Tax Saving Urgency Marketing March 2026: BFSI Conversion Playbook for the March 31 Deadline

Estimated reading time: ~15 minutes

Key Takeaways

- Hidden operational cutoffs (e.g., ELSS by March 28) matter more than the legal March 31 deadline—communicate them early and clearly.

- Behavioral nudges using loss aversion, social proof, and the deadline effect—plus micro-commitments—consistently lift conversions.

- Segmented playbooks for HNIs, mass affluent, and employees drive relevance—blend concierge-led advice with payroll-linked pushes.

- Conversion toolkit: ELSS/NPS personalized calculators, countdown videos, and insurance benefit automation for last-mile action.

- Scale personalization compliantly with multilingual, dynamic video and a 14-day sprint framework aligned to DPDP and KYC.

1. The Procrastination Cliff: Why Tax Saving Urgency Marketing March 2026 is the BFSI Growth Window

The final weeks of the Indian financial year represent the most critical window for Banking, Financial Services, and Insurance (BFSI) institutions to drive Assets Under Management (AUM) and premium growth. As the fiscal year-end approaches, tax saving urgency marketing March 2026 becomes the primary lever for CMOs to capture the “procrastination premium” from millions of taxpayers. With the March 31 deadline looming, the intersection of behavioral science, hyper-personalization, and regulatory compliance defines the winners in this high-stakes environment.

The Indian tax landscape in 2026 is characterized by a sophisticated digital-first taxpayer base, yet the “procrastination cliff” remains a dominant behavioral reality. Despite early-year planning efforts, a significant portion of Section 80C, 80D, and 80CCD(1B) investments are executed in the final 14 days of March. This period is not merely a deadline; it is a psychological trigger where “present bias”—the tendency to overvalue immediate costs over future benefits—is finally overridden by the looming threat of tax leakage.

For BFSI marketers, the 2026 season presents unique operational challenges. While March 31 is the legal deadline, the operational reality is far tighter. Equity Linked Savings Schemes (ELSS) transactions often require earlier cutoffs to ensure same-day Net Asset Value (NAV) processing. In 2026, with specific non-business days falling at the end of the month, the effective deadline for many mutual fund houses may be as early as March 28. Failing to communicate this “hidden deadline” results in customer dissatisfaction and lost tax benefits.

Furthermore, the National Pension System (NPS) continues to be a high-growth instrument, offering an additional ₹50,000 deduction under Section 80CCD(1B). In a year where Budget 2026 has doubled down on compliance ease and digital transparency, the mandate for CMOs is clear: remove every ounce of friction from the investment journey. Platforms like TrueFan AI enable financial institutions to bridge this gap by delivering personalized, time-sensitive video nudges that transform abstract tax liabilities into immediate, actionable investment decisions.

Sources:

2. Behavioral Nudge Tax Marketing: Converting Intent into Action

Effective behavioral nudge tax marketing moves beyond generic “Save Tax” banners. It leverages cognitive biases to guide users toward optimal financial outcomes. In the 2026 context, three specific biases drive the highest conversion rates: loss aversion, social proof, and the deadline effect. By framing the conversation around the “pain of loss” (the specific amount of tax money “lost” to the government) rather than the “gain of saving,” marketers can trigger a more immediate response.

Ethical guardrails are paramount in this approach. Urgency must be grounded in operational truth. For instance, a countdown timer should reflect the actual AMC cutoff for ELSS NAV, not just the midnight stroke of March 31. Transparency regarding lock-in periods—such as the three-year mandate for ELSS or the liquidity constraints of NPS—builds long-term trust, which is the cornerstone of BFSI customer retention tax season strategies.

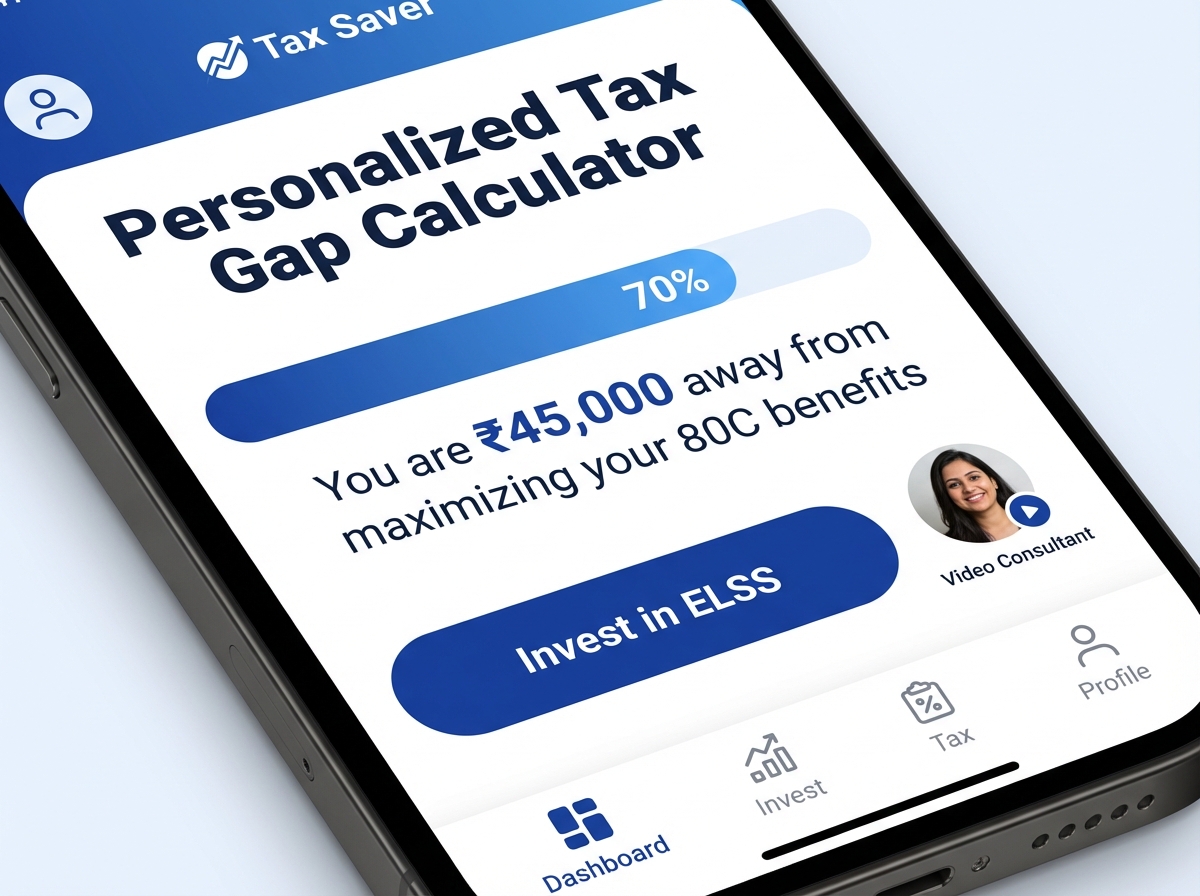

To implement these nudges at scale, BFSI entities are deploying “Time Anchors” and “Micro-commitments.” A time anchor might state: “Invest by 6 PM today to secure your 80C claim for this FY.” A micro-commitment involves a low-friction entry point, such as a “30-second tax gap checker.” These tools reduce the cognitive load on the taxpayer, making the path from realization to transaction as seamless as possible. In 2026, data shows that personalized nudges mentioning a user’s specific 80C shortfall can increase click-through rates by up to 40% compared to generic messaging.

Sources:

3. Segmented Playbooks: From HNI Wealth to Corporate Employee Tax Planning

A one-size-fits-all approach is the fastest way to dilute marketing ROI during the March madness. High-Net-Worth Individuals (HNIs) and corporate employees have vastly different tax-saving motivations and friction points. Corporate employee tax planning in 2026 is heavily influenced by the choice between the Old and New Tax Regimes. Marketing automation must first identify the user’s regime to provide relevant product recommendations. For those in the Old Regime, the focus remains on maximizing the ₹1.5 lakh 80C limit and the ₹50,000 NPS top-up (financial year-end marketing 2026 guide).

For the HNI segment, the strategy shifts toward HNI wealth management urgency. These individuals often require more sophisticated advice, such as optimizing Section 80G donations or managing capital gains through strategic rebalancing before the fiscal year ends. The journey for an HNI should be “concierge-led,” utilizing high-touch digital assets like tax consultant video consultations. A personalized video from a Relationship Manager (RM), detailing the specific gaps in a multi-crore portfolio, carries significantly more weight than a standard email.

Meanwhile, the “Mass Affluent” segment—primarily corporate professionals—benefits from payroll-linked pushes. By detecting an 80C shortfall after the February or March salary credit, banks can trigger automated product mixes. This might include a combination of ELSS for growth, NPS for retirement, and health insurance top-ups for Section 80D benefits. The goal is to provide salary-specific investment recommendations that align with the individual’s cash flow and risk profile, delivered via WhatsApp-first journeys with one-click execution capabilities.

Sources:

4. The 2026 Conversion Toolkit: ELSS Mutual Fund Personalized Calculators and Beyond

The 2026 toolkit for tax season is dominated by interactive, data-driven assets. At the heart of this is the ELSS mutual fund personalized calculators. These are no longer static web forms; they are dynamic modules that pull data from the user’s CRM profile to show real-time “Tax Savings Potential.” By inputting variables like age, salary band, and existing 80C investments, the calculator provides a clear output: “Invest ₹X in ELSS to save ₹Y in taxes.”

Complementing these calculators are NPS enrollment deadline videos. Given the complexity of NPS—with its Tier 1 and Tier 2 accounts, annuity requirements, and specific tax tiers—short-form video is the most effective medium for education. A 45-second video can explain the additional ₹50,000 benefit under Section 80CCD(1B) more effectively than a 1,000-word article. These videos should include live countdowns to bank-specific cut-offs, ensuring the user understands the urgency of the timestamp.

Insurance tax benefit automation represents the third pillar of the toolkit. For many, insurance is a “set and forget” product. Automation can detect unpaid premiums or lapsed policies and send personalized payment links that highlight the immediate tax impact. For example: “Pay your ₹15,000 premium by March 25 to claim Section 80D benefits for your parents.” This level of granularity transforms a routine bill payment into a strategic tax-saving move. Finally, 80C investment panic campaigns utilize investment deadline FOMO triggers—such as “Only 4 hours left for same-day NAV”—to drive the final surge of late-night transactions on March 30 and 31.

Sources:

5. Scaling Personalization and Financial Urgency Conversion Optimization

In the hyper-competitive March window, the ability to scale personalization determines market share. Financial urgency conversion optimization requires moving beyond segment-level messaging to individual-level relevance. TrueFan AI’s 175+ language support and Personalised Celebrity Videos allow BFSI brands to deliver high-impact messages that resonate emotionally and rationally. Imagine a customer receiving a video in their native tongue, addressing them by name, and accurately stating their remaining 80C limit—this level of “hyper-personalization” is the new standard for 2026.

Solutions like TrueFan AI demonstrate ROI through significantly higher engagement rates and reduced customer acquisition costs (CAC). By using AI-driven virtual reshoots, marketing teams can update their urgency messaging in real-time. If an AMC extends its cutoff or a new regulatory clarification emerges on March 29, the entire video campaign can be updated across thousands of personalized assets without a new shoot. This agility is crucial during the volatile final week of the financial year.

The integration of these assets into the multichannel mix—WhatsApp, SMS, and App Push—ensures that the message reaches the user where they are most active. Analytics dashboards now track not just clicks, but “watch-through” rates and “calculator completion” rates, allowing marketers to identify which specific personalization element (e.g., mentioning the user’s employer or city) is driving the highest lift in incremental AUM. In 2026, the data is clear: personalized video content generates 3.5x more conversions than static images in tax-saving campaigns.

Sources:

6. Fiscal Year-End Compliance Marketing and the 14-Day Execution Sprint

As we navigate the 2026 season, fiscal year-end compliance marketing must be at the forefront. The Digital Personal Data Protection (DPDP) Act of 2023 (interactive video data capture and consent) is now fully operational, requiring strict adherence to data minimization and explicit consent. Every personalized nudge, whether it’s a video or a calculator, must be backed by a robust audit trail of user consent. Furthermore, RBI’s evolving KYC guidelines for 2026 mean that “last-minute” investors may face hurdles if their documentation is not up to date. Marketing campaigns must include “KYC Check” nudges as early as March 1 to prevent transaction failures on March 31.

The execution of a successful March campaign follows a rigorous 14-day sprint:

- Days 1–4 (The Education Phase): Focus on “Tax Gap Analysis.” Deploy ELSS mutual fund personalized calculators and NPS explainer videos. Segment the database by tax regime and 80C utilization.

- Days 5–9 (The Consideration Phase): Launch 80C investment panic campaigns with a focus on “Loss Aversion.” Use salary-specific investment recommendations to show exactly how much can be saved.

- Days 10–12 (The Urgency Phase): Intensify March 31 countdown marketing. Deploy investment deadline FOMO triggers and open tax consultant video consultations for high-value segments.

- Days 13–14 (The Final Sprint): Focus on “Operational Certainty.” Provide real-time updates on payment gateway success rates and AMC cut-offs. Switch messaging from ELSS to NPS or Insurance if the mutual fund NAV window has closed.

This structured approach ensures that the marketing engine doesn’t just “scream louder” as the deadline nears, but rather provides increasing levels of value and clarity to the taxpayer.

Sources:

Frequently Asked Questions

As the clock ticks toward midnight on March 31, 2026, BFSI institutions must be prepared to answer the most pressing customer queries with speed and accuracy. March 31 countdown marketing is as much about support as it is about sales.

Is ELSS eligible under 80C if I invest on March 31?

While legally possible, it is highly risky. For an investment to qualify for the current financial year, the funds must reach the AMC, and the NAV must be assigned based on the cutoff times. If March 31 falls on a weekend or if there are banking delays, your investment might be processed with an April 1 NAV, making it ineligible for the 2025–26 tax year. It is strongly advised to complete ELSS transactions by March 28.

How does the New Tax Regime affect my 80C/80D strategy in 2026?

Under the New Tax Regime, most popular deductions like Section 80C (ELSS, LIC, PPF) and 80D (Health Insurance) are not available. However, the employer’s contribution to NPS under Section 80CCD(2) remains deductible. If you are in the New Regime, your focus should shift toward long-term wealth creation rather than immediate tax saving.

Can I still get the additional ₹50,000 NPS benefit?

Yes, Section 80CCD(1B) allows for an additional deduction of up to ₹50,000 for contributions to the NPS (Tier 1 account), over and above the ₹1.5 lakh limit of Section 80C. This is one of the most effective last-minute tax-saving tools for those in the Old Regime.

What happens if my payment fails on March 31?

Payment gateway congestion is common on the final day. Always have a backup payment method (like UPI or Net Banking) ready. BFSI providers often deploy insurance tax benefit automation to send instant receipts, but for mutual funds, the timestamp of the fund realization is what matters.

How can I get personalized advice in the final 48 hours?

Many leading banks now offer tax consultant video consultations through their mobile apps. Additionally, modern BFSI players use AI-driven personalized video to provide instant, tailored guidance on tax-saving gaps, ensuring you don’t miss the deadline due to a lack of information. See our guide to 80C investment personalized videos.