UAE Fintech Trends 2026: Digital Bank Licenses, Real-Time Payments CBUAE, Crypto Regulation ADGM, and Stablecoin Framework Dubai

Estimated reading time: ~15 minutes

Key Takeaways

- The UAE’s 2026 Regulatory Reset requires entities to align licenses with the new CBUAE Law by 16 September 2026.

- UAE digital bank licenses demand high capital, strong governance, and rigorous operational resilience/ICT risk and AML/CFT controls.

- Real-time payments via Aani (NPSS) now power P2P and P2M, and interlink with India’s UPI for low-cost cross-border flows.

- ADGM’s FSRA leads institutional crypto regulation with strict custody, surveillance, and technology governance standards.

- Dubai’s stablecoin framework spans VARA and CBUAE’s PTSR, requiring 100% reserves and FATF Travel Rule compliance.

The landscape of UAE Fintech Trends in 2026 represents a sophisticated convergence of regulatory maturity, cross-border interoperability, and advanced digital infrastructure. As the Central Bank of the UAE (CBUAE) concludes its 2023–2026 Strategic Plan, the focus has shifted from foundational digital transformation to the optimization of a robust, multi-layered financial ecosystem. For enterprise leaders, navigating this environment requires a granular understanding of federal mandates, free-zone specificities, and the integration of real-time payment rails that now link the UAE to global markets like India.

The 2026 context is defined by a critical regulatory milestone: entities subject to the new CBUAE Law have until 16 September 2026 to regularize their status and align their licensing permissions with the updated federal framework. This “Regulatory Reset” ensures that all financial institutions, from legacy banks to emerging neobanks, adhere to modernized standards of supervisory oversight and operational resilience. Platforms like TrueFan AI enable enterprise stakeholders to communicate these complex regulatory shifts to global teams through high-fidelity, localized video content, ensuring compliance alignment across diverse jurisdictions. ONDC personalized video onboarding

This guide provides an exhaustive analysis of the five pillars defining the UAE's fintech trajectory in 2026. We examine the pathways to obtaining a UAE digital bank license, the integration of real-time payments CBUAE (Aani), the institutional nuances of crypto regulation ADGM, and the evolving stablecoin framework Dubai. By synthesizing current data points and enterprise playbooks, this resource serves as the definitive roadmap for market entry and scaling within the Middle East’s premier financial hub.

Sources:

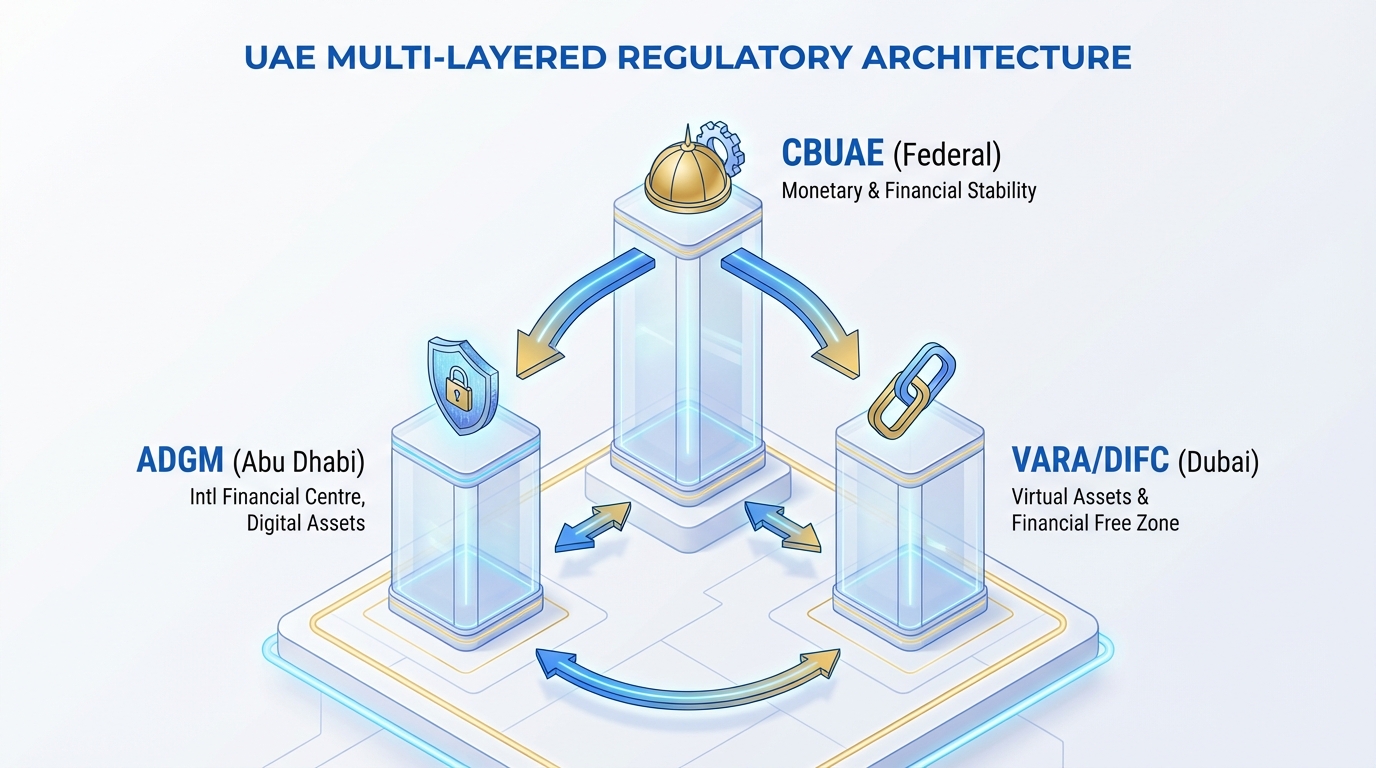

1. The Multi-Layered Regulatory Architecture of UAE Fintech Trends

Understanding UAE Fintech Trends requires a deep dive into the “layered” regulatory model that distinguishes between federal (onshore) jurisdiction and specialized financial free zones. In 2026, the interplay between these authorities has become more integrated, yet the distinction in scope remains vital for enterprise structuring. The CBUAE governs the onshore federal landscape, overseeing national payment systems, retail banking, and the newly implemented Payment Token Services Regulation (PTSR).

In contrast, the Abu Dhabi Global Market (ADGM) and the Dubai International Financial Centre (DIFC) operate as “islands” of common law with their own independent regulators—the FSRA and DFSA, respectively. Furthermore, the Dubai Virtual Assets Regulatory Authority (VARA) provides a specialized framework for virtual asset service providers (VASPs) operating within the Emirate of Dubai, excluding the DIFC. This architecture allows the UAE to offer bespoke environments for different business models, ranging from high-volume retail payments to institutional-grade virtual asset trading.

A significant coverage gap often missed by competitors is the “cross-emirate friction” that arises when a free-zone entity attempts to touch onshore retail liquidity. For instance, an entity licensed under crypto regulation ADGM must still align with CBUAE’s PTSR if it intends to offer AED-referenced “payment tokens” to the broader UAE public. Navigating this requires a dual-compliance strategy that accounts for both the prudential standards of the free zone and the federal mandates of the CBUAE.

Sources:

2. Securing a UAE Digital Bank License: Pathways and Prerequisites

The pursuit of a UAE digital bank license has become a primary objective for global fintech conglomerates and local consortia seeking to capitalize on the region's high digital adoption rates. Unlike traditional banking licenses, the digital bank framework focuses on entities that operate without a physical branch network, leveraging API-first architectures to deliver retail and corporate services. As of 2026, the market is led by pioneers like Wio Bank and Zand, which have set the benchmark for capital adequacy and technology risk management.

To obtain this license, enterprises must navigate a rigorous multi-stage application process with the CBUAE. The prerequisites include a minimum paid-up capital that often exceeds AED 2 billion for full-service digital banks, alongside a robust governance structure featuring UAE-experienced Non-Executive Directors (NEDs). The CBUAE mandates a comprehensive submission pack including a three-year financial projection, an Internal Capital Adequacy Assessment Process (ICAAP), and an Internal Liquidity Adequacy Assessment Process (ILAAP).

A critical 2026 update is the emphasis on “Operational Resilience” and “ICT Risk Management.” The CBUAE now requires digital banks to demonstrate 24/7 monitoring capabilities and a data localization strategy that aligns with federal data protection laws. Enterprises must also implement a “Compliance-by-Design” approach, ensuring that AML/CFT (Anti-Money Laundering and Countering the Financing of Terrorism) protocols are embedded into the core banking engine. This includes real-time transaction screening and automated Suspicious Activity Reporting (SAR) workflows.

Sources:

3. Real-Time Payments CBUAE: Navigating the Aani and NPSS Ecosystem

The implementation of real-time payments CBUAE, specifically through the Aani platform, has revolutionized the UAE’s domestic liquidity landscape. Aani, operating under the National Payment Systems Strategy (NPSS), enables 24/7 instant transfers using aliases such as mobile numbers or email addresses. By early 2025, Aani had already surpassed 1.5 million registered users, and by 2026, it has become the default rail for person-to-merchant (P2M) and person-to-person (P2P) transactions across the Emirates.

For enterprises, the integration of Aani offers transformative use cases, including instant payroll disbursements, request-to-pay (RTP) features for utilities, and real-time insurance payouts. The 2026 landscape is further enhanced by the interlinking of Aani with India’s Unified Payments Interface (UPI). UPI business account activation This cross-border corridor allows for seamless, low-cost remittances and retail spend enablement, tapping into the massive trade and expatriate flow between the two nations. Indian authorities have highlighted this as a cornerstone of the “India-UAE Bridge,” projecting significant growth in non-oil trade through 2026.

Integrating with real-time payments CBUAE requires connectivity via the Al Etihad Payments (AEP) gateway. Enterprises must implement robust fraud analytics to manage the risks associated with “instant” finality. This includes “Confirmation of Payee” services to prevent misdirected payments and sophisticated mule account detection algorithms. TrueFan AI's 175+ language support and Personalised Celebrity Videos can be utilized by banks to create multilingual onboarding tutorials for Aani, helping diverse customer segments navigate the instant payment interface with confidence. WhatsApp catalog video marketing guide

Sources:

- Al Etihad Payments: Aani User Milestones

- MEA India: Joint Statement on UPI-AANI Interlinking

- Gulf News: 2026 Payment Experience Trends

4. Institutional Crypto Regulation ADGM: The FSRA Virtual Asset Framework

The crypto regulation ADGM framework, governed by the Financial Services Regulatory Authority (FSRA), remains the gold standard for institutional virtual asset activities in the MENA region. In 2026, the FSRA has further refined its Virtual Asset Rulebook to include enhanced standards for fiat-referenced tokens (FRTs), custody of digital assets, and market abuse surveillance. The ADGM’s approach is rooted in “same risk, same regulation,” ensuring that crypto-native firms meet the same prudential and conduct standards as traditional financial institutions.

Enterprises seeking permissions under the ADGM regime can apply for various regulated activities, such as “Operating a Multilateral Trading Facility” (MTF), “Providing Custody,” or “Dealing in Investments as Principal.” A key differentiator of the ADGM framework is its focus on “Market Integrity.” Licensed entities must implement advanced surveillance systems to detect and prevent wash trading, spoofing, and other forms of market manipulation. Furthermore, the FSRA requires strict segregation of client assets and robust “cold storage” protocols for custodial services.

The 2026 evolution of crypto regulation ADGM also emphasizes “Technology Governance.” This involves regular independent audits of smart contracts, penetration testing of exchange infrastructure, and a comprehensive business continuity plan (BCP) that accounts for blockchain-specific risks like network forks or 51% attacks. For global enterprises, the ADGM provides a “passportable” reputation, allowing them to engage with institutional investors who require a high degree of regulatory certainty before committing capital to the virtual asset class.

Sources:

- ADGM FSRA: Financial Services Regulatory Authority Portal

- Baker McKenzie: 2026 Financial Institutions Reset

5. The Stablecoin Framework Dubai: Interplay Between VARA and CBUAE PTSR

The stablecoin framework Dubai is characterized by a unique dual-regulatory oversight that enterprises must navigate with precision. While Dubai’s VARA provides the rulebooks for virtual asset issuance and service provision within the Emirate, the CBUAE’s Payment Token Services Regulation (PTSR), issued as Circular 2/2024, governs the use of “payment tokens” for onshore transactions. This means that any stablecoin intended for use as a medium of exchange for goods and services in the UAE—specifically AED-referenced tokens—must receive CBUAE authorization.

The PTSR sets high bars for issuers, including mandatory reserve requirements where 100% of the token value must be backed by highly liquid, safe assets held in UAE-licensed banks. Issuers must also provide daily valuations and monthly independent attestations of their reserves. This framework is designed to prevent the systemic risks associated with algorithmic or under-collateralized stablecoins, ensuring that “payment tokens” maintain a stable 1:1 peg with their reference currency.

For VASPs operating in Dubai, VARA’s rulebooks cover market integrity, disclosure, and consumer protection. A significant coverage gap in many analyses is the “Travel Rule” implementation for stablecoins. In 2026, both VARA and CBUAE require full compliance with FATF (Financial Action Task Force) standards, meaning that originator and beneficiary information must be transmitted for every stablecoin transfer above a certain threshold. Solutions like TrueFan AI demonstrate ROI through their ability to automate the creation of personalized compliance training videos for VASP employees, ensuring that “Travel Rule” protocols are understood and executed flawlessly across the organization.

Sources:

- VARA: Virtual Assets Regulations and Rulebooks

- CMS LawNow: The New CBUAE Payment Token Services Regulation

- Addleshaw Goddard: CBUAE Sandbox and PTSR Updates

6. 2026 Enterprise Playbook: Compliance-by-Design and Macro Trends

As we progress through 2026, several macro trends are shaping the future of UAE Fintech Trends. The “Regulatory Reset” is driving a shift toward “Embedded Finance,” where non-financial companies integrate banking and payment services directly into their platforms. This is supported by the UAE’s Open Finance framework, which mandates the use of standardized APIs for data sharing and payment initiation. Enterprises must now view compliance not as a hurdle, but as a core product feature that builds trust with a digitally-savvy consumer base.

The 2026 Enterprise Checklist:

- Regulatory Alignment: Ensure all licensing permissions are regularized before the 16 September 2026 CBUAE grace period deadline.

- Aani Integration: Map API flows for real-time payments CBUAE, focusing on alias management and request-to-pay (RTP) use cases.

- AML/CFT Posture: Implement AI-driven transaction monitoring that aligns with federal AML laws and FATF “Travel Rule” requirements.

- Data Sovereignty: Audit data residency to ensure compliance with UAE federal data protection and CBUAE ICT risk standards.

- Multilingual Engagement: Utilize hyper-personalized communication tools to bridge the gap between complex regulatory requirements and end-user understanding. Vernacular voice SEO strategies

The “Fintech Roundup” of early 2026 indicates a high cadence of regulatory updates, with weekly consultation papers from the FSRA and VARA. Enterprises must remain agile, adopting “RegTech” solutions that can automate the tracking of these changes. The integration of AI in compliance is no longer optional; it is a necessity for managing the volume of data generated by real-time payment rails and virtual asset transactions.

Sources:

Disclaimer: This guide is for informational purposes only and does not constitute legal or financial advice. Regulatory frameworks in the UAE are subject to frequent updates; enterprises should consult with legal counsel to ensure full compliance with current CBUAE, ADGM, and VARA mandates.

Recommended Internal Links

- UPI business account activation — Practical playbook on instant payments onboarding and QR flows; useful context when planning Aani and UPI corridor experiences.

- WhatsApp catalog video marketing guide — How to automate multilingual, personalized video tutorials and payment flows over WhatsApp—ideal for Aani onboarding content.

- Vernacular voice SEO strategies — Tactics for multilingual discoverability and voice-led journeys; supports the Multilingual Engagement checklist item.

- WhatsApp catalog video marketing — Campaign blueprints for WhatsApp video-led funnels; aligns with using WhatsApp as a high-conversion compliance and onboarding channel.

- ONDC personalized video onboarding — Enterprise example of personalized, step-by-step video onboarding at scale—relevant to regulatory change communication and staff training.

Frequently Asked Questions

How do I obtain a UAE digital bank license in 2026?

To obtain a UAE digital bank license, you must apply to the CBUAE, demonstrating a minimum capital (often AED 2 billion), a robust tech stack, and a governance structure with UAE-experienced directors. The process involves pre-application meetings and a rigorous review of your ICAAP/ILAAP and AML/CFT frameworks.

What is the significance of the September 2026 deadline for UAE fintechs?

The 16 September 2026 deadline is the end of the grace period for entities to regularize their status under the new CBUAE Law. This ensures all financial institutions are fully aligned with the modernized federal licensing and supervisory standards.

How does Aani facilitate real-time payments CBUAE for businesses?

Aani allows businesses to initiate and receive payments instantly, 24/7, using aliases like mobile numbers. It supports request-to-pay (RTP) and QR-code payments, significantly improving cash flow and reducing the reliance on traditional settlement cycles.

Is crypto regulation ADGM applicable to businesses in Dubai?

Crypto regulation ADGM applies specifically to entities operating within the Abu Dhabi Global Market. However, if an ADGM-licensed entity provides services to onshore UAE clients or deals with AED-referenced tokens, it must also comply with CBUAE regulations, such as the PTSR.

How can TrueFan AI assist with fintech compliance in the UAE?

TrueFan AI can assist by automating the creation of high-quality, multilingual (175+ languages) compliance training and customer onboarding videos. This ensures that complex regulations like the stablecoin framework Dubai are communicated effectively to stakeholders and clients in real-time.

What is the difference between VARA and the CBUAE PTSR for stablecoins?

VARA regulates virtual asset service providers within Dubai (excluding DIFC), while the CBUAE PTSR governs “payment tokens” (stablecoins) used for onshore transactions across the UAE. Issuers of AED-referenced stablecoins typically require CBUAE authorization under the PTSR.