Tax saving urgency marketing March 2026: Behavioral triggers and AI video playbooks to close 80C investments before March 31

Estimated reading time: ~12 minutes

Key Takeaways

- Use behavioral triggers like loss aversion and scarcity to drive timely 80C actions before March 31.

- Interactive calculator videos personalize ELSS, NPS, PPF, and insurance choices while staying DPDP-compliant.

- Balance urgency with compliance by highlighting practical cut-offs (e.g., ELSS NAV dates) and mandated disclosures.

- Corporate employee drives and salary-specific journeys reduce choice overload and speed proof submissions.

- Post-deadline retention playbooks convert tax savers into long-term investors using refund reinvestment and analytics.

The final quarter of the 2025–26 financial year presents a high-stakes window for BFSI CMOs and wealth management leaders. As the March 31 deadline looms, the Indian market witnesses a massive surge in last-minute tax-saving activity, with millions of taxpayers seeking to exhaust their Section 80C limits. To capture this demand, financial institutions must move beyond generic reminders and adopt sophisticated tax saving urgency marketing March 2026 strategies.

The challenge in 2026 is twofold: navigating the increasing complexity of the Digital Personal Data Protection (DPDP) Act and overcoming the cognitive load that leads to investor inertia. Platforms like TrueFan AI enable BFSI brands to break through this noise by deploying hyper-personalized, interactive video journeys that transform a stressful compliance task into a seamless, guided experience. By integrating behavioral science with real-time data, firms can drive significant uplifts in ELSS, NPS, and insurance conversions.

1. Behavioral Science and March 31 Countdown Marketing Automation

Effective tax-season marketing relies on understanding the psychological state of the investor during the “March Rush.” Behavioral triggers such as loss aversion and scarcity are not merely marketing tactics; they are essential tools for guiding users toward timely financial decisions. In 2026, March 31 countdown marketing automation has evolved to include dynamic, micro-deadline messaging that reflects the operational realities of the Indian banking system.

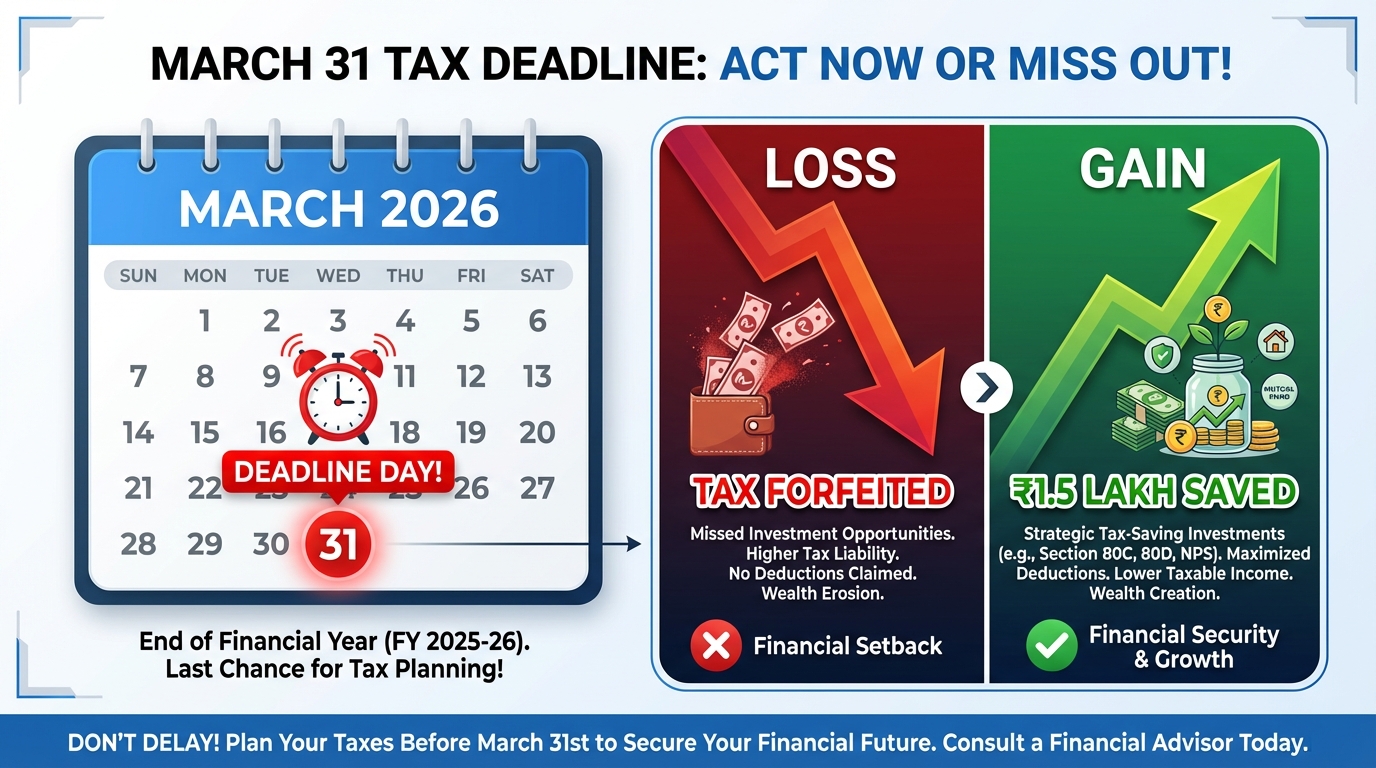

Loss aversion is a primary driver in tax planning. Investors are more motivated by the “loss” of a tax deduction than the “gain” of a future return. Framing a campaign around the potential forfeiture of the ₹1.5 lakh Section 80C deduction, or the additional ₹50,000 available under Section 80CCD(1B) for NPS, creates immediate psychological stakes. When a user sees the specific rupee impact on their post-tax income—calculated based on their 20% or 30% tax slab—the urgency becomes tangible.

However, urgency must be balanced with accuracy. While March 31 is the legal deadline, the practical deadline for many instruments is earlier. For instance, ELSS mutual fund processing often requires a NAV cut-off that can fall as early as March 28. Using compliance deadline FOMO triggers that highlight these operational cut-offs prevents last-minute transaction failures and builds trust. Automated countdown timers embedded in personalized videos or WhatsApp messages provide a visual nudge that reduces the “procrastination gap.”

To operationalize this, wealth management firms are utilizing commitment devices. A “one-click reserve” feature allows users to pledge an investment amount, which then triggers a sequence of pre-filled application steps. This reduces the friction between the intention to save tax and the execution of the investment. By combining these behavioral nudges with automated delivery, BFSI brands can maintain a persistent yet helpful presence in the investor's decision-making journey.

Sources:

- Treelife: Important Financial Timelines Before 31st March 2026

- Economic Times: ELSS deadline nuance—why March 28 matters

2. Interactive 80C Investment Calculator Videos and Personalization

The complexity of choosing between ELSS, NPS, PPF, and insurance often leads to “choice overload,” where the investor does nothing because they are overwhelmed by options. In 2026, the industry has shifted toward 80C investment calculator videos to solve this. These are not static tools but interactive video experiences that capture zero-party data—information a customer intentionally shares—to provide immediate, tailored advice. To quantify the savings impact and pitch mix precisely, pair calculators with tax saving ROI calculators.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow these calculators to resonate across India’s diverse demographic landscape. A user might receive a video where a familiar face explains their specific tax-saving “headroom.” Through interactive overlays, the user inputs their salary band, current 80C utilization, and age. The video then dynamically branches to show a personalized recommendation card.

For a younger professional in a high-tax bracket, the video might prioritize ELSS for its 3-year lock-in and equity growth potential. For a mid-career professional, it might highlight the dual benefit of NPS for retirement and the extra ₹50,000 deduction. These salary-specific investment recommendations ensure that the advice is relevant and actionable. This level of personalization is critical for investment decision paralysis solutions, as it narrows the field of choice to the most beneficial options for that specific individual.

Furthermore, these interactive journeys are designed with DPDP compliance at their core. Before any data is captured, a micro-modal provides a clear notice of purpose, ensuring that the collection of salary or age data is consensual and transparent. This “privacy-first” personalization builds a foundation of trust that is essential for high-value financial transactions. The data captured is then synced in real-time with the CRM, allowing for immediate follow-up by human advisors if the user expresses interest but doesn't complete the transaction (interactive video data capture guide).

Sources:

3. ELSS Mutual Fund Panic Campaigns and NPS Personalization

As the final week of March approaches, the marketing tone shifts from education to execution. ELSS mutual fund panic campaigns (executed with responsible urgency) focus on the unique benefits of Equity-Linked Savings Schemes. ELSS remains a favorite due to its shortest lock-in period among 80C options and its potential for market-linked wealth creation. However, the “panic” element must be managed carefully to comply with SEBI and AMFI guidelines. For a full D‑day playbook, see the March 31 urgency guide and the panic marketing playbook.

Campaigns must clearly state that “Mutual Fund investments are subject to market risks” and advise users to “read all scheme-related documents carefully.” In 2026, these disclosures are integrated into the video experience itself, often as persistent overlays or mandatory viewing segments before the CTA becomes active. The urgency is framed around the “Practical Deadline”—reminding investors that to secure the NAV for the 2025–26 financial year, they must complete their transaction before the AMC's specific cut-off time, often days before March 31.

Simultaneously, NPS enrollment deadline personalization targets the specific “extra” deduction available under Section 80CCD(1B). Many taxpayers exhaust their ₹1.5 lakh 80C limit through EPF or insurance but overlook the additional ₹50,000 benefit offered by the National Pension System. Marketing journeys for NPS in 2026 use age-based glide path visuals to show how a small investment today impacts the retirement corpus (NPS enrollment deadline videos).

Personalization logic for NPS also distinguishes between corporate and government employees, as their contribution structures and tax benefits under Section 80CCD(2) differ. By providing last-minute tax saving comparisons between ELSS and NPS within a single video interface, BFSI brands can help users allocate their remaining budget across the most tax-efficient instruments. This dual-track approach ensures that the institution captures the maximum possible “wallet share” of the user's tax-saving budget.

Sources:

4. Insurance Tax Benefit Urgency and HNI Wealth Management

Insurance remains a cornerstone of the 80C and 80D landscape. Insurance tax benefit urgency videos in 2026 focus on the dual value of “Protection + Deduction.” Unlike market-linked investments, insurance often requires a more detailed KYC and medical underwriting process, making the March 31 deadline even more critical. Marketing flows must emphasize that “securing the policy” is not instantaneous and should be initiated well before the final 48 hours. To keep persistency high and lapses low during March, pair with renewal personalization tactics.

For health insurance, the focus shifts to Section 80D, where deductions are available for premiums paid for self, spouse, children, and senior citizen parents. Urgency videos use “gap analysis” to show users what they are currently missing in terms of coverage and tax savings. Solutions like TrueFan AI demonstrate ROI through these journeys by providing real-time quote read-outs within the video, allowing the user to see exactly what their premium and tax saving will be without leaving the experience.

High-Net-Worth Individuals (HNIs) require a different approach. HNI wealth advisor video consultations are “white-glove” flows that offer a higher level of sophistication. Instead of a standard calculator, the HNI receives a personalized video from their dedicated advisor (or a high-quality AI avatar of a senior leader) discussing their specific portfolio exposure and tax-saving opportunities. These videos often include a direct calendar embed, allowing the HNI to book a priority consultation within 24 hours.

This segment is also where financial advisor lead generation is most potent. By using AI to screen and score leads based on the user's interaction with the video—such as which sections they re-watched or which data points they entered—firms can route the “hottest” leads to their most senior advisors. This ensures that the limited time of human experts is spent on the highest-value opportunities during the peak March rush.

Sources:

5. Corporate Employee Drives and Overcoming Decision Friction

A significant portion of last-minute tax saving comes from salaried employees who must submit “proof of investment” to their HR departments to avoid heavy TDS (Tax Deducted at Source) in their March paychecks. Corporate employee tax planning drives are co-branded journeys between the financial institution and the employer. These campaigns are delivered via HR portals, internal Slack/Teams channels, and corporate email (financial wellness video campaigns). For appraisal-season alignment and benefits literacy, extend to HR-led programs.

These drives utilize salary-specific investment recommendations tailored to the employee's specific pay grade and tax bracket. For example, an entry-level employee might be nudged toward a small ELSS SIP, while a senior executive is shown the benefits of maximizing NPS and high-value term insurance. The “urgency” here is tied to the internal payroll deadline, which is often a few days before March 31. Videos explain exactly how to download the investment proof and where to upload it in the HRMS, closing the loop on the entire process.

To combat investment decision paralysis solutions, these corporate journeys use “progressive disclosure.” Instead of showing a list of 20 mutual funds, the video presents the “Top 2 Fits” based on the employee's profile. If the employee wants more options, they can click to expand, but the default path is designed for speed and simplicity. This “choice architecture” is essential for converting users who are stressed by both their professional workload and the tax deadline.

Social proof also plays a role in these corporate environments. Messaging such as “85% of your colleagues have already submitted their 80C proofs” creates a healthy sense of “positive FOMO.” When combined with a “Speak to an Advisor Now” button that promises a call-back within 60 seconds, the friction to invest is virtually eliminated.

Sources:

6. Compliance, Data Governance, and Post-March Retention

In the 2026 regulatory environment, every marketing action must be underpinned by robust governance. The SEBI Master Circular for Investment Advisers (June 2025) requires firms to “disclose to the client the extent of use of Artificial Intelligence” in advisory workflows. This means that any AI-driven recommendation in a video must be accompanied by a clear disclosure. Similarly, the DPDP Act mandates that consent must be “explicit, informed, and revocable.” For privacy-first data capture patterns and consent orchestration, see the implementation guide.

Beyond the March 31 deadline, the focus shifts to BFSI customer retention tax season strategies. The goal is to turn a one-time tax saver into a long-term investor. Tax refund maximization campaigns are launched in April and May, helping users file their returns correctly and suggesting that they “re-invest” their tax refund into a systematic investment plan (SIP) for the next financial year. This moves the conversation from “emergency saving” to “planned wealth creation” (predictive analytics for retention).

Measurement of these campaigns goes beyond simple click-through rates. Leading indicators include video completion rates, the accuracy of data captured in calculators, and the volume of advisor bookings. Lagging indicators focus on the total AUM (Assets Under Management) gathered, the reduction in TDS-related customer queries, and the 12-month retention rate of the newly acquired customers. By analyzing sentiment and interaction patterns within the interactive videos, BFSI brands can refine their scripts and offers in real-time.

Finally, security is paramount. All data processed through these interactive journeys must adhere to ISO 27001 and SOC 2 standards. In a world of increasing deepfakes and financial fraud, ensuring that the personalized video comes from a verified, secure source is the ultimate builder of trust.

Sources:

Glossary of Terms

- Section 80C: A provision under India’s Income Tax Act allowing deductions up to ₹1.5 lakh on specified investments/expenses (ELSS, PPF, Life Insurance, etc.) in the old tax regime.

- ELSS (Equity-Linked Savings Scheme): A mutual fund eligible under Section 80C with a mandatory 3-year lock-in. It offers market-linked returns and has the shortest lock-in among 80C options.

- NPS (National Pension System): A retirement product regulated by PFRDA. Contributions are eligible under Section 80CCD(1) and an additional ₹50,000 under 80CCD(1B).

- Section 80D: A deduction for health insurance premiums paid for self, family, and parents, separate from the 80C limit.

- DPDP Consent: Explicit, informed, and revocable permission from an individual to process their personal data for specified purposes, as mandated by the Digital Personal Data Protection Act.

- Zero-Party Data: Information that a customer intentionally and proactively shares with a brand, such as their financial goals or salary band, usually collected via interactive experiences.

Recommended Internal Links

- Urgency playbook for March 31 campaigns — D‑day messaging and behavioral nudges

- D‑day countdown and processing cut-offs guide — Practical deadlines and NAV windows

- 80C calculator videos and personalization mechanics — Reduce choice overload with tailored flows

- Calculators to quantify tax-saving ROI — Show impact by slab and instrument

- DPDP-compliant interactive video data capture — Consent, notices, and secure sync

- Behavioral nudge tactics for ELSS — Loss aversion, scarcity, and framing

- NPS 80CCD(1B) enrollment deadline flows — Visual glide paths and extra deductions

- Insurance urgency and instant-issuance playbooks — Close before underwriting cut-offs

- March renewal personalization for insurers — Persistency and lapse reduction

- Corporate employee financial wellness drives — Co-branded HR distributions

- Appraisal-season benefits and payroll-aligned nudges — Proof workflows and reminders

- Post‑March retention analytics and automation — Refund reinvestment to SIPs

Frequently Asked Questions

What is the actual deadline for Section 80C investments in 2026?

The legal deadline is March 31, 2026. However, for instruments like ELSS mutual funds, the practical deadline is often March 28 due to banking holidays and NAV cut-off times. It is advisable to complete all transactions at least 3–4 days in advance to ensure the investment is processed within the financial year.

Can I claim deductions for both NPS and ELSS?

Yes. You can claim up to ₹1.5 lakh under Section 80C, which includes ELSS, PPF, and insurance. Additionally, you can claim an extra ₹50,000 under Section 80CCD(1B) specifically for NPS contributions, bringing your total potential deduction to ₹2 lakh.

How do interactive 80C investment calculator videos protect my data?

In 2026, these tools must comply with the DPDP Act. Before you enter any information, the platform must provide a clear notice explaining what data is being collected (e.g., salary, age) and for what purpose. You have the right to withdraw your consent at any time. TrueFan AI ensures all interactive data capture is DPDP-compliant and secured with enterprise-grade encryption.

What happens if I miss the March 31 deadline?

If you miss the deadline, you cannot claim those investments as deductions for the Financial Year 2025–26. This could result in higher tax liability and a lower take-home salary if your employer has already deducted TDS based on your projected savings.

Is health insurance premium part of the ₹1.5 lakh 80C limit?

No. Health insurance premiums are covered under Section 80D, which is a separate deduction. You can claim up to ₹25,000 for yourself/family and an additional amount for parents (up to ₹50,000 if they are senior citizens).

Do I need to disclose if an AI tool recommended my investment?

Yes, according to SEBI's 2025 guidelines, financial institutions must disclose the extent to which AI is used in providing investment advice. This ensures transparency in how your personalized recommendations were generated.