible “Green Projects,” such as renewable energy, energy efficiency, or sustainable water management. For UAE enterprises, issuing these bonds requires a robust sustainable finance framework that outlines how the projects will be selected and how the impact will be measured (e.g., tonnes of CO2 avoided).

Abu Dhabi’s strategic advantage lies in its deep capital markets and the presence of regional giants like Masdar and TAQA, who have set the benchmark for green issuance. Masdar’s multi-billion dollar green bond programs demonstrate how a clear link between issuance and environmental impact can attract global institutional investors. These issuers publish annual allocation and impact reports, providing transparency on how every dollar is spent and the resulting environmental benefits.

The lifecycle of Green bonds Abu Dhabi involves several critical steps: framework development, obtaining an SPO, bookbuilding with investors, and ongoing post-issuance reporting. This process ensures that the bond remains compliant with international standards throughout its tenor. As the UAE moves toward the 2026 compliance deadline, the demand for these instruments is expected to surge, as they provide a verifiable way for companies to fund their transition plans while meeting UAE ESG Compliance expectations.

Sources:

- Masdar Green Finance Framework and Bond Issuance

- TAQA Green Bond Allocation and Impact Reporting

- ADGM Sustainable Finance Policy Context

Section 5: Carbon Credit Trading Dubai: Utilizing Market Instruments for Decarbonization

For many enterprises, achieving absolute zero emissions by 2026 is technically unfeasible, making carbon credit trading Dubai a vital component of a comprehensive decarbonization strategy. A carbon credit represents one tonne of CO2 equivalent reduced or removed from the atmosphere. In the UAE, the infrastructure for trading these credits is rapidly maturing, led by the Dubai Financial Market’s voluntary carbon credit pilot and the establishment of the AirCarbon Exchange (ACX) in ADGM.

The UAE National Register of Carbon Credits, managed by the Ministry of Climate Change and Environment (MOCCAE), serves as the sovereign registry to ensure the integrity of credits issued within the country. This registry prevents double-counting and ensures that credits meet high standards of additionality and permanence. For businesses engaged in ESG reporting UAE 2026, the use of carbon credits must be transparently disclosed, distinguishing between internal reductions and the use of offsets to meet net-zero claims.

The trading lifecycle in Dubai involves project origination, validation by independent bodies, issuance on the National Register, and secondary trading on platforms like DFM or ACX. Enterprises must exercise caution to ensure they are purchasing high-quality credits that align with their sustainable finance framework. When a credit is used to offset emissions, it must be “retired” on the registry to ensure it cannot be traded again, providing an audit-ready trail for UAE ESG Compliance verifiers.

Sources:

- DFM Voluntary Carbon Credits Market Launch

- UAE National Register of Carbon Credits (MOCCAE)

- ADGM and ACX Regulated Carbon Exchange Announcement

Section 6: The 2026 Enterprise Playbook for Integrated UAE ESG Compliance

To navigate the complexities of UAE ESG Compliance by 2026, enterprises must adopt an integrated playbook that combines regulatory reporting, financing, and market instruments. The first step is a 90-180 day readiness plan that focuses on data integrity. By establishing a Scope 1-3 emissions baseline using automated MRV tools, companies can identify their most significant “hotspots” and prioritize reduction efforts. This data forms the foundation of all ESG reporting UAE 2026 activities.

Simultaneously, the finance team should develop a sustainable finance framework that identifies future green investment needs. Whether through Green bonds Abu Dhabi or sustainability-linked loans, having a pre-approved framework allows the company to move quickly when market conditions are favorable. This strategy should be complemented by a clear policy on carbon credit trading Dubai, defining the quality criteria for any offsets used to address residual emissions.

Finally, governance must be elevated to the board level. This includes establishing a dedicated ESG committee, integrating sustainability KPIs into executive compensation, and setting up a rigorous internal audit process. By 2026, the expectation from investors and regulators will be “assurance-ready” data. A proactive approach to governance not only ensures compliance but also builds a narrative of transparency and leadership that can be communicated to all stakeholders.

Section 7: Communicating Your ESG Journey with TrueFan AI Enterprise

As the technical requirements for UAE ESG Compliance and ESG reporting UAE 2026 become more demanding, the challenge of communicating these complex updates to diverse stakeholders grows. Platforms like TrueFan AI enable enterprises to transform dense regulatory data and sustainable finance framework milestones into engaging, high-impact video content. Whether it is an update on Green bonds Abu Dhabi allocation or the integrity of a carbon credit trading Dubai program, visual storytelling is essential for maintaining investor trust and employee alignment.

TrueFan AI’s 175+ language support and Personalised Celebrity Videos allow global enterprises to localize their ESG narratives at scale. By using API-driven triggers, companies can push tailored video updates directly from their IR portals or CRMs, ensuring that stakeholders receive timely and relevant information. This level of personalization is particularly effective for explaining complex transition plans or the nuances of the UAE’s emerging green taxonomy.

Solutions like TrueFan AI demonstrate ROI through increased stakeholder engagement and improved comprehension of ESG performance. The platform offers virtual reshoots, allowing executives to update scripts as regulations evolve without the need for costly production cycles. With ISO 27001 and SOC 2-grade security, TrueFan AI ensures that sensitive corporate data is handled with the highest level of governance, making it a compliance-safe choice for enterprise-scale ESG communications.

Recommended Internal Links

- Best practices for green bond campaigns, SPOs, assurance, and post-issuance reporting — useful for Sections 2, 3, and 4, plus IR communication in Section 7.

- Operationalizing sustainable finance communications and Environmental ROI storytelling at scale — complements Sections 2, 4, and 7.

- Investor education for ESG and carbon credit participation via video — relevant to the intro, Section 5, and Section 7.

- Multilingual, video-first IR workflows aligned with assured data — supports Section 7’s communication strategy.

- Green bond marketing automation and stakeholder updates across WhatsApp and microsites — adds depth to Sections 4 and 7.

Frequently Asked Questions

Is UAE ESG Compliance mandatory in 2026 and what is the deadline?

Yes, for many entities, particularly those listed on the ADX and DFM, ESG reporting becomes mandatory by 2026. This means that data for the 2025 fiscal year must be collected and prepared for disclosure by mid-2026, aligning with the UAE’s broader climate and sustainability laws.

What is the UAE’s sustainable finance framework and how does taxonomy affect issuers?

The framework is a set of guidelines and regulations, such as those from ADGM, that define what constitutes a “green” or “sustainable” activity. The emerging UAE Sustainable Finance Taxonomy provides a standardized classification system, helping issuers avoid greenwashing and ensuring that their projects are recognized by international investors.

How do Green bonds Abu Dhabi work and which projects qualify?

Green bonds are used to fund projects with clear environmental benefits, such as solar parks or energy-efficient infrastructure. To issue these in Abu Dhabi, a company must have a framework aligned with ICMA principles, obtain a Second-Party Opinion, and commit to annual reporting on how the funds are used and their impact.

What is carbon credit trading Dubai and how does the National Register ensure integrity?

It is the buying and selling of verified carbon offsets on platforms like DFM or ACX. The UAE National Register of Carbon Credits ensures integrity by acting as a central database that tracks the issuance, transfer, and retirement of every credit, preventing double-counting and ensuring high environmental standards.

How can TrueFan AI help enterprises communicate ESG progress effectively?

TrueFan AI allows companies to create personalized, multi-language video explainers that simplify complex ESG data for investors, customers, and employees. This helps bridge the gap between technical compliance and stakeholder understanding, fostering greater transparency and trust.

What are the penalties for non-compliance with ESG reporting UAE 2026?

While specific penalty structures are still being finalized by various regulators, enterprises can expect financial fines, public censuring, and potential exclusion from government contracts or green financing incentives if they fail to meet the mandatory disclosure requirements by the 2026 deadline.