Digital fraud prevention India 2026: Hyper-personalized, vernacular video and WhatsApp automation for trust at peak season

Estimated reading time: ~12 minutes

Key Takeaways

- Shift from generic alerts to hyper-personalized, vernacular video education at key moments of risk across UPI, cards, and wallets.

- Deploy WhatsApp automation and in-app micro-interventions for real-time, behavior-aware safeguards during peak seasons.

- Target vulnerable cohorts—elderly, Tier-2/3, and youth—with segment-specific fraud scripts and local languages.

- Measure outcomes with fraud prevention ROI using leading (engagement) and lagging (loss reduction) indicators and robust governance.

- Run a seasonal operating model for Diwali and IPL with war-room content updates mapped to emerging scam patterns.

The landscape of digital fraud prevention India 2026 has evolved into a sophisticated battleground where traditional reactive measures are no longer sufficient to protect consumer assets. As the nation embraces a near-total digital economy, Chief Information Security Officers (CISOs) and Customer Protection Teams face an unprecedented surge in social engineering and payment-related crimes. Recent data underscores the gravity of this crisis, with editorial reports highlighting a staggering Rs 52,000 crore digital scam epidemic currently plaguing the Indian financial ecosystem.

Furthermore, financial institutions like South Indian Bank have noted that approximately ₹22,842 crore was lost to cyber fraud in the last year alone, signaling a critical need for proactive intervention. Digital fraud prevention India 2026 is defined as a coordinated enterprise program that combines multilingual education, behavior-aware nudges, channel automation, and rigorous governance to reduce successful social engineering and payment scams across UPI, cards, and wallets. This is particularly vital during peak shopping seasons like Diwali, the Great Indian Festival, and the IPL, where transaction volumes skyrocket and consumer vigilance often dips.

The sophistication of threats in 2026, as discussed by industry leaders at Davos and analyzed by firms like BioCatch, suggests that AI-enabled fraud is now the baseline. To counter this, enterprises must deploy customer trust building campaigns that prioritize hyper-personalized, vernacular video education and automated alerts. By shifting from generic warnings to context-aware interventions, organizations can effectively pre-empt scams and demonstrate a clear fraud prevention ROI measurement.

Sources:

- Telegraph India editorial: Rs 52,000 crore digital scam crisis

- South Indian Bank: Rising digital scams and how you can stay safe

- YouTube: Cyber fraud awareness discussion

- BioCatch: Rising fraud numbers in India

Why India’s 2026 payments landscape raises the stakes for UPI scam awareness videos

The Unified Payments Interface (UPI) has become the bedrock of Indian commerce, facilitating instant, interoperable, bank-account-linked real-time payments at a national scale. Managed by the National Payments Corporation of India (NPCI), UPI's ubiquity is both a triumph of financial inclusion and a massive surface area for malicious actors. According to the latest NPCI UPI Product Statistics, the sheer volume of monthly transactions has reached levels that demand education-at-scale to prevent systemic vulnerabilities.

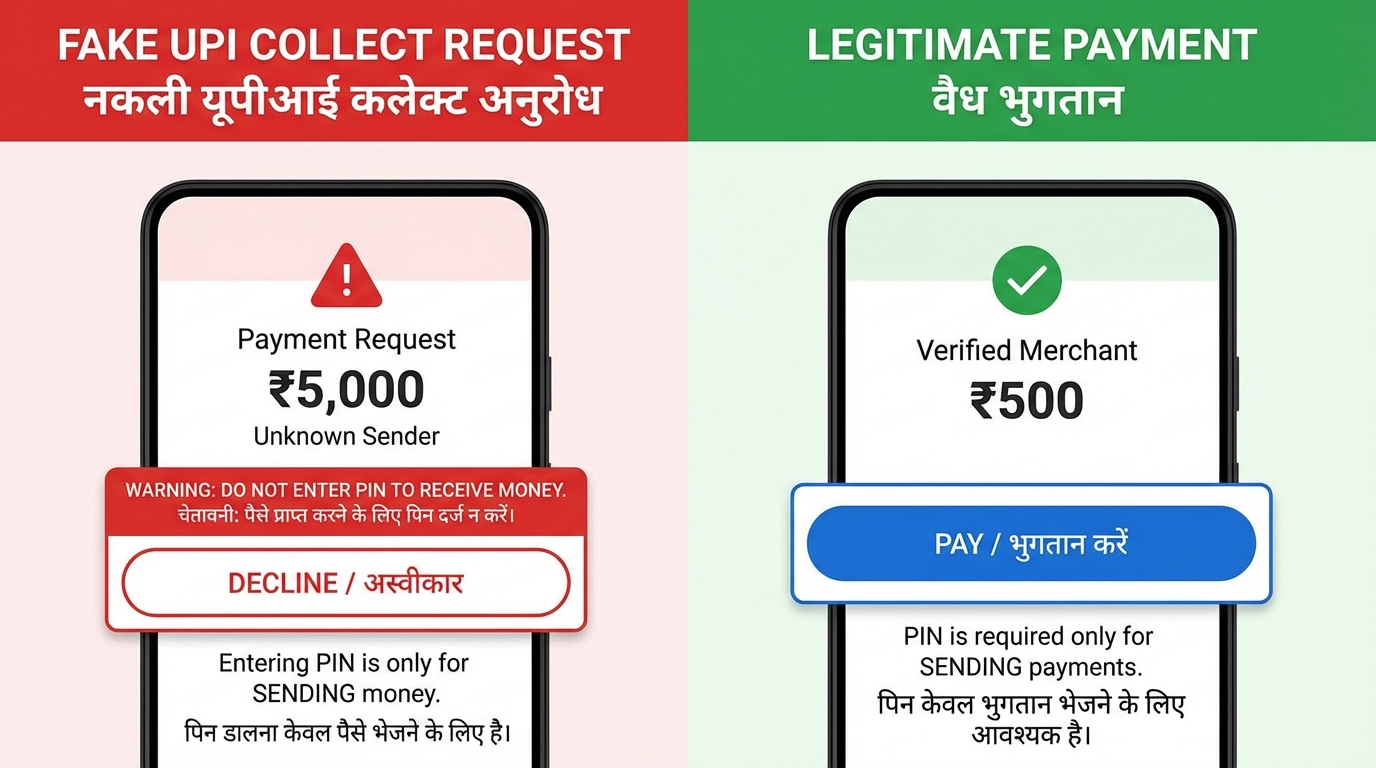

As the transaction surface expands, social engineering remains the primary vector for financial loss. Scammers exploit the "instant" nature of UPI to pressure victims into making irrevocable transfers. Consequently, security controls must evolve to include education at the exact "moments of risk." This is where UPI scam awareness videos and secure payment education videos become indispensable. These assets should be strategically intercepted into high-risk user flows, such as when a user receives a "collect money" request from an unknown VPA, attempts to add a high-value payee, or scans a QR code in an unfamiliar geographic location. Regional-language voice shopping

Benchmarking against international standards, such as those outlined in BCG’s analysis of UPI as a global benchmark, reveals that while the technology is world-class, the human element remains the weakest link. Implementing digital fraud prevention India 2026 strategies requires a shift toward visual, easy-to-consume content that demystifies complex payment flows. By integrating these videos directly into the app journey, banks and fintechs can provide real-time coaching that prevents the "request vs. collect" confusion that still accounts for a significant portion of UPI fraud.

Sources:

Targeting vulnerable segments with vernacular fraud awareness content

Effective fraud prevention is not a one-size-fits-all endeavor; it requires deep empathy and precision in targeting segments most susceptible to specific scam archetypes. In 2026, the digital divide is less about access and more about literacy and psychological resilience against high-pressure tactics.

Elderly customer protection campaigns

Senior citizens are frequently targeted through "digital arrest" scams and authority-based impersonation. Elderly customer protection campaigns must be designed with larger typography, slower narration, and a focus on "red flags" such as requests for screen-sharing or immediate "bail" payments. Scripts should emphasize that no Indian authority, including the CBI or Police, ever requests payments over WhatsApp or UPI. These campaigns should also encourage "caregiver co-targeting," where family members are alerted to help monitor the elderly user's digital safety.

Vernacular fraud awareness content for Tier-2/3 users

For the millions of new-to-UPI users in Tier-2 and Tier-3 cities, vernacular fraud awareness content is the only way to bridge the comprehension gap. These users often fall prey to QR code scams where they are told scanning a code will "deposit" money into their account. 15-30 second myth-busting shorts, delivered in regional dialects and featuring local cultural motifs, can effectively explain the technical reality: scanning a QR code and entering a PIN is always an outbound payment.

Youth, deal-hunters, and festival shopping security

The younger demographic, while digitally savvy, is often blinded by the urgency of "flash sales" and "limited-time offers" during peak seasons. Festival shopping security initiatives must focus on fake website detection education. This involves teaching users to look beyond the "padlock" icon and verify domain names, check for spelling anomalies in brand URLs, and prefer Cash on Delivery (COD) for unknown vendors. Creator-style explainers that mimic the aesthetic of social media can make these security lessons more engaging and shareable. Tier-2 festival commerce automation

Sources:

Phishing prevention personalization: Moving beyond generic alerts

In 2026, the most effective defense against social engineering is phishing prevention personalization. This strategy involves tailoring security content and warnings to a user’s specific risk profile, language preference, and real-time behavior. For instance, if a user clicks a suspicious link delivered via SMS, the system should immediately trigger a customized in-app or WhatsApp explainer detailing why that specific link was flagged.

Cyber security awareness personalization takes this a step further by creating adaptive learning paths. If a user consistently ignores generic security pop-ups but engages with video content, the system should prioritize video-based nudges. Behavioral signals such as unusual time-of-day login attempts, rapid additions of multiple payees, or link-click patterns from unverified senders should all serve as triggers for personalized intervention. Platforms like TrueFan AI enable enterprises to generate these personalized video responses at scale, ensuring that the warning is as relevant as the threat itself. Vernacular voice SEO strategies

As noted by DigitalTerminal, the ability for businesses to stay ahead of scammers in India depends on the coordination of timely alerts. By personalizing these alerts, organizations reduce "warning fatigue," ensuring that when a security notification appears, the user perceives it as a critical, relevant instruction rather than background noise. This level of personalization is essential for maintaining trust in a landscape where phishing, vishing, and smishing attacks are increasingly indistinguishable from legitimate communications.

Sources:

- DigitalTerminal: How businesses can stay ahead of scammers (India 2026)

- Sumsub: Digital trust trends in Asia

Stop the common scam patterns with digital arrest scam awareness

To effectively implement digital fraud prevention India 2026, organizations must address the specific mechanics of the most prevalent scam patterns. Understanding the taxonomy of these crimes allows for the creation of targeted marketing and educational materials that disrupt the scammer's script.

Digital arrest scam awareness

The "digital arrest" scam is a psychological extortion tactic where criminals impersonate law enforcement via video calls. They coerce victims into staying on the call for hours, claiming they are under "virtual observation" for money laundering or drug trafficking. Digital arrest scam awareness campaigns must hammer home a single truth: Indian law enforcement will never conduct a trial or demand bail money via a video call. The "Pause—Verify—Report" framework, coupled with the 1930 national helpline, should be the centerpiece of all creative assets.

OTP fraud prevention marketing

Despite years of warnings, OTP (One-Time Password) theft remains a major issue, often facilitated by SIM-swapping or screen-sharing apps. OTP fraud prevention marketing in 2026 must use dramatic, high-impact visuals to show the immediate consequences of sharing a code. Creative assets should demonstrate "safe flows," such as how a legitimate bank app looks versus a fraudulent request. TrueFan AI's 175+ language support and Personalised Celebrity Videos can be used to deliver these "Never Share OTP" messages through voices that users trust and recognize, significantly increasing message retention.

Fake website detection education: A 6-step HowTo

Phishing sites have become incredibly sophisticated, often mirroring the exact UI/UX of major retailers like Amazon or Flipkart. To protect users, enterprises should promote a 6-step fake website detection education checklist:

- Domain Verification: Check for extra characters or misspellings (e.g., amozon.in instead of amazon.in).

- HTTPS & Certificate: Ensure the site uses HTTPS, but remember that scammers can also obtain SSL certificates.

- Visual Anomalies: Look for low-resolution logos, broken links, or inconsistent fonts.

- Policy Pages: Legitimate sites have detailed "About Us," "Contact," and "Refund Policy" pages.

- VPA Name Match: When paying via UPI, ensure the name on the payment screen matches the brand.

- Trial Payment: For unknown sites, try a small Rs 1 payment first to see if the merchant details look suspicious.

Sources:

WhatsApp scam alert automation and real-time safeguards

WhatsApp has become the primary communication channel for millions of Indians, making it both a high-risk environment and a powerful tool for security. WhatsApp scam alert automation regional-language voice shopping guide allows enterprises to send programmatic, trigger-based warnings the moment a risky event is detected. For example, if a user's account shows a high-risk "collect request" from an unverified VPA, a webhook can trigger a personalized video alert on WhatsApp within seconds.

This flow requires a consented opt-in, ensuring that users are prepared to receive these critical alerts. The automation should include an escalation path: if a user repeatedly ignores warnings, the system can trigger a call-back from a human agent or temporarily freeze high-value transactions. To prevent fatigue, rate-limiting and a preference center are essential, allowing users to choose the intensity of their security notifications.

In-app interstitials also play a vital role at "moments of truth." Before a user enters an OTP or approves a large transaction, a 5-second secure payment education video can serve as a final check. These micro-interventions are far more effective than long-form training modules because they occur exactly when the user is most vulnerable to making a mistake. By integrating these safeguards, brands can build a reputation for proactive protection, which is a cornerstone of digital fraud prevention India 2026. Multilingual voice marketing automation

Sources:

- DigitalTerminal: How businesses can stay ahead of scammers (India 2026)

- I4C: National cyber awareness hub

Proving impact: Fraud prevention ROI measurement and governance

For CISOs, the challenge is often justifying the spend on awareness campaigns. This requires a robust fraud prevention ROI measurement framework that tracks both leading and lagging indicators. Leading indicators include video completion rates, the number of "risky links" blocked after an education campaign, and an increase in users reporting scams via the 1930 helpline or in-app tools. Regional-language voice shopping strategies

Lagging indicators provide the financial justification: a measurable reduction in fraud losses within targeted cohorts and a drop in the number of OTP-sharing incidents. Solutions like TrueFan AI demonstrate ROI through their ability to scale these personalized interventions without a linear increase in costs, providing a dashboard that maps campaign bursts to a decline in successful scams. Experiment design, such as using geo-fenced holdout groups during the festival shopping security window, allows for a "difference-in-difference" analysis to prove causality.

Governance is equally critical. All automated communications must align with India’s Digital Personal Data Protection (DPDP) Act. This includes maintaining audit trails of what was sent, ensuring human-in-the-loop review for AI-generated content, and providing clear opt-out mechanisms. A rigorous governance stack ensures that while the organization is being proactive, it is also remaining compliant and maintaining the highest standards of data privacy. Vernacular voice SEO strategies

Sources:

Operating model for peak seasons: Diwali, Dussehra, and IPL

The surge in transaction volume during India’s festive and sporting seasons requires a specialized operating model. Digital fraud prevention India 2026 is not a static process; it must be dynamic and seasonal.

- Pre-Peak (T-6 to T-2 weeks): This phase focuses on creative localization and building the "consent" database. Organizations should line up celebrity-led variants of UPI scam awareness videos and test the automated triggers for WhatsApp delivery. Co-branding with authorities like the I4C or SBI adds a layer of credibility that is vital for trust.

- Peak (T0 to T+3 weeks): During the actual festival or IPL window, a 24x7 "war room" approach is necessary. Real-time content tweaks should be made based on the latest scam memes or trending social engineering tactics. If a new "fake cashback" scam goes viral on Day 1 of a sale, the automated system should be updated with a specific rebuttal video by Day 2. Voice SEO for regional festivals

- Post-Peak (T+1 to T+3 weeks): The final phase involves a deep-dive analysis of incidents. By creating heatmaps of where content performed best and where losses still occurred, teams can refresh their playbooks for the next seasonal spike. This continuous loop of "Educate-Detect-Respond-Analyze" is the only way to stay ahead of the evolving threat landscape.

Conclusion

The imperative for digital fraud prevention India 2026 is clear: as scammers become more sophisticated, our defense mechanisms must become more personal, visual, and proactive. By moving away from static warnings and embracing hyper-personalized, vernacular video education, enterprises can build a "human firewall" that is resilient to even the most convincing social engineering tactics.

The integration of WhatsApp scam alert automation and real-time behavioral nudges ensures that security is not just a policy, but a lived experience for the user. As we navigate the high-stakes environments of the Great Indian Festival and the IPL, the ability to measure the ROI of these customer trust building campaigns will separate industry leaders from those left vulnerable to the ₹52,000 crore scam crisis. The future of digital trust in India depends on our ability to educate at the speed of fraud.

Frequently Asked Questions

What is a digital arrest scam?

A digital arrest scam is a form of social engineering where fraudsters impersonate law enforcement officers (CBI, Police, or Customs) via video calls. They claim the victim is involved in a crime and "arrest" them virtually, demanding money for "clearance" or "bail." Remember, no Indian authority will ever conduct such proceedings over a video call or ask for money via UPI.

How can I verify a UPI collect request safely?

Before approving any UPI request, check the VPA (Virtual Payment Address) of the requester. Legitimate merchants will have a verified name. Never enter your UPI PIN to receive money; a PIN is only required to send money. If you are unsure, reject the request and contact the merchant through their official website.

What should I do if I accidentally shared my OTP?

Immediately freeze your bank accounts and cards using your banking app. Change your net banking passwords and report the incident on the national cybercrime helpline at 1930 or via the National Cybercrime Reporting Portal. Timely reporting is crucial for the potential recovery of funds.

How does TrueFan AI help in digital fraud prevention India 2026?

TrueFan AI provides a platform for generating hyper-personalized, multilingual security videos that can be triggered in real-time via WhatsApp or in-app webhooks. This allows banks and enterprises to deliver context-specific warnings that are far more effective than generic security alerts.

How can I identify a fake shopping website?

Check the URL for slight misspellings of famous brands. Look for the presence of clear contact information and a physical address. If a deal looks too good to be true (e.g., an iPhone for Rs 5,000), it is almost certainly a scam. Use a small test payment of Rs 1 to see the recipient's name before committing to a larger transaction.